UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

|

Filed by the Registrant |  |

Filed by a Party other than the Registrant |

| Check the appropriate box: | |

|

Preliminary Proxy Statement |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14A-6(E)(2)) |

|

Definitive Proxy Statement |

|

Definitive Additional Materials |

|

Soliciting Material under §240.14a-12 |

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check all boxes that apply): | |

|

No fee required. |

|

Fee paid previously with preliminary materials. |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

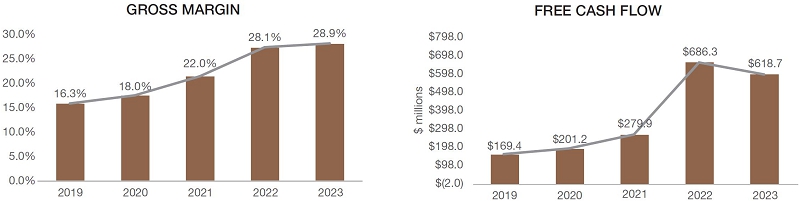

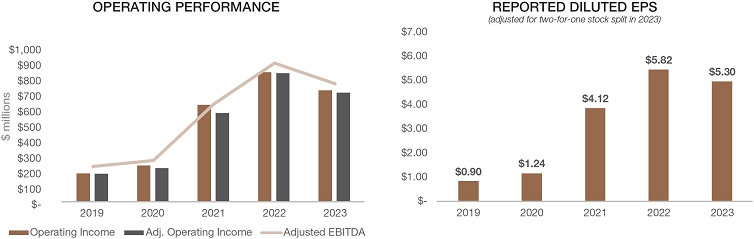

| SUMMARY OF OPERATIONS (Dollars in thousands except per share data) | 2023 ($) | 2022 ($) | 2021 ($) | 2020 ($) | 2019 ($) | ||||||||||||||

| Net sales | 3,420,345 | 3,982,455 | 3,769,345 | 2,398,043 | 2,430,616 | ||||||||||||||

| Operating income | 756,053 | 877,149 | 655,845 | 245,838 | 191,403 | ||||||||||||||

| Net income | 602,897 | 658,316 | 468,520 | 139,493 | 100,972 | ||||||||||||||

| Adjusted EBITDA(1) | 778,662 | 914,507 | 645,535 | 272,399 | 232,648 | ||||||||||||||

| Diluted earnings per share | 5.30 | 5.82 | 4.12 | 1.24 | 0.90 | ||||||||||||||

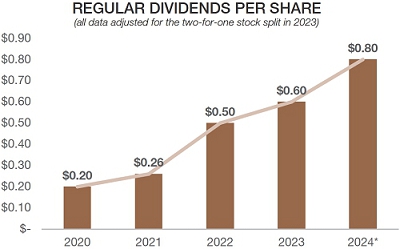

| Dividends per share(3) | 0.60 | 0.50 | 0.26 | 0.20 | 0.20 | ||||||||||||||

| SUMMARY OF CASH FLOW | |||||||||||||||||||

| Cash Flow from Operations | 672,766 | 723,943 | 311,701 | 245,073 | 200,544 | ||||||||||||||

| Capital Expenditures | 54,025 | 37,639 | 31,833 | 43,885 | 31,162 | ||||||||||||||

| Free-Cash Flow(2) | 618,741 | 686,304 | 279,868 | 201,188 | 169,382 | ||||||||||||||

| SIGNIFICANT YEAR-END DATA | |||||||||||||||||||

| Cash, cash equivalents and ST investments | 1,269,039 | 678,881 | 87,924 | 119,075 | 97,944 | ||||||||||||||

| Total Assets | 2,759,301 | 2,242,399 | 1,728,936 | 1,528,568 | 1,370,940 | ||||||||||||||

| Total Debt | 981 | 2,029 | 1,875 | 327,876 | 386,254 | ||||||||||||||

| Ratio of current assets to current liabilities | 6.4 to 1 | 4.4 to 1 | 2.7 to 1 | 2.4 to 1 | 3.0 to 1 | ||||||||||||||

| Book value per share(3) | 20.48 | 15.71 | 10.67 | 6.81 | 5.65 | ||||||||||||||

| (1) | Adjusted EBITDA is a non-GAAP financial measure. See Appendix A for a reconciliation of Adjusted EBITDA to our results reported under GAAP. |

| (2) | Free cash flow is a non-GAAP financial measure, which represents cash flow from operations minus capital expenditures. Both cash flow from operations and capital expenditures presented above are as reported in the Company’s Annual Reports on Form 10-K for the years presented. |

| (3) | Adjusted for the two-for-one stock split that occurred on October 20, 2023. |

|

|

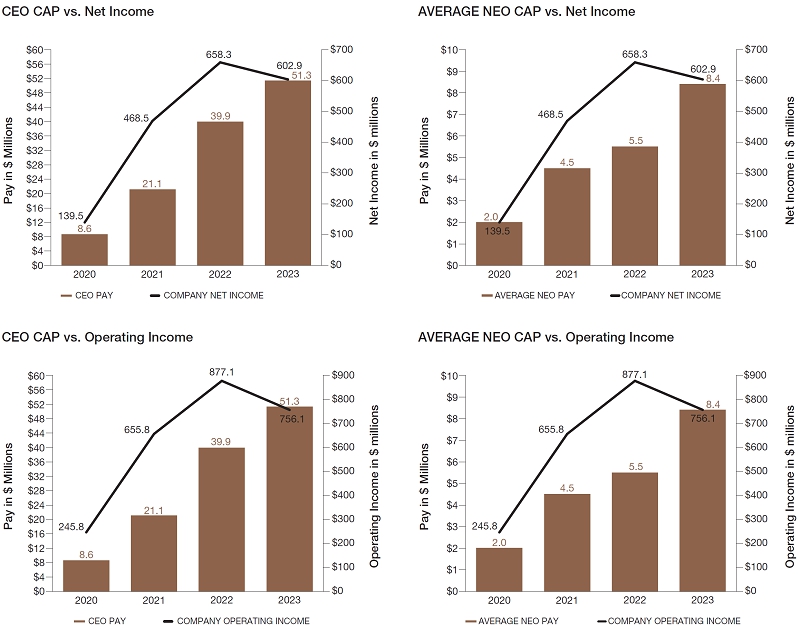

In terms of financial performance, 2023 was the second best year in the history of our Company, surpassed only by the record year we had in 2022. Net income was approximately $602.9 million on $3.4 billion in sales; we generated an impressive $672.8 million in cash flow from operations; and we delivered a 61.9% return to our shareholders.

This strong performance occurred despite challenging market conditions, most notably interest rates reaching multiyear highs and persistent inflation. While our U.S. businesses experienced the greatest decline in demand over the prior year, overall end user consumption remained at reasonable levels. We largely attribute the decline in demand to customers’ rebalancing their inventories as a result of the surpluses they built amidst the supply chain disruptions experienced in 2021-2022. For our international operations, changes in business conditions in 2023 were less significant, as the softening of those markets predated the impact in the U.S.

After operating in 2022 at a fairly intense pace, 2023 can be characterized as a year of ’‘optimization’’. Generally speaking, we focused on executing on projects aimed at improving overall efficiencies to adjust to changing conditions. We executed on increasing productive capacity and throughput, thereby enabling us to consolidate volumes and close duplicative and higher cost operations. Although a lot of this work did not necessarily bolster our financial results in 2023, the time and resources we invested have strengthened us for 2024 and beyond.

In addition to all of the other work we had on our plates, we also persevered through two unforeseen disasters. In March of 2023, a category 3 tornado directly hit our copper fittings plant in Covington, Tennessee. The tornado crippled one of our core operations, and also hit the local community hard. Nonetheless, our people demonstrated their “can do spirit” as they set up temporary manufacturing operations and leveraged other Mueller operations, as well as both suppliers and competitors, to maintain the flow of products, all with an unrelenting commitment to servicing our customers. As we approach the one-year anniversary of this event, the plant remains closed, but the reconstruction of the building and offices is nearing completion. Some manufacturing activity will resume during the second quarter of 2024, but a full recovery will take significantly longer. We expect to recoup our losses, including extensive business interruption losses, through our insurance upon completion of the restoration process.

The tornado at Covington came on the heels of the previously reported fire that leveled the primary manufacturing plant and administrative offices of our Westermeyer business in Bluffs, Illinois in late 2022. Throughout 2023, the Westermeyer team worked tirelessly to recover and rebuild, all while operating out of makeshift operations. We can now report that our new facility is complete, and that the installation of new and advanced manufacturing equipment is underway. Not only will the business begin operating at full strength by May, but it will also now have ample space and capacity to grow and expand.

Although these adversities presented some significant hurdles for our team, they have also elevated and better positioned these businesses for the future. To have achieved the results we did notwithstanding the variety of challenges we faced is truly a testament to the resilience of our dedicated team and business model.

At our core, we are a manufacturer, and our people are our most important resource. We are proud to report that in 2023, we again set new records in our safety performance, reducing our incident rate per hour worked by 10% to our lowest rate since we began maintaining these statistics. Safety is imperative, and we will continue to pursue operational excellence and strive towards our goal of no accidents.

Our financial health is excellent. We ended 2023 with cash and short-term investments totaling $1.3 billion net of debt, and a current ratio of 6.4 to 1. Our operations are well

capitalized, and we will continue to reinvest to be a low cost, sustainable producer. For the fourth straight year, we have announced a double-digit (33%) dividend increase. We will continue to deploy capital in both a balanced and opportunistic manner, maintaining a long-term focus on growth with a goal of delivering double-digit compounded annual returns.

* announced

We have a positive business outlook for 2024 and beyond. Although government infrastructure spending to date across most categories has not proceeded as rapidly as news headlines may suggest, the increasingly apparent need to replace aging systems will help ignite these markets and amplify demand for our products as conditions improve. With respect to building construction, our primary market, housing, remains underserved, and the moderation of interest rates — which we believe have hit their peak — will similarly spur demand.

One enduring source of our confidence is the nature of our product base, which is used in a wide range of applications from water quality and transmission, to climate comfort, to food preservation and more. The common thread across our portfolio is that our products are essential to everyday life. It is these types of critical infrastructure products on which we will continue to invest, focus, and seek new, potentially transformational growth opportunities.

Without a doubt, 2024 will present new challenges and opportunities, but our organization is experienced, hungry and prepared to tackle them. We are extremely grateful and proud of our dedicated employees who make Mueller the best in the business. We thank our customers for their loyalty, and you, our stockholders, for your continued investment in our Company.

Very truly yours,

Greg Christopher

Chairman & CEO

THURSDAY, MAY 9, 2024 8:00 A.M., Central Time

150 Schilling Boulevard |

|

NOTICEof Annual Meeting |

REVIEW YOUR PROXY STATEMENT | |

|

BY INTERNET http://www.proxyvote.com |

|

|

BY TELEPHONE Call the telephone number on your proxy card. |

|

|

BY MAIL Mark, date, sign and return your |

|

|

IN PERSON Attend the Annual meeting at the |

|

It is important that your shares be represented at the Annual Meeting regardless of the size of your holdings. Whether or not you intend to be present at the meeting in person, we urge you to mark, date and sign the enclosed proxy card and return it in the enclosed self-addressed envelope, which requires no postage if mailed in the United States. | |

PURPOSE

To vote on four proposals:

| 1. | To elect eight directors, each to serve on the Company’s Board of Directors (the “Board”), until the next annual meeting of stockholders (tentatively scheduled for May 8, 2025), or until his or her successor is elected and qualified; |

| 2. | To consider and act upon a proposal to approve the appointment of Ernst & Young LLP, independent registered public accountants, as auditors of the Company for the fiscal year ending December 28, 2024; |

| 3. | To conduct an advisory vote on the compensation of the Company’s named executive officers (“NEOs”); |

| 4. | To approve the Company’s 2024 Incentive Plan; and |

To conduct and transact such other business as may properly be brought before the Annual Meeting and any adjournment thereof.

RECORD DATE

Only stockholders of record at the close of business on March 14, 2024, will be entitled to notice of and vote at the Annual Meeting or any adjournment(s) thereof. A complete list of stockholders entitled to vote at the Annual Meeting will be prepared and maintained at the Company’s corporate headquarters at 150 Schilling Boulevard, Suite 100, Collierville, Tennessee 38017. This list will be available for inspection by stockholders of record during normal business hours for a period of at least 10 days prior to the Annual Meeting.

| ||

| /s/ Christopher J. Miritello | ||

|

Christopher J. Miritello Corporate Secretary March 28, 2024 |

| TABLE OF CONTENTS |  |

| MUELLER INDUSTRIES • 2024 PROXY STATEMENT | 6 |

|

THIS SUMMARY HIGHLIGHTS SELECTED INFORMATION IN THIS PROXY STATEMENT. PLEASE REVIEW THE ENTIRE PROXY STATEMENT AND OUR ANNUAL REPORT ON FORM 10-K BEFORE VOTING YOUR SHARES.

We are providing you with these proxy materials in connection with the solicitation by the Board of Directors of Mueller Industries, Inc. (the “Company”) of proxies for our 2024 Annual Meeting of Stockholders (the “Annual Meeting”), which will be held at 8:00 A.M. Central time on Thursday, May 9, 2024, at our corporate headquarters located at 150 Schilling Boulevard, Collierville, Tennessee 38017.

Notice of the availability of this Proxy Statement, together with the Company’s Annual Report for the fiscal year ended December 30, 2023, is first being mailed to stockholders on or about March 28, 2024. Pursuant to rules adopted by the Securities and Exchange Commission, the Company is providing access to its proxy materials over the Internet at http://www.proxyvote.com.

When a proxy card is returned properly signed, the shares represented thereby will be voted in accordance with the stockholder’s directions appearing on the card. If the proxy card is signed and returned without directions, the shares will be voted for the nominees named herein and in accordance with the recommendations of the Company’s Board of Directors as set forth herein. A stockholder giving a proxy may revoke it at any time before it is voted at the Annual Meeting by giving written notice to the secretary of the Annual Meeting or by casting a ballot at the Annual Meeting. Votes cast by proxy or in person at the Annual Meeting will be tabulated by election inspectors appointed for the Annual Meeting. The election inspectors will also determine whether a quorum is present. The holders of a majority of the shares of common stock, $.01 par value per share (“Common Stock”), outstanding and entitled to vote who are present either in person or represented by proxy will constitute a quorum for the Annual Meeting.

The cost of soliciting proxies will be borne by the Company. In addition to solicitation by mail, directors, officers and employees of the Company may solicit proxies by telephone or otherwise. The Company will reimburse brokers or other persons holding stock in their names or in the names of their nominees for their charges and expenses in forwarding proxies and proxy material to the beneficial owners of such stock.

Record Date: March 14, 2024

| MUELLER INDUSTRIES • 2024 PROXY STATEMENT | 7 |

|

|

|

Date and Time: Thursday, May 9, 2024 8:00 A.M., Central Time |

Place: 150 Schilling Boulevard Collierville, Tennessee 38017 |

Record Date: March 14, 2024 |

We are asking you to vote on the following proposals at the Annual Meeting:

| Proposal | Board Recommendation | Page Reference |

| Proposal 1 – Election of Directors | FOR each nominee | 11 |

| Proposal 2 – Approval of Auditor | FOR | 21 |

| Proposal 3 – Say-on-Pay | FOR | 23 |

| Proposal 4 – Approval of 2024 Incentive Plan | FOR | 42 |

| MUELLER INDUSTRIES • 2024 PROXY STATEMENT | 8 |

The following table provides summary information about each director nominee. The Board of Directors believes that these nominees reflect an appropriate composition to effectively oversee the performance of management in the execution of the Company’s strategy, and as such, recommends a vote “for” each of the eight nominees listed below.

| Name | Age | Director Since |

Primary Occupation | Independence | Committee Memberships |

Current Other Public Boards | ||||||

Gregory L. Christopher Chairman and Chief Executive Officer |

62 | 2010 | Chief Executive Officer, Mueller Industries, Inc. | N | None | None | ||||||

| Elizabeth Donovan | 71 | 2019 | Retired, Chicago Board Options Exchange | Y | N* | None | ||||||

| William C. Drummond | 70 | 2022 | Principal, The Marston Group PLC | Y | A | None | ||||||

| Gary S. Gladstein | 79 | 2000 | Private Investor, Consultant | Y | C | None | ||||||

| Scott J. Goldman | 71 | 2008 | Chief Executive Officer, TextPower, Inc. | Y | C*, N | None | ||||||

| John B. Hansen | 77 | 2014 | Retired Executive Vice President, Mueller Industries, Inc. | Y | A*, N | None | ||||||

Terry Hermanson Lead Independent Director since January 1, 2019 |

81 | 2003 | Principal, Mr. Christmas Incorporated | Y | C | None | ||||||

| Charles P. Herzog, Jr. | 66 | 2017 | Co-Founder and Principal, Atadex LLC & Vypin LLC | Y | A | None |

A = Audit Committee

C = Compensation and Personnel Development Committee

N = Nominating and Governance Committee

* = Chair

Director Experiences and Skills

We ask our stockholders to approve the selection of Ernst & Young LLP (“EY”) as our independent registered public accounting firm for the fiscal year ending December 30, 2023. Below is summary information about fees paid to EY for services provided in 2023 and 2022:

| 2023 | 2022 | |||||||

| Audit Fees | $ | 3,504,288 | $ | 3,298,330 | ||||

| Audit-Related Fees | $ | 71,234 | $ | 53,000 | ||||

| Tax Fees | $ | 494,663 | $ | 617,000 | ||||

| All Other Fees | — | — | ||||||

| $ | 4,070,185 | $ | 3,968,330 | |||||

| MUELLER INDUSTRIES • 2024 PROXY STATEMENT | 9 |

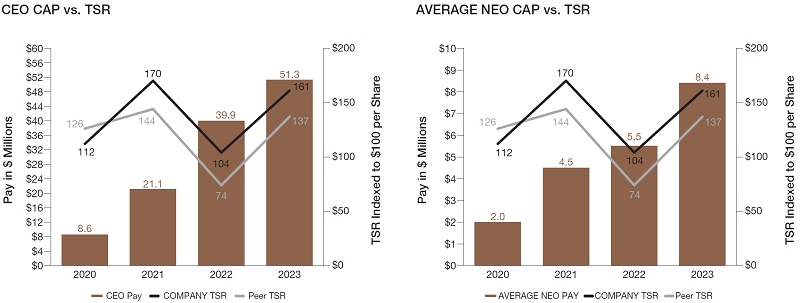

We are seeking your advisory vote to approve the compensation of our named executive officers as disclosed in this proxy statement. Our executive officers are responsible for achieving long-term strategic goals, and as such, their compensation is weighted toward rewarding long-term value creation for stockholders. Beyond base salary and traditional benefits, we maintain an annual cash incentive compensation program that is driven by a pay-for-performance philosophy and based on ambitious performance targets both at the Company and business line levels. We also maintain a long-term equity incentive compensation program, the primary objective of which is to motivate and retain top talent —a particularly vital goal given the uniquely competitive industry in which we operate. Accordingly, we utilize a combination of extended time-vesting schedules and performance-based vesting criteria to encourage executives and associates alike to enjoy lengthy tenures at the Company, develop industry expertise and relationships, ensure sound transition and succession planning, and drive our long-term success.

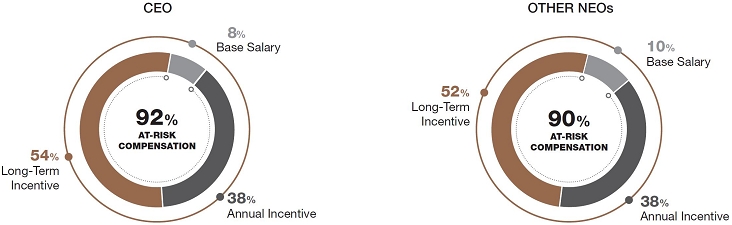

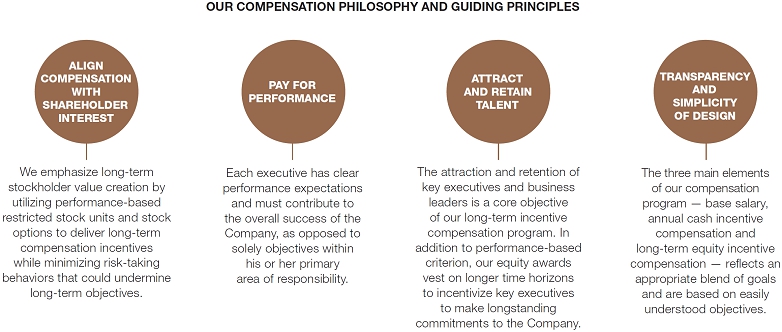

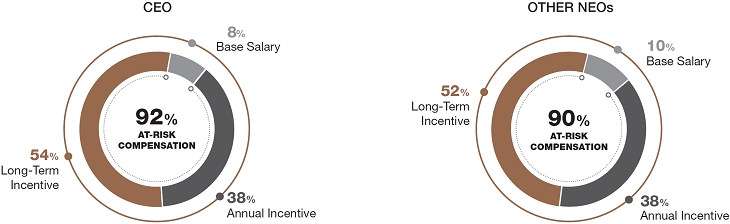

Our emphasis on a pay for performance compensation model is best illustrated in the following charts, which show that in 2023, a substantial majority of our NEOs’ overall compensation —consisting of target long-term and short-term incentive compensation combined — is performance-based or “at risk.”

We are seeking your approval of the 2024 Incentive Plan (the “2024 Plan”), which is included with this Proxy Statement. If approved by our stockholders, the 2024 Incentive Plan will enable the Company to make future stock-based awards in furtherance of its broader compensation strategy as discussed more fully herein. Specifically, the Board of Directors believes that the 2024 Plan will play an integral role in attracting and retaining the high caliber employees who are essential to the Company’s success, and in motivating those individuals to enhance our growth and profitability. The Board of Directors also believes that stock ownership by employees provides performance incentives and fosters long-term commitments that benefit the Company and its stockholders.

| MUELLER INDUSTRIES • 2024 PROXY STATEMENT | 10 |

|

Eight director nominees will be elected at the Annual Meeting, each to serve until the next annual meeting (tentatively scheduled for May 8, 2025), or until the election and qualification of their successors. At the recommendation of the Nominating and Governance Committee, the Board has nominated the following persons to serve as directors for the term beginning at the Annual Meeting: Gregory L. Christopher, Elizabeth Donovan, William C. Drummond, Gary S. Gladstein, Scott J. Goldman, John B. Hansen, Terry Hermanson and Charles P. Herzog, Jr. (collectively, the “Nominees”).

Directors are elected by a plurality of the votes cast, which means that the individuals who receive the greatest number of votes cast “For” are elected as directors up to the maximum number of directors to be chosen at the Annual Meeting. Consequently, any shares not voted “For” a particular director (whether as a result of a direction to withhold or a broker non-vote) will not be counted in such director’s favor.

The Board of Directors has adopted a majority vote policy in uncontested elections. An uncontested election means any stockholders meeting called for purposes of electing any director(s) in which (i) the number of director nominees for election is equal to the number of positions on the Board of Directors to be filled through the election to be conducted at such meeting, and/or (ii) proxies are being solicited for the election of directors solely by the Company.

The election of directors solicited by this Proxy Statement is an uncontested election. In the event that a nominee for election in an uncontested election receives a greater number of votes “Withheld” for his or her election than votes “For” such election, such nominee will tender an irrevocable resignation to the Nominating and Governance Committee, which will decide whether to accept or reject the resignation and submit such recommendation for prompt consideration by the Board of Directors no later than ninety (90) days following the uncontested election.

The Nominating and Governance Committee considers, among other things, the following criteria in selecting and reviewing director nominees:

| • | personal and professional integrity, and the highest ethical standards; |

| • | skills, business experience and industry knowledge useful to the oversight of the Company based on the perceived needs of the Company and the Board at any given time; |

| • | the ability and willingness to devote the required amount of time to the Company’s affairs, including attendance at Board and committee meetings; |

| • | the interest, capacity and willingness to serve the long-term interests of the Company; and |

| • | the lack of any personal or professional relationships that would adversely affect a candidate’s ability to serve the best interests of the Company and its stockholders. |

The Nominating and Governance Committee also assesses the contributions of the Company’s incumbent directors in connection with their potential re-nomination. In identifying and recommending director nominees, the Committee members take into account such factors as they determine appropriate, including recommendations made by the Board of Directors.

As reflected in its formal charter, the Nominating and Governance Committee considers the diversity of the Company’s Board and employees to be a tremendous asset. The Company is committed to maintaining a highly qualified and diverse Board, and as such, all candidates are considered regardless of their age, gender, race, color of skin, ethnic origin, political affiliation, religious preference, sexual orientation, country of origin, disability or any other category.

Through Charter amendments enacted in February 2023, the Nominating and Governance Committee reaffirmed its commitment to including, in each search, qualified candidates who reflect diverse backgrounds, including diversity of gender and race. Moreover, the Committee will consider all candidates irrespective of whether their backgrounds includes work in the corporate, academic, government or non-profit sectors. These efforts to promote diversity are assessed annually to assure that the Board contains a balanced and effective mix of individuals capable of advancing the Company’s long-term interests.

The Nominating and Governance Committee does not consider individuals nominated by stockholders for election to the Board. The Board believes that this is an appropriate policy because the Company’s Restated Certificate of Incorporation and Amended and Restated By-laws (“Bylaws”) allow a qualifying stockholder to nominate an individual for election to the Board, said nomination of which can be brought directly before a meeting of stockholders. Procedures and deadlines for doing so are set forth in the Company’s Bylaws, the applicable provisions of which may be obtained, without charge, on the Company’s website or upon written request to the Secretary of the Company at the address set forth herein.

The presiding officer of the meeting may refuse to acknowledge the nomination of any person not made in compliance with the procedures set forth in the Bylaws. See “Stockholder Nominations for Board Membership and Other Proposals for 2024 Annual Meeting.”

| MUELLER INDUSTRIES • 2024 PROXY STATEMENT | 11 |

|

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE THEIR SHARES FOR EACH OF THE NOMINEES. |

| GREGORY L. CHRISTOPHER Chairman of the Board and Chief Executive Officer | |

Age 62

Director Since 2010 |

Mr. Christopher has served as Chairman of the Board of Directors since January 1, 2016. Mr. Christopher has served as Chief Executive Officer of the Company since October 30, 2008. Prior to that, he served as the Company’s Chief Operating Officer and President of the Standard Products Division. |

| ELIZABETH DONOVAN | |

Age 71

Director

Since |

Ms. Donovan was an early member, and at the time, one of the few women on the Chicago Board Options Exchange. She subsequently became an independent broker representing major institutional options orders and has been retired from employment for more than five years.

Ms. Donovan was nominated to serve as a director of the Company because of her knowledge of market dynamics and institutional trading practices, knowledge acquired through her 18-year tenure as a fiduciary representative amidst an array of market conditions. She currently serves as Chairwoman of the Nominating and Governance Committee. |

| WILLIAM C. DRUMMOND | |

Age 70

Director Since |

Mr. Drummond, a Certified Public Accountant, has served as a Principal of The Marston Group PLC, a CPA and advisory firm, since 2013. Prior to that, he was a Partner at Ernst & Young LLP (“EY”).

Mr. Drummond was nominated to serve as a director of the Company because of his strength in the area of accounting, combined with his financial acumen, and his knowledge of and experience with tax and audit matters. He currently serves on the Audit Committee. |

| GARY S. GLADSTEIN | |

Age 79

Director Since |

Mr. Gladstein served as Chairman of the Board of Directors of the Company from 2013 to 2015, and was previously a director of the Company from 1990 to 1994. Mr. Gladstein is currently an independent investor and consultant. From the beginning of 2000 to August 31, 2004, Mr. Gladstein was a Senior Consultant at Soros Fund Management. He was a partner and Chief Operating Officer at Soros Fund Management from 1985 until his retirement at the end of 1999. During the past five years, Mr. Gladstein also served as a director of Inversiones y Representaciones Sociedad Anónima, Darien Rowayton Bank and a number of private companies.

Mr. Gladstein was nominated to serve as a director of the Company because of his financial and accounting expertise, combined with his years of experience providing strategic advisory services to complex organizations. In addition, having been a member of the compensation, audit and other committees of public company boards, Mr. Gladstein is deeply familiar with corporate governance issues. He currently serves on the Compensation and Personnel Development Committee. |

| SCOTT J. GOLDMAN | |

Age 71

Director Since |

For 12 years, Mr. Goldman has served as Chief Executive Officer of TextPower, Inc., which provides software-integrated text messaging alerts to utilities, municipalities and courts. He holds multiple patents for cybersecurity-related authentication technologies and speaks, writes and educates executives about cybersecurity matters. He has assisted Fortune 1000 companies in licensing, developing, building and operating wireless technologies and systems around the world.

Mr. Goldman was nominated to serve as a director of the Company because of his extensive experience with cybersecurity, advanced technologies and global market strategies. He currently serves as Chairman of the Compensation and Personnel Development Committee, and is also a member of the Nominating and Governance Committee. |

| MUELLER INDUSTRIES • 2024 PROXY STATEMENT | 12 |

| JOHN B. HANSEN | |

Age 77

Director Since |

Prior to his retirement as an Executive Vice President of the Company in 2014, Mr. Hansen served the Company in a variety of roles, including President-Plumbing Business, President-Manufacturing Operations and Senior Vice President – Strategy and Industry Relations.

Mr. Hansen was nominated to serve as a director because of his extensive industry experience and deep knowledge of the Company, its full array of operations and the global markets it serves. He currently serves as Chairman of the Audit Committee, and is also a member of the Nominating and Governance Committee. |

| TERRY HERMANSON Lead Independent Director | |

Age 81

Director Since |

Mr. Hermanson has been the principal of Mr. Christmas Incorporated, a wholesale merchandising company, since 1978, and presently serves as its Chairman.

Mr. Hermanson was nominated to serve as a director of the Company because of his extensive experience in manufacturing, importing, sales, international business and strategic planning. In addition to serving as Lead Independent Director, Mr. Hermanson is also a member of the Compensation and Personnel Development Committee. |

| CHARLES P. HERZOG, JR. | |

Age 66

Director Since |

Since 2010, Mr. Herzog has been a principal at Atadex LLC, a firm he co-founded. He co-founded a second firm, Vypin LLC, in 2016. Atadex and Vypin provide advanced technological and data delivery solutions to support the transportation logistics industry.

Mr. Herzog was nominated to serve as a director of the Company based on his extensive knowledge of the transportation logistics industry, and the developing technologies that support it. He currently serves as a member of the Audit Committee. |

| MUELLER INDUSTRIES • 2024 PROXY STATEMENT | 13 |

|

Our Board of Directors’ commitment to sound governance practices is embodied in its Corporate Governance Guidelines, which are periodically reviewed in light of evolving trends, regulations and related disclosure requirements. These practices include the following:

| Board Independence |

• Seven of our eight director nominees are independent. • Our CEO is our only management director. |

| Board Composition |

• All Board members are elected annually. • The Board annually evaluates its performance and the performance of its committees. |

| Board Committees |

• We have three committees: Audit; Compensation and Personnel Development; and Nominating and Governance • All committees are composed entirely of independent directors. |

| Leadership Structure |

• Our Board has a Lead Independent Director who liaises between our CEO & Chairman and other directors. • Among other duties, our Lead Independent Director chairs executive sessions of our independent directors. |

| Environmental, Social & Governance (ESG) Oversight | • Our Nominating & Governance Committee oversees our ESG program, and delegates such responsibilities to other committees, subcommittees or the full Board of Directors as necessary. |

| Open Communication |

• We encourage open communication and strong working relationships among the Lead Independent Director, Chairman and other directors • Our directors have direct access to management |

| Stock Ownership | • Our directors are subject to stock ownership requirements. |

In order for a director to qualify as “independent,” our Board of Directors must affirmatively determine, consistent with NYSE rules, that the director has no material relationship with the Company that would impair the director’s independence. Our Board of Directors undertook its annual review of director independence in February 2024. In applying the NYSE standards for independence, and after considering all relevant facts and circumstances, the Board of Directors has affirmatively determined that all directors, with the exception of Mr. Christopher, are “independent.” In the course of the Board of Directors’ determination regarding the independence of each non-management director, the Board considered for:

| • | Mr. Drummond, the fact that although he was previously a partner with EY, the Company’s independent auditing firm, he retired from EY in 2012, and the Company has received written confirmation from EY that (i) all independence issues related to his service on the Company’s Board of Directors have been resolved, (ii) Mr. Drummond would not be receiving any unfunded retirement benefits from EY, and (iii) all other non-pension related financial ties and firm amenities had been settled. |

| • | Mr. Hansen, the fact that while he was previously an executive officer of the Company (until his retirement on April 30, 2014), more than five years have lapsed since the termination of his employment relationship with the Company. |

| MUELLER INDUSTRIES • 2024 PROXY STATEMENT | 14 |

The Board of Directors and its committees meet regularly throughout the year, and may also hold special meetings and act by written consent from time to time. In 2023, the Board of Directors held four regularly scheduled meetings and one special meeting. During this time, our directors attended 100% of our Board of Directors meetings and meetings of the committees on which they served.

Three standing committees have been convened to assist the Board of Directors with various functions: the Audit Committee, the Compensation and Personnel Development Committee, and the Nominating and Governance Committee. Each committee operates pursuant to a formal charter that may be obtained, free of charge, at the Company’s website at www.muellerindustries.com, or by requesting a print copy from our Corporate Secretary at the address listed herein.

| AUDIT COMMITTEE | |

|

Current Members:

John B. Hansen (Chairman) William C. Drummond Charles P. Herzog, Jr.

Meetings in

|

The Audit Committee assists the Board of Directors in fulfilling its oversight functions with respect to matters involving financial reporting, independent and internal audit processes, disclosure controls and procedures, internal controls over financial reporting, related-party transactions, employee complaints, cybersecurity and risk management. In particular, the Audit Committee is responsible for:

• appointing, retaining, compensating and evaluating the Company’s independent auditors; • reviewing and discussing with management and the independent auditors the Company’s annual and quarterly financial statements, and accounting policies; • reviewing the effectiveness of the Company’s internal audit procedures and personnel; • reviewing, evaluating and assessing the Company’s risk management programs, including with respect to cybersecurity; • reviewing the Company’s policies and procedures for compliance with disclosure requirements concerning conflicts of interest and the prevention of unethical, questionable or illegal payments; and • making such other reports and recommendations to the Board of Directors as it deems appropriate.

The Board of Directors has determined that each Audit Committee member meets the standards for independence required by the New York Stock Exchange (the “NYSE”) and applicable SEC rules. Moreover, it has determined (i) that all members of the Audit Committee are financially literate; and (ii) that William C. Drummond possesses accounting and related financial management expertise within the meaning of the listing standards of the NYSE, and therefore is an audit committee financial expert within the meaning of applicable SEC rules. In accordance with the rules and regulations of the SEC, the above paragraph regarding the independence of the members of the Audit Committee shall not be deemed to be “soliciting material” or to be “filed” with the SEC or subject to Regulation 14A or 14C of the Exchange Act or to the liabilities of Section 18 of the Exchange Act and shall not be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, notwithstanding any general incorporation by reference of this Proxy Statement into any other filed document. |

| COMPENSATION AND PERSONNEL DEVELOPMENT COMMITTEE | |

|

Current Members:

Scott J. Goldman (Chairman) Gary S. Gladstein Terry Hermanson

Meetings in

|

Previously known as the Compensation and Stock Option Committee, the Compensation and Personnel Development Committee was re-named in February 2023 to reflect its oversight responsibility with respect to various human capital related issues. Pursuant to its recently amended charter, the Committee is responsible for, among other things:

• providing assistance to the Board of Directors in discharging the Board of Directors’ responsibilities related to executive and employee compensation and benefits; management organization; employee recruitment, engagement and retention; training and talent development; performance evaluation; succession planning; workplace culture; and employee health and safety; and • making such recommendations to the Board of Directors as it deems appropriate. |

| NOMINATING AND GOVERNANCE COMMITTEE | |

|

Current Members:

Elizabeth Donovan (Chairwoman) Scott J. Goldman

Meetings in

|

The Nominating and Governance Committee is responsible for:

• recommending director nominees to the Board of Directors; • recommending committee assignments and responsibilities to the Board of Directors; • overseeing the evaluation of the Board of Directors and management effectiveness; • developing and recommending to the Board of Directors corporate governance guidelines; • reviewing the Company’s implementation of procedures for identifying, assessing, monitoring, managing and reporting on the environmental, social and governance (ESG) risks and opportunities related to the Company’s business; and • delegating responsibilities to other Board Committees, subcommittees or the full Board as it deems appropriate, including with respect to ESG matters. |

| MUELLER INDUSTRIES • 2024 PROXY STATEMENT | 15 |

The Board of Directors is actively involved in oversight of risks that could affect the Company. These efforts can be summarized as follows:

The Board of Directors has adopted various policies, including a comprehensive set of Corporate Governance Guidelines, by which the Company is governed. These policies are designed to promote sound corporate governance and prudent stewardship of the Company, both by the Board of Directors and management.

The Corporate Governance Guidelines include amendments adopted in February 2020 that prohibit the future pledging of the Company’s common stock as security under any obligation by our directors and executive officers.

The Company maintains a policy (which was recently updated in February 2023) that mandates compliance with insider trading laws and institutes safeguards to mitigate the risk of insider trading. Further, the Corporate Governance Guidelines prohibit any director, officer or employee of the Company from engaging in short sales, transactions in derivative securities (including put and call options), or other forms of hedging and monetization transactions, such as zero-cost collars, equity swaps, exchange funds and forward sale contracts, that allow the holder to limit or eliminate the risk of a decrease in the value of the Company’s securities.

In November 2023, the Board of Directors approved an enhanced policy for the recovery of erroneously awarded compensation (“Recovery Policy), which is published on the Company’s website and is intended to satisfy the requirements under applicable law and NYSE listing rules. The Recovery Policy provides that if the Company is required to restate its financial results due to material noncompliance with any financial reporting requirements under the securities laws, the Company shall promptly take action to recoup from any current or former executive officer any incentive-

| MUELLER INDUSTRIES • 2024 PROXY STATEMENT | 16 |

based compensation received in excess of what would have been received based on the Company’s restated financial results, as determined by the Compensation and Personnel Development Committee. The Company’s right of recoupment pursuant to the Recovery Policy applies to all incentive-based compensation received during the three-year period preceding the earlier of (i) date on which the Company concludes (or reasonably should have concluded) that it is required to prepare an accounting restatement, or (ii) the date a legally authorized body directs the Company to prepare such restatement. Executive officers subject to the Recovery Policy include, the Company’s NEOs and controller, business unit presidents and vice presidents, and any other officers or members of management who perform policy-making functions. The Company may not indemnify any executive officer for the loss of any erroneously awarded incentive-compensation that is repaid, returned or recovered under the terms of the Recovery Policy. Compensation earned prior to October 2, 2023 remains subject to the Company’s previous recovery policy under its Corporate Governance Guidelines.

The Company has adopted a Code of Business Conduct and Ethics, which is designed to help officers, directors and employees resolve ethical issues in an increasingly complex business environment. The Code of Business Conduct and Ethics is applicable to all of the Company’s officers, directors and employees, including the Company’s principal executive officer, principal financial officer, principal accounting officer or controller and other persons performing similar functions. The Code of Business Conduct and Ethics covers topics, including but not limited to, conflicts of interest, confidentiality of information and compliance with laws and regulations.

It is the duty of the Board of Directors to serve as prudent fiduciaries for stockholders and to oversee the management of the Company’s business. Accordingly, the Corporate Governance Guidelines include specifications for director qualification and responsibility, attendance, access to officers and employees, compensation, orientation, continuing education and self-evaluation.

The Company’s policy is that all members of the Board of Directors attend annual meetings of stockholders, except where the failure to attend is due to unavoidable circumstances or conflicts discussed in advance with the Chairman of the Board. All members of the Board of Directors attended the 2023 annual meeting of stockholders in person.

| Where to Find Our Key Governance Policies: The Corporate Governance Guidelines and Code of Business Conduct and Ethics can be obtained free of charge from the Company’s website at www.muellerindustries.com, or may be requested in print by any stockholder. |

Any stockholder or interested party who wishes to communicate with the Board of Directors, or specific individual directors, including the non-management directors as a group, may do so by directing a written request addressed to such directors or director in care of the Chairman of the Nominating and Governance Committee, Mueller Industries, Inc., 150 Schilling Boulevard, Suite 100, Collierville, Tennessee 38017. Communication(s) directed to the Chairman will be relayed to him, except to the extent that it is deemed unnecessary or inappropriate to do so pursuant to the procedures established by a majority of the independent directors. Communications directed to non-management directors will be relayed to the intended director except to the extent that doing so would be contrary to the instructions of the non-management directors. Any communication so withheld will nevertheless be made available to any non-management director who wishes to review it.

Related party transactions may present potential or actual conflicts of interest, and create the appearance that Company decisions are based on considerations other than the best interests of the Company and its stockholders. Management carefully reviews all proposed related party transactions (if any), other than routine banking transactions, to determine if the transaction is on terms comparable to those that could be obtained in an arms-length transaction with an unrelated third party. Management reports to the Audit Committee, and then to the Board of Directors on all proposed material related party transactions. Upon the presentation of a proposed related party transaction to the Audit Committee or the Board of Directors, the related party is excused from participation in discussion and voting on the matter.

| MUELLER INDUSTRIES • 2024 PROXY STATEMENT | 17 |

The Company assesses and manages environmental, social and governance (“ESG”) considerations that may be material to the long-term sustainability of our business. Pursuant to its charter, the Nominating and Governance Committee is responsible for reviewing and discussing with management the Company’s implementation of procedures for identifying, assessing, monitoring, managing and reporting on the ESG and sustainability risks and opportunities related to the Company’s business. In so doing, it may form subcommittees or delegate responsibility to other Board Committees or the full Board of Directors as it deems appropriate. Among other matters, we focus on such issues as workplace health and safety, environmental stewardship, business ethics and compliance, supply chain management and the development of human capital. We also focus outwardly on the communities in which we operate, including through a foundation that makes charitable contributions to various causes and organizations. ESG-related risks and opportunities are integral to our strategic decision-making. Such matters are addressed by senior management and subject to the oversight of the Nominating and Governance Committee and the full Board of Directors. The Company also prioritizes the enhanced reporting and disclosure of the ESG-related risks and opportunities relating to its business and associated metrics. Since 2021, the Company has published an annual Sustainability Report. The report is available on the Company’s website at www.muellerindustries.com/sustainability.

| MUELLER INDUSTRIES • 2024 PROXY STATEMENT | 18 |

|

Our non-employee director compensation for 2023 was awarded in a combination of cash and equity, as shown below:*

| Annual fee for the Lead Independent Director. | For serving as Lead Independent Director, Mr. Hermanson received an annual fee of $90,000. |

| Annual fee for other directors | All other non-employee directors received an annual fee of $80,000. |

| Meeting fees |

• $3,000 per Audit Committee meeting attended • $1,500 per Compensation and Personnel Development Committee, or Nominating and Governance Committee meeting attended |

| Annual fees for Committee Chairs |

• $25,000 for the Audit Committee Chair • $10,000 each for the chairs of the Compensation and Personnel Development and Nominating and Governance Committees |

| Annual equity award | • All non-employee directors were granted 3,000 shares of restricted stock on May 4, 2023 (adjusted to 6,000 shares following the two-for-one stock split that occurred on October 20, 2023). |

| * | In his capacity as Chairman of the Board of Directors, Mr. Christopher received neither a retainer nor any meeting fees. |

In addition, each director received reimbursement for such director’s expenses incurred in connection with any such Board or Committee meeting, and each Committee fee was paid whether or not such committee meeting was held in conjunction with a Board of Directors meeting.

| MUELLER INDUSTRIES • 2024 PROXY STATEMENT | 19 |

The table below summarizes the total compensation we paid to our non-employee directors for the fiscal year ended December 30, 2023.

| Name | Fees Earned or Paid in Cash ($) |

Stock Awards ($) |

(1) | Cash Dividends ($) |

Total ($) | ||

| Elizabeth Donovan | 94,500 | 215,775 | 3,150 | 313,425 | |||

| William C. Drummond | 98,000 | 215,775 | 3,150 | 316,925 | |||

| Gary S. Gladstein | 83,000 | 215,775 | 3,150 | 301,925 | |||

| Scott J. Goldman | 97,500 | 215,775 | 3,150 | 316,425 | |||

| John B. Hansen | 127,500 | 215,775 | 3,150 | 346,425 | |||

| Terry Hermanson | 93,000 | 215,775 | 3,150 | 311,925 | |||

| Charles P. Herzog, Jr. | 100,500 | 215,775 | 3,150 | 319,425 |

| (1) | Represents the aggregate grant date fair value of awards granted to our directors in 2023, determined under Financial Accounting Standards Board Accounting Standards Codification 718. For information on the valuation assumptions with respect to awards made, refer to Note 18 - Stock-Based Compensation to the Company’s Consolidated Financial Statements filed with its Annual Report on Form 10-K for the fiscal year ended December 30, 2023. The amounts above reflect the Company’s aggregate expense for these awards and do not necessarily correspond to the actual value that will be recognized by the directors. |

To further align the Company’s goal of aligning directors’ economic interests with those of stockholders, the Company has adopted stock ownership guidelines for its non-employee directors recommending that they hold equity interests of the Company (including vested and unvested interests, provided that with respect to options, only vested options that are exercisable within 60 days of the applicable measurement date will be counted) with a value equal to three times the annual cash director fee payable to each such director. All directors are expected to comply with the stock ownership guidelines within five years of being elected to the Board of Directors, and current directors should comply as soon as practicable. Director compliance with the stock ownership guidelines is monitored on an ongoing basis by the Company’s General Counsel.

| MUELLER INDUSTRIES • 2024 PROXY STATEMENT | 20 |

|

The Audit Committee has reappointed Ernst & Young LLP (“EY”) to audit and certify the Company’s financial statements for the fiscal year ended December 30, 2023, subject to ratification by the Company’s stockholders, which requires the affirmative vote of a majority of the outstanding shares of the Company present in person or by proxy at the Annual Meeting. If the appointment of EY is not so ratified, the Audit Committee will reconsider its action and will appoint auditors for the 2024 fiscal year without further stockholder action. Notwithstanding, the Audit Committee may at any time in the future in its discretion reconsider the appointment without submitting the matter to a vote of stockholders. Representatives of EY are expected to attend the Annual Meeting to answer questions and make a statement if they so choose.

Fees for EY’s audit and other services for each of the two fiscal years ended December 30, 2023 and December 31, 2022 are set forth below:

| 2023 | 2022 | |||||||

| Audit Fees (professional services rendered for the audit of (i) the Company’s consolidated annual and interim/quarterly financial statements, and (ii) internal controls over financial reporting) | $ | 3,504,288 | $ | 3,298,330 | ||||

| Audit-Related Fees (assurance and other services, including international accounting and reporting compliance) | $ | 71,234 | $ | 53,000 | ||||

| Tax Fees (tax compliance, advice and planning) | $ | 494,663 | $ | 617,000 | ||||

| All Other Fees | — | — | ||||||

| $ | 4,070,185 | $ | 3,968,330 | |||||

The Audit Committee’s policy is to pre-approve all audit and non-audit services provided by the independent auditors. Pre-approval is generally provided for up to one year, and any such pre-approval is detailed as to the particular service or category of services. The Audit Committee has delegated pre-approval authority to its Chairman when expedition of services is necessary. The independent auditors and management are required periodically to report to the full Audit Committee regarding the extent of services provided by the independent auditors in accordance with this pre-approval, and the fees for the services performed to date. All of the services provided by the independent auditors during fiscal years 2023 and 2022, respectively, under the categories Audit Fees, Audit-Related Fees, Tax Fees and All Other Fees described above were pre-approved.

|

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE THEIR SHARES FOR THE APPROVAL OF ERNST & YOUNG LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM. |

| MUELLER INDUSTRIES • 2024 PROXY STATEMENT | 21 |

|

The Audit Committee oversees the Company’s financial reporting process on behalf of the Board of Directors. Management has the primary responsibility for the financial statements and the reporting process, including the systems of internal controls. In fulfilling its oversight responsibilities, the Audit Committee reviewed the audited financial statements in the Annual Report on Form 10-K with management, including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements.

The Audit Committee reviewed with the independent auditors, who are responsible for expressing an opinion on the conformity of those audited financial statements with generally accepted accounting principles, their judgments as to the quality, not just the acceptability, of the Company’s accounting principles and such other matters as are required to be discussed with the Audit Committee under Public Company Accounting Oversight Board’s (PCAOB) Auditing Standard No. 1301. In addition, the Audit Committee discussed with the independent auditors the auditors’ independence from management and the Company, including the matters in the written disclosures required by Public Company Accounting Oversight Board’s Rule 3526, and considered the compatibility of non-audit services provided by the independent auditors with the auditor’s independence.

The Audit Committee discussed with the Company’s internal and independent auditors the overall scope and plans for their respective audits. The Audit Committee meets with the internal and independent auditors, with and without management present, to discuss the results of their examinations, their evaluations of the Company’s internal controls, and the overall quality of the Company’s financial reporting.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors (and the Board of Directors has approved) that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 30, 2023 for filing with the SEC. The Audit Committee and the Board has re-appointed, subject to stockholder approval, Ernst & Young LLP, independent auditors, to audit the consolidated financial statements of the Company for the fiscal year ending December 28, 2024.

The Audit Committee is governed by a formal charter which can be accessed from the Company’s website at www.muellerindustries.com, or may be requested in print by any stockholder. The members of the Audit Committee are considered independent because they satisfy the independence requirements for Board members prescribed by the NYSE listing standards and Rule 10A-3 of the Exchange Act.

John B. Hansen, Chairman

William C. Drummond

Charles P. Herzog, Jr.

This Section is not “soliciting material,” is not deemed “filed” with the SEC and is not to be incorporated by reference in any filing of the Company under the Securities Act or the Exchange Act, whether made before or after the date hereof, and irrespective of any general incorporation language in any such filing.

| MUELLER INDUSTRIES • 2024 PROXY STATEMENT | 22 |

|

In accordance with Section 14A of the Exchange Act, stockholders are being asked to vote on an advisory, non-binding basis, on the compensation of the Company’s named executive officers. Specifically, the following resolution will be submitted for a stockholder vote at the Annual Meeting, the approval of which will require the affirmative vote of a majority of the outstanding shares of the Company present in person or by proxy at the Annual Meeting and entitled to vote thereon:

“RESOLVED, that the stockholders of the Company approve, on an advisory basis, the compensation of the Company’s named executive officers listed in the 2023 Summary Compensation Table included in the proxy statement for the 2024 Annual Meeting, as such compensation is disclosed pursuant to Item 402 of Regulation S-K in this proxy statement under the section titled “Compensation Discussion and Analysis,” as well as the compensation tables and other narrative executive compensation disclosures thereafter.”

Although the stockholder vote is not binding on either the Board of Directors or the Company, the views of stockholders on these matters are valued and will be taken into account in addressing future compensation policies and decisions.

The Company’s Compensation and Personnel Development Committee is comprised of knowledgeable and experienced independent directors, who are committed to regular review and effective oversight of our compensation programs. The Company’s executive compensation program is grounded in a pay for performance philosophy, and accordingly, has been designed to motivate the Company’s key employees to achieve the Company’s strategic and financial goals, and to support the creation of long-term value for stockholders. Moreover, given the particularly competitive markets in which we operate and the nature of our business, a principal goal underlying the Company’s long-term incentive compensation program specifically is the long-term retention and motivation of critical executives and business leaders, to ensure that the Company will continue to benefit from an exceptionally strong leadership team that will be well positioned to develop sound transition and succession plans for its key executives as such needs arise in the future. The Company’s success depends upon their leadership, judgment and experience, and as such, our compensation program is designed to promote their enduring commitment to the Company. We encourage stockholders to read the Executive Compensation section of this proxy statement, including the Compensation Discussion and Analysis (CD&A) and compensation tables, for a more detailed discussion of the Company’s compensation programs and policies, and how they are appropriate and effective in promoting growth, creating value, and retaining key members of our team.

|

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE THEIR SHARES FOR THE APPROVAL, ON AN ADVISORY BASIS, OF THE COMPENSATION OF THE COMPANY’S NAMED EXECUTIVE OFFICERS. |

| MUELLER INDUSTRIES • 2024 PROXY STATEMENT | 23 |

|

COMPENSATION DISCUSSION AND ANALYSISTABLE OF CONTENTS |

| EXECUTIVE SUMMARY | 24 | ||

| DETERMINATION OF EXECUTIVE COMPENSATION | 26 | ||

| ELEMENTS OF COMPENSATION | 26 | ||

| COMPENSATION RISK MANAGEMENT | 31 |

This Compensation Discussion and Analysis (“CD&A”) provides an overview of how our named executive officers were compensated in 2023, as well as how this compensation furthers our established compensation philosophy and objectives.

The Company’s NEOs for fiscal year 2023 were:

We believe in a pay for performance philosophy, such that a material portion of a named executive officer’s compensation is dependent upon both the short-term and long-term strategic and financial performance of the Company, considered in light of general economic and specific Company, industry, and competitive conditions. For 2023, we continued to reward named executive officers in a manner consistent with this philosophy by setting annual incentive targets based on the Company’s achievement of certain levels of operating income. While also rooted in a pay for performance philosophy, our long-term equity incentive compensation program is focused primarily on promoting retention of key executives and business leaders. We believe that our long-term equity incentive compensation program serves as a valuable tool for recruitment and retention in our industry, where the competition for leadership talent is a foremost concern, as well as for ensuring sound and smooth succession and transition planning for our NEOs. Accordingly, we continued to grant equity awards, such that any long-term compensation opportunity will be directly tied to stock performance, and will only be received by key executives and business leaders who remain with and make long-term commitments to the Company’s success. The Compensation and Personnel Development Committee (hereinafter referred to as “the Committee” for purposes of this CD&A section) evaluates, on an annual basis, the overall structure and design of our program, and believes it has and continues to reflect the best balance of the Company’s priorities.

| MUELLER INDUSTRIES • 2024 PROXY STATEMENT | 24 |

Our pay and equity programs are designed to align executives’ interests with those of our stockholders, and to motivate and retain critical leaders. Below is a snapshot of our compensation practices:

| WHAT WE DO | WHAT WE DON’T DO | |||

|

We maintain a fully independent Compensation and Personnel Development Committee. |  |

We do not provide for single trigger severance upon a change in control. | |

|

A higher percentage of our executives’ compensation is variable rather than fixed. |  |

We do not permit gross-up payments to cover excise taxes. | |

|

We utilize varying performance metrics under our short-term and long-term incentive plans. |  |

We do not permit the pledging or hedging of our common stock. | |

|

Our annual incentive program is based on earnings performance and capped for maximum payouts. |  |

We do not support compensation programs or policies that reward material or excessive risk taking. | |

|

Our equity awards include extended vesting schedules and performance-based criteria. |  |

We do not maintain any supplemental executive retirement plans. | |

|

We have a recovery policy applicable to all senior employees, including all NEOs, our controller, all president and vice president level personnel, and any other employees involved in policymaking functions. | |||

At our 2023 Annual Meeting, we held our annual non-binding stockholder advisory vote on executive compensation. Approximately 83% of our shares voted (excluding abstentions and broker non-votes) were in favor of the compensation of our named executive officers as disclosed in the proxy statement for the 2023 Annual Meeting.

We were gratified by the level of stockholder support received in 2023 for our non-binding stockholder advisory vote on executive compensation, and believe it reflected our continued efforts to engage with stockholders on executive compensation matters.

As in prior years, the Committee will consider the outcome of this year’s stockholder advisory vote on executive compensation as it makes future compensation decisions.

| MUELLER INDUSTRIES • 2024 PROXY STATEMENT | 25 |

Guided by the philosophy and design outlined above, the Committee determines the compensation of our Chief Executive Officer. In turn, our Chief Executive Officer makes recommendations to the Committee regarding all components of our other NEOs’ compensation, including base salary, annual cash incentive compensation, and long-term equity incentive compensation. The Committee considers and acts upon those recommendations in setting the compensation of our other NEOs.

In determining compensation, we generally do not rely upon hierarchical or seniority-based levels or guidelines, nor did the Committee formally benchmark executive compensation (or any component thereof) against any particular peer group. Instead, we utilize a more flexible approach that allows us to adapt components and levels of compensation to motivate and reward individual executives within the context of our broader strategic and financial goals. This requires that we consider subjective factors including, but not limited to the following:

| • | The nature of the executive’s position; |

| • | The performance record of the executive, combined with the value of the executive’s skills and capabilities in supporting the long-term performance of the Company; |

| • | The Company’s overall operational and financial performance; and |

| • | Whether each executive’s total compensation potential and structure is sufficient to ensure the retention of the executive officer when considering the compensation potential that may be available elsewhere. |

In making compensation decisions, the Committee relies on the members’ general knowledge of our industry, supplemented by advice from our Chief Executive Officer based on his knowledge of our industry and the markets in which we participate. From time to time, we conduct informal analyses of compensation practices and our Compensation and Personnel Development Committee may review broad-based third-party surveys to obtain a general understanding of current compensation practices.

The Committee has chosen incentive operating income targets as the metric to measure performance for each NEO. Our NEOs’ compensation is based upon their oversight of and responsibility for the entire Company. As such, it is reflective of the scope and breadth of their management responsibility, and the performance of the Company on a consolidated basis.

As outlined below, our compensation program for our NEOs is comprised of three primary elements: (i) base salary and traditional benefits, (ii) annual incentive compensation, and (iii) long-term equity incentive compensation. Each element plays an integral role in our overall compensation strategy. Moreover, the Committee has approved certain executive perquisites and post-employment change-in-control compensation to our NEOs for purposes of motivating them and retaining their services.

| Element of Compensation | Purpose/Description | Form/Timing of Payment | ||

| Base Salary and traditional benefits | To provide a base level of compensation for services performed, to encourage the continued service of our executive officers and to attract additional talented executive officers when necessary | Cash / throughout the fiscal year | ||

| Annual Incentive Compensation | To attract, motivate and reward executives to achieve and surpass key performance target goals | Cash / typically in February based upon the prior fiscal year’s performance | ||

| Long-Term Equity Incentive Compensation | To attract, motivate and reward executives to increase stockholder value, and encourage them to make long-term commitments to serve the Company | Restricted stock units with performance and time vesting criterion / following the release of second quarter earnings |

| MUELLER INDUSTRIES • 2024 PROXY STATEMENT | 26 |

Base salaries paid to our NEOs are set forth in the “Summary Compensation Table for 2023.” Base salary adjustments are determined by making reasoned subjective determinations about current economic conditions such as general wage inflation as well as the executive’s qualifications, experience, responsibilities, and past performance. In addition to base salaries, we provide traditional benefits such as group health, disability, and life insurance benefits, as well as matching contributions to our 401(k) plan.

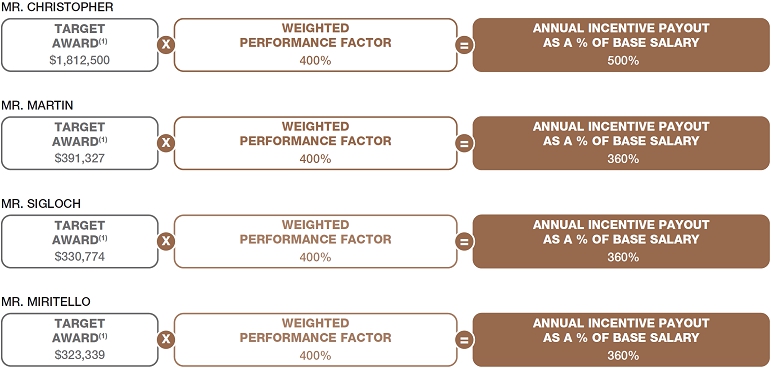

Each of our NEOs received annual incentive compensation for 2023 based upon the actual performance of the Company relative to the performance targets (as described below), which were established by the Committee on February 2, 2023. The table below shows the target annual incentive award for each of our NEOs.

For 2023, the amount of incentive compensation payable to each of our named executive officers was calculated as follows:

INCENTIVE GRADE LEVEL FACTOR

Set forth below are the incentive grade level factors for each of our NEOs:

| NEO | Multiple of Base Salary |

| Mr. Christopher | 125% |

| Mr. Martin | 90% |

| Mr. Sigloch | 90% |

| Mr. Miritello | 90% |

| MUELLER INDUSTRIES • 2024 PROXY STATEMENT | 27 |

PERFORMANCE FACTOR

Set forth below are the corresponding payout percentages tied to various levels of achievement above or below pre-approved primary operating income performance targets. To promote alignment between pay and performance, incentive compensation amounts are not paid to NEOs when the achievement level of the operating income performance target is less than 73%.

| Performance to Target(1) | Payout Percentage |

| 73% | 50% |

| 86% | 75% |

| 100% | 100% |

| 109% | 250% |

| 118% | 300% |

| 127% | 350% |

| 136% | 400% |

| (1) | Performance to target percentages have been rounded to the nearest whole percent for purposes of this table. |

The performance factor applicable to each of the NEOs was determined based on the achievement level of the consolidated Company incentive operating income target, as shown in the following table:

| Name | Incentive

Operating Income Performance Criteria(1) |

Incentive Operating Income Performance Target(2) |

Weighting | Performance | 2023 Achievement Level Over Primary Target |

2023 Performance Factor | ||||||

| Gregory L. Christopher | Consolidated Company | $550 million | 100% | $764 million | 139% | 400% | ||||||

| Jeffrey A. Martin | Consolidated Company | $550 million | 100% | $764 million | 139% | 400% | ||||||

| Steffen Sigloch | Consolidated Company | $550 million | 100% | $764 million | 139% | 400% | ||||||

| Christopher J. Miritello | Consolidated Company | $550 million | 100% | $764 million | 139% | 400% |

| (1) | Incentive operating income is the performance criteria metric used for all bonus plans. Incentive operating income includes adjustments to operating income as presented in the Company’s audited financial statements for purposes of defining the performance criteria, such as: (i) certain standard adjustments made annually, including expenses associated with phantom shares granted to personnel in our European businesses and FIFO variances; and (ii) certain adjustments made when applicable, including impairment charges, certain gains or losses on the sale of assets, certain gains stemming from claim recoveries, consolidation related expenses and purchase accounting adjustments. |

| (2) | The performance targets applicable to our NEOs were established by the Committee on February 2, 2023, and continue the Company’s longstanding approach of establishing ambitious performance goals that would motivate and incentivize our NEOs to deliver value to our stockholders throughout the Company’s fiscal year. |

| MUELLER INDUSTRIES • 2024 PROXY STATEMENT | 28 |

2023 NEO ANNUAL INCENTIVE CALCULATIONS

As a result of 2023 performance, the annual incentive payments for the NEOs were calculated as follows:

| (1) | The target award is determined by multiplying the NEO’s base earnings by the applicable incentive grade level factor. |

OVERVIEW

Our long-term equity-based incentive compensation program serves three goals:

| 1. | Aligning our NEOs’ financial interests with the interests of our stockholders; |

| 2. | Retaining the services of talented and seasoned executives, motivating them to make deep, long-term commitments to the Company, and ensuring sound and smooth succession and transition planning for the Company and our NEOs; and |

| 3. | Rewarding our NEOs for advancing our long-term financial success and increasing stockholder value. |

The Committee has made the retention of executives and key employees a particular focus of the long-term equity incentive compensation program in recent years.

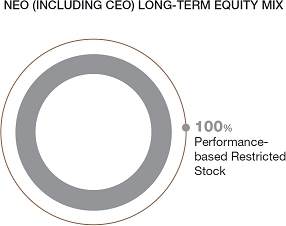

The Committee has decided that the best way to meet the objectives of our long-term incentive program is to award a combination of performance-based restricted stock and time-based restricted stock, allocated as shown below. In 2023, to reaffirm the alignment of pay and performance, the Committee chose to award only performance-based restricted stock to our NEOs, which, provided performance criteria are met, will cliff vest after a period of three years for Messrs. Christopher, Martin and Sigloch, and five years for Mr. Miritello.

The Committee believes that the extended and cliff vesting schedules and performance criteria described below will motivate our NEOs and key employees to remain with the Company and make long-term contributions to stockholder value generation.

| MUELLER INDUSTRIES • 2024 PROXY STATEMENT | 29 |

VESTING SCHEDULE FOR PERFORMANCE-BASED RESTRICTED STOCK

To foster executive retention, 100% of the regular annual equity awards given to NEOs in 2023, all of which are performance-based, will cliff vest after a period of three years (or five years for Mr. Miritello). The Committee elected to use a long-term vesting schedule to promote executive retention in our competitive industry and to incentivize performance. However, given the importance of long-term equity incentive awards in our compensation program, the Committee provided for accelerated vesting in the event of death, disability or a change in control (as explained in more detail in the “2023 Grant of Plan Based Awards Table”). The Committee believes that accelerated vesting would be appropriate in those circumstances to encourage our executives to focus on the potential benefits of a change in control transaction for our stockholders without harboring concerns for their financial security.

| (1) | Mr. Miritello’s 2023 performance-based restricted stock award has a five-year vesting term and is therefore scheduled to vest on July 30, 2028. |

PERFORMANCE CRITERIA FOR PERFORMANCE-BASED RESTRICTED STOCK

Of the annual equity awards granted to our NEOs in 2023, 100% are performance-based, and vesting is contingent upon the Company’s performance as measured by an adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) metric. This single metric was utilized in 2023 to prioritize management’s enhanced attention to earnings and cash flow. Specifically, utilizing this metric ensures that annual performance-based awards to these NEOs will only vest based upon the achievement of specified earnings growth targets over a three-year performance period, which for the 2023 grants, was January 1, 2023 to December 27, 2025. For this purpose, the adjusted EBITDA metric means the total adjusted EBITDA achieved by the Company during the three-year performance period, as compared with a cumulative adjusted EBITDA target of $1.25 billion.

The degree to which the annual equity awards granted to our NEOs vest is contingent upon the Company’s actual performance as compared with the adjusted EBITDA target. The table below illustrates the applicable achievement levels and corresponding vesting percentages based upon the adjusted EBITDA metric. If the achievement percentage is less than 80%, the vesting percentage is 0%. Moreover, if the achievement percentage is between the specified levels, the vesting percentage is determined by linear interpolation.

ADJUSTED EBITDA METRIC

| Achievement Percentage | Vesting Percentage |

| 80% | 50% |

| 110% | 200% |

To be clear, the adjusted EBITDA target established for our annual equity grants is just one of a number of different, yet complementary performance metrics utilized by the Company in its efforts to design an overall compensation program that is appropriately balanced and furthers its underlying aims. For example, the Company’s performance-based compensation program also incorporates the ambitious short and long-term operating targets that underlie the Company’s annual cash incentive compensation program and reflect the Company’s long-term aspirations for strategic growth.

The Company has traditionally maintained, and will continue to maintain lofty expectations and goals with respect to stockholder value creation. Nevertheless, given the primary retention aim of the long-term equity incentive compensation program, the Committee has concluded that the performance-based criterion for the equity awards granted to our NEOs are appropriate in the context of our well-balanced overall executive compensation program.

TIMING OF LONG-TERM EQUITY AWARD GRANTS

Long-term equity incentive awards to our Chief Executive Officer and other NEOs are traditionally granted annually, and are based on the determinations of the Committee. Our Chief Executive Officer makes recommendations to the Committee regarding awards for other NEOs and members of the management team. In 2023, the NEOs received their annual grants in October following the effective date of the two-for-one stock split approved by the Board of Directors.

In granting long-term equity awards to our NEOs, the Committee applied no set formula for allocating awards, and instead made reasoned, subjective determinations based upon their performance, the importance of retaining their services, and their role in helping us achieve our long-term goals. In 2023, we awarded annual grants to our NEOs reserving an aggregate of 422,000 shares (assuming the maximum performance threshold is met).

| MUELLER INDUSTRIES • 2024 PROXY STATEMENT | 30 |