Filed by the Registrant

Filed by the Registrant Filed by a Party other than the Registrant

Filed by a Party other than the RegistrantUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant Filed by the Registrant |

Filed by a Party other than the Registrant Filed by a Party other than the Registrant |

| Check the appropriate box: | |

|

Preliminary Proxy Statement |

|

Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

|

Definitive Proxy Statement |

|

Definitive Additional Materials |

|

Soliciting Material Pursuant to Section 240.14a-12 |

MUELLER INDUSTRIES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

| Payment of Filing Fee (check the appropriate box): | ||

|

No fee required. | |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

|

Fee paid previously with preliminary materials. | |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

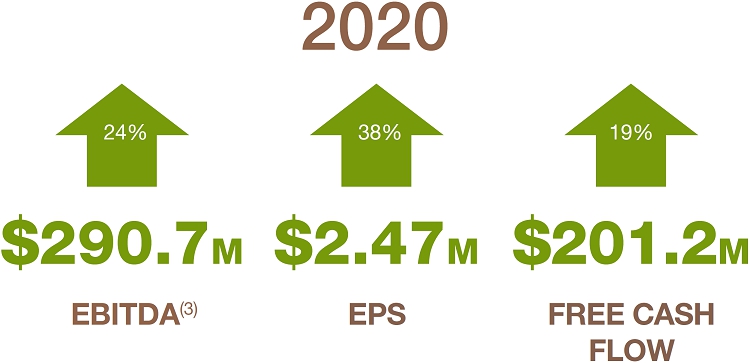

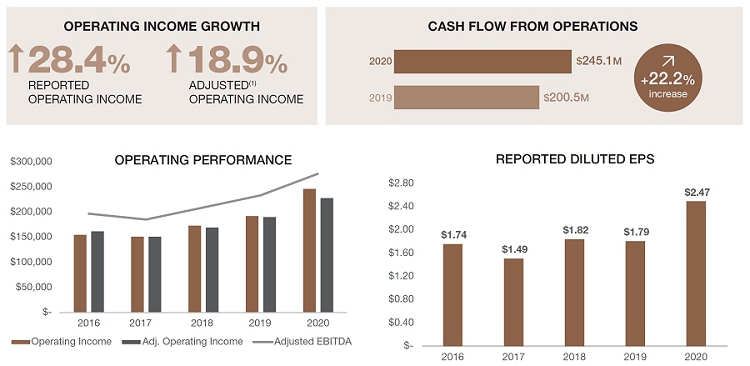

RESULTS AT A GLANCE

| SUMMARY OF OPERATIONS | 2020 | 2019 | 2018 | 2017 | 2016 | |||||

| (Dollars in thousands except per share data) | ($) | ($) | ($) | ($) | ($) | |||||

| Net Sales | 2,398,043 | 2,430,616 | 2,507,878 | 2,266,073 | 2,055,622 | |||||

| Operating income | 245,838 | 191,403 | 172,969 | 150,807 | 154,401 | |||||

| Net income | 139,493 | 100,972 | 104,459 | 85,598 | 99,727 | |||||

| Diluted earnings per share | 2.47 | 1.79 | 1.82 | 1.49 | 1.74 | |||||

| Dividends per share | 0.40 | 0.40 | 0.40 | 8.40(2) | 0.38 | |||||

| SUMMARY OF CASH FLOW | 2020 | 2019 | 2018 | 2017 | 2016 | |||||

| (Dollars in thousands) | ($) | ($) | ($) | ($) | ($) | |||||

| Cash Flow from Operations | 245,073 | 200,544 | 167,892 | 43,995 | 157,777 | |||||

| Capital Expenditures | 43,885 | 31,162 | 38,481 | 46,131 | 37,497 | |||||

| Free Cash Flow(1) | 201,188 | 169,382 | 129,411 | (2,136) | 120,280 | |||||

| BALANCE SHEET | 2020 | 2019 | 2018 | 2017 | 2016 | |||||

| (Dollars in thousands except per share data) | ($) | ($) | ($) | ($) | ($) | |||||

| Cash and cash equivalents | 119,075 | 97,944 | 72,616 | 120,269 | 351,317 | |||||

| Total Assets | 1,528,568 | 1,370,940 | 1,369,549 | 1,320,173 | 1,447,476 | |||||

| Total Debt | 327,876 | 386,254 | 496,698 | 465,072 | 227,364 | |||||

| Ratio of current assets to current liabilities | 2.4 to 1 | 3.0 to 1 | 3.0 to 1 | 3.1 to 1 | 4.1 to 1 | |||||

| Book value per share | 13.61 | 11.30 | 9.67 | 9.03 | 15.66 |

| (1) | Free cash flow is a non-GAAP financial measure, which represents cash flow from operations minus capital expenditures. Both cash flow from operations and capital expenditures presented above are as reported in the Company’s Annual Report on Form 10-K for the years presented. | |

| (2) | Includes special dividend of $8.00 per share paid on March 9, 2017. | |

| (3) | EBITDA is a non-GAAP financial measure. See Appendix A for a reconciliation of EBITDA to our results reported under GAAP. |

|

MESSAGE FROM OUR CHAIRMAN |

|

Dear Stockholders:

Just over a year ago, the COVID-19 pandemic triggered an unprecedented global health crisis and stopped the world in its tracks. Above all, we would like to extend our deepest gratitude to the first responders and medical personnel whose heroism and sacrifice have assisted so many communities impacted by this terrible virus. We are also grateful for and proud of our own employees who stepped up to the plate, adapting to new and rapidly evolving conditions to keep our businesses running, so that we could provide the many products that have proven so critical to our national and global infrastructure during this difficult period.

Despite the disruption caused by the pandemic, Mueller delivered solid results in 2020. After adjusting for the one-time gain of $22.1 million stemming from our claim in the Deepwater Horizon settlement, which was recorded during the first quarter, Mueller still achieved double digit growth over its prior year results in each of these key metrics: earnings, earnings per share (EPS), and cash generation.

These improvements over 2019 were driven by a combination of higher gross margins and SG&A cost containment. As value added products comprised a greater percentage of our overall revenues, and manufacturing costs decreased by 5.6% on a year over year basis, our gross margins improved by 1.7%. Moreover, when news of the pandemic first broke, we undertook aggressive cost-cutting measures, which proved instrumental in reducing costs in all areas of our business. As a result, on a comparative basis, our SG&A expenses declined by 6.4%.

Continued reinvestment in our manufacturing platform enabled our plants to be more agile and adapt to the downturn in demand.

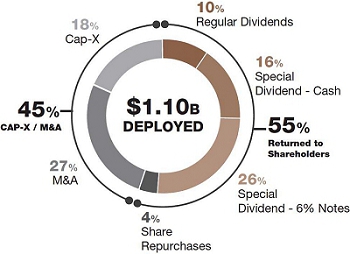

Capital Deployment

Manufacturing is the backbone of our Company, and as such, strategic investment in our operations is not only critical to both workplace safety and product quality, but is also a key component of our core pursuit to be the low cost producer. In 2020, capital project spending totaled $43.9 million, and it was deployed with the care and sense of responsibility that have long characterized our approach to fiscal management. Excluding the $11 million purchase of our headquarters building in Collierville, Tennessee, our spending was slightly below our customary level of capital spending, and well below depreciation. Investment in environmental, health and safety initiatives totaled $8.4 million, and helped us reduce emissions, conserve more water and energy, and increase the amount of recycled material used in production. Of the remaining spend, $14.4 million was directed at two projects that will support our long term strategic plan and help deliver meaningful efficiencies in future years.

In 2020, we deployed $72.6 million to complete two strategic acquisitions. Integral to our growth strategy is the pursuit of acquisitions that are complementary to businesses we know and operate, including the two acquisitions we closed this past year.

2016-2020 CAPITAL ALLOCATION

Sustainability

Our strong financial and operating performance aside, the measure of any company’s success extends well beyond the numbers. Increasingly, we also evaluate our Company’s progress based on its contribution to the sustainability of the local communities in which we operate, and the world at large. Sustainability has many components, and we view the associated risks and opportunities through the widest lens. Looking inward, we take the necessary actions to ensure we provide a safe and healthy working environment for our people, as well as opportunities for professional growth and development. Looking outward, we consider how our decisions both impact and contribute to the communities in which we operate. We also consider how our decisions affect the various systems, both natural and technological, that sustain our living planet, and the impact the continued functioning of these systems may have on our ability to operate long term.

We are happy to report that in 2020, we again made positive strides in the environmental, social and governance (ESG) measures that are of increasing importance to our stockholders. Importantly, we greatly improved our safety performance, achieving a 16% reduction in accidents per man hour worked, with zero “major” OSHA recordable incidences. Since we began measuring them in 2010, we have reduced OSHA recordable incidences by 65% in our core businesses. Accounting for acquisitions during this same timeframe, our incidence rate has decreased by 35%.

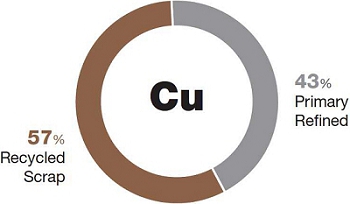

As an industrial manufacturer, we devote a great amount of attention to environmental compliance. In 2020, our North American operations reduced greenhouse gas emissions by 9.5% on a per unit basis, and reduced energy consumption by 15.6% on a per unit basis. Moreover, we continue to utilize a majority of recycled scrap in our manufacturing process, 66% in 2019 and 57% in 2020.

RECYCLED CONTENT

We continue to seek alternative processing methodologies to increase our consumption percent of recycled materials. Using recycled copper significantly reduces the energy and water consumption that results from the mining process, and also mitigates the related environmental impacts that are otherwise incurred when raw material imports and unconsumed scrap exports must travel long distances.

Financial Conditions

At the close of 2020, the Company’s market capitalization was $1.98 billion. This equates to 6.8 times EBITDA and 8.0 times cash from operations. We held $119 million in cash, and had a total debt balance of $327 million. We recently announced our plan to redeem the $284 million in outstanding debentures due in 2027, along with a 30% increase in our dividend. At this time, I am pleased to report that the Company is in excellent financial shape and has ample liquidity and cash flows not only to operate our businesses, but also to pursue our continued growth plans both organically and through acquisitions.

Going Forward

The pandemic has impacted all global economies. With the arrival of vaccines, in record time, we anticipate that we will see reopenings and a return of demand in almost all businesses in the near future. In particular, residential building markets on a global basis remain underserved, and we expect expansion in home construction to help drive economic recoveries. Construction is an important determinant of demand for many of our products.

In addition, we are optimistic that in 2021 and beyond, we will continue to see increased demand for products and technologies aimed at clean water distribution, indoor air quality and climate comfort, refrigeration and food preservation, and energy storage and transmission. These all are important end markets, and will remain a focus as we consider growth opportunities.

Our approach is to set lofty goals and drive hard to exceed them. Our 2024 Plan calls for double digit compounded annual growth in operating income over a six-year period. As it did in 2019, our operating income growth in 2020 has kept us on track to achieve that Plan. Given the unprecedented challenges we confronted, our results are a testament to the strength of our Company, and the adaptability of those who work tirelessly on its behalf.

We remain optimistic about the future and once again thank our valued employees, loyal customers and, of course, our stockholders for their continued support.

Very truly yours,

Greg Christopher

Chairman and Chief Executive Officer

THURSDAY, MAY 6, 2021

10:00 A.M., Central Time

150 Schilling Boulevard,

Second Floor

Collierville, Tennessee 38017

| REVIEW YOUR PROXY STATEMENT AND VOTE IN ONE OF FOUR WAYS: | |||

| BY INTERNET |  |

||

| http://www.proxyvote.com | |||

| BY TELEPHONE |  |

||

| Call the telephone number on your proxy card. | |||

| BY MAIL |  |

||

| Mark, date, sign and return your | |||

| proxy card in the enclosed envelope. | |||

| IN PERSON |  |

||

| Attend the Annual meeting at the | |||

| Company’s headquarters. | |||

| It is important that your shares be represented at the Annual Meeting regardless of the size of your holdings. Whether or not you intend to be present at the meeting in person, we urge you to mark, date and sign the enclosed proxy card and return it in the enclosed self-addressed envelope, which requires no postage if mailed in the United States. | |||

NOTICE

of

Annual Meeting

of Stockholders

PURPOSE

To vote on three proposals:

1. To elect eight directors, each to serve on the Company’s Board of Directors (the “Board”), until the next annual meeting of stockholders (tentatively scheduled for May 5, 2022), or until his or her successor is elected and qualified;

2. To consider and act upon a proposal to approve the appointment of Ernst & Young LLP, independent registered public accountants, as auditors of the Company for the fiscal year ending December 25, 2021; and

3. To conduct an advisory vote on the compensation of the Company’s named executive officers (“NEOs”).

To conduct and transact such other business as may properly be brought before the Annual Meeting and any adjournment thereof.

|

RECORD DATE

Only stockholders of record at the close of business on March 19, 2021, will be entitled to notice of and vote at the Annual Meeting or any adjournment(s) thereof. A complete list of stockholders entitled to vote at the Annual Meeting will be prepared and maintained at the Company’s corporate headquarters at 150 Schilling Boulevard, Suite 100, Collierville, Tennessee 38017. This list will be available for inspection by stockholders of record during normal business hours for a period of at least 10 days prior to the Annual Meeting.

/s/ Christopher J. Miritello

Christopher J. Miritello

Corporate Secretary

April 1, 2021

MUELLER INDUSTRIES • 2021 PROXY STATEMENT 7

|

PROXY SUMMARY |

THIS SUMMARY HIGHLIGHTS SELECTED INFORMATION IN THIS PROXY STATEMENT. PLEASE REVIEW THE ENTIRE PROXY STATEMENT AND OUR ANNUAL REPORT ON FORM 10-K BEFORE VOTING YOUR SHARES.

| — | 2020 PERFORMANCE |

Adjusted operating income and adjusted EBITDA are non-GAAP financial measures which exclude certain items in order to better reflect results of on-going operations. See Appendix A for a reconciliation of non-GAAP financial measures to our results reported under GAAP.

MUELLER INDUSTRIES • 2021 PROXY STATEMENT 8

| — | ANNUAL MEETING OF STOCKHOLDERS |

|

|

|

| Date and Time: | Place: | Record Date: |

| Thursday, May 6, 2021 | 150 Schilling Boulevard | March 19, 2021 |

| 10:00 A.M., Central Time | Second Floor | |

| Collierville, Tennessee 38017 |

| — | AGENDA AND VOTING MATTERS |

We are asking you to vote on the following proposals at the Annual Meeting:

| Proposal | Board Recommendation | Page Reference |

| Proposal 1 – Election of Directors | FOR each nominee | 11 |

| Proposal 2 – Approval of Auditor | FOR | 21 |

| Proposal 3 – Say-on-Pay | FOR | 23 |

| — | PROPOSAL 1: ELECTION OF DIRECTORS |

The following table provides summary information about each director nominee. The Board of Directors believes that these nominees reflect an appropriate composition to effectively oversee the performance of management in the execution of the Company’s strategy, and as such, recommends a vote “for” each of the eight nominees listed below.

| Name | Age | Director Since | Primary Occupation | Independence | Committee Memberships | Current Other Public Boards | ||||||

| Gregory L. Christopher Chairman and Chief Executive Officer | 59 | 2010 | Chief Executive Officer, Mueller Industries, Inc. | N | None | None | ||||||

| Elizabeth Donovan | 68 | 2019 | Retired, Chicago Board Options Exchange | Y | NCG | None | ||||||

| Gennaro J. Fulvio | 64 | 2002 | Member, Fulvio & Associates, LLP | Y | A* | None | ||||||

| Gary S. Gladstein | 76 | 2000 | Private Investor, Consultant | Y | C* | None | ||||||

| Scott J. Goldman | 68 | 2008 | Chief Executive Officer, TextPower, Inc. | Y | A, C | None | ||||||

| John B. Hansen | 74 | 2014 | Retired Executive Vice President, Mueller Industries, Inc. | Y | A, NCG | None | ||||||

| Terry Hermanson Lead Independent Director since January 1, 2019 | 78 | 2003 | Principal, Mr. Christmas Incorporated | Y | None | None | ||||||

| Charles P. Herzog, Jr. | 64 | 2017 | Co-Founder and Principal, Atadex LLC & Vypin LLC | Y | C, NCG* | None |

A = Audit Committee

C = Compensation and Stock Option Committee

NCG = Nominating and Corporate Governance Committee

* = Chair

MUELLER INDUSTRIES • 2021 PROXY STATEMENT 9

| — | PROPOSAL 2: RATIFICATION OF INDEPENDENT AUDITORS |

We ask our stockholders to approve the selection of Ernst & Young LLP (“EY”) as our independent registered public accounting firm for the fiscal year ending December 25, 2021. Below is summary information about fees paid to EY for services provided in 2020 and 2019:

| 2020 | 2019 | |||||||

| Audit Fees | $ | 2,749,755 | $ | 2,856,774 | ||||

| Audit-Related Fees | 47,000 | 50,250 | ||||||

| Tax Fees | 406,000 | 422,350 | ||||||

| All Other Fees | — | — | ||||||

| $ | 3,202,755 | $ | 3,329,374 | |||||

| — | PROPOSAL 3: ADVISORY VOTE TO APPROVE COMPENSATION OF NAMED EXECUTIVE OFFICERS |

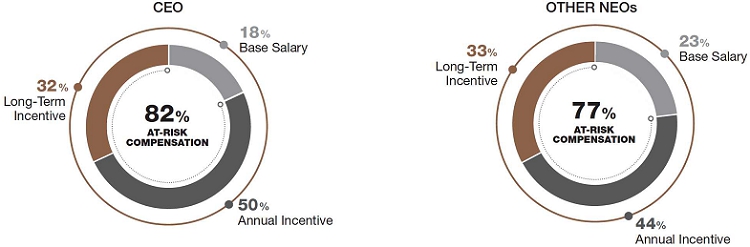

We are seeking your advisory vote to approve the compensation of our named executive officers as disclosed in this proxy statement. Our executive officers are responsible for achieving long-term strategic goals, and as such, their compensation is weighted toward rewarding long-term value creation for stockholders. Beyond base salary and traditional benefits, we maintain an annual cash incentive compensation program that is driven by a pay-for-performance philosophy and based on ambitious performance targets both at the Company and business line levels. We also maintain a long-term equity incentive compensation program, the primary objective of which is to motivate and retain top talent — a particularly vital goal given the uniquely competitive industry in which we operate. Accordingly, we utilize a combination of extended time-vesting schedules and performance-based vesting criteria to encourage executives and associates alike to enjoy lengthy tenures at the Company, develop industry expertise and relationships, and drive our long-term success.

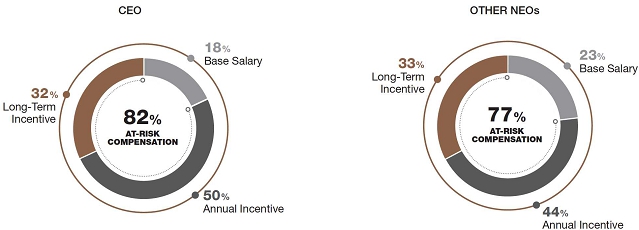

Our emphasis on creating long-term stockholder value is best illustrated in the following charts, which show that long-term incentive compensation accounts for the largest percentage of the NEOs’ overall compensation for 2020. Moreover, a majority of the NEOs’ compensation — consisting of target long-term and short-term incentive compensation combined — is performance-based or “at risk.”

MUELLER INDUSTRIES • 2021 PROXY STATEMENT 10

|

PROXY STATEMENT |

— PROPOSAL 1: ELECTION OF DIRECTORS

Eight director nominees will be elected at the Annual Meeting, each to serve until the next annual meeting (tentatively scheduled for May 5, 2022), or until the election and qualification of their successors. At the recommendation of the Nominating and Corporate Governance Committee, the Board has nominated the following persons to serve as directors for the term beginning at the Annual Meeting: Gregory L. Christopher, Elizabeth Donovan, Gennaro J. Fulvio, Gary S. Gladstein, Scott J. Goldman, John B. Hansen, Terry Hermanson and Charles P. Herzog, Jr. (collectively, the “Nominees”).

Directors are elected by a plurality of the votes cast, which means that the individuals who receive the greatest number of votes cast “For” are elected as directors up to the maximum number of directors to be chosen at the Annual Meeting. Consequently, any shares not voted “For” a particular director (whether as a result of a direction to withhold or a broker non-vote) will not be counted in such director’s favor.

The Board of Directors has adopted a majority vote policy in uncontested elections. An uncontested election means any stockholders meeting called for purposes of electing any director(s) in which (i) the number of director nominees for election is equal to the number of positions on the Board of Directors to be filled through the election to be conducted at such meeting, and/or (ii) proxies are being solicited for the election of directors solely by the Company.

The election of directors solicited by this Proxy Statement is an uncontested election. In the event that a nominee for election in an uncontested election receives a greater number of votes “Withheld” for his or her election than votes “For” such election, such nominee will tender an irrevocable resignation to the Nominating and Corporate Governance Committee, which will decide whether to accept or reject the resignation and submit such recommendation for prompt consideration by the Board of Directors no later than ninety (90) days following the uncontested election.

— SELECTING NOMINEES TO THE BOARD

The Nominating and Corporate Governance Committee considers, among other things, the following criteria in selecting and reviewing director nominees:

| • | personal and professional integrity, and the highest ethical standards; |

| • | skills, business experience and industry knowledge useful to the oversight of the Company based on the perceived needs of the Company and the Board at any given time; |

| • | the ability and willingness to devote the required amount of time to the Company’s affairs, including attendance at Board and committee meetings; |

| • | the interest, capacity and willingness to serve the long-term interests of the Company; and |

| • | the lack of any personal or professional relationships that would adversely affect a candidate’s ability to serve the best interests of the Company and its stockholders. |

The Nominating and Corporate Governance Committee also assesses the contributions of the Company’s incumbent directors in connection with their potential re-nomination. In identifying and recommending director nominees, the Committee members take into account such factors as they determine appropriate, including recommendations made by the Board of Directors.

As reflected in its formal charter, the Nominating and Corporate Governance Committee considers the diversity of the Company’s Board and employees to be a tremendous asset. The Company is committed to maintaining a highly qualified and diverse Board, and as such, all candidates are considered regardless of their age, gender, race, color of skin, ethnic origin, political affiliation, religious preference, sexual orientation, country of origin, physical handicaps or any other category. These efforts to promote diversity are assessed annually to assure that the Board contains a balanced and effective mix of individuals capable of advancing the Company’s long-term interests.

The Nominating and Corporate Governance Committee does not consider individuals nominated by stockholders for election to the Board. The Board believes that this is an appropriate policy because the Company’s Restated Certificate of Incorporation and Amended and Restated By-laws (“Bylaws”) allow a qualifying stockholder to nominate an individual for election to the Board, said nomination of which can be brought directly before a meeting of stockholders. Procedures and deadlines for doing so are set forth in the Company’s Bylaws, the applicable provisions of which may be obtained, without charge, on the Company’s website or upon written request to the Secretary of the Company at the address set forth herein.

The presiding officer of the meeting may refuse to acknowledge the nomination of any person not made in compliance with the procedures set forth in the Bylaws. See “Stockholder Nominations for Board Membership and Other Proposals for 2021 Annual Meeting.”

MUELLER INDUSTRIES • 2021 PROXY STATEMENT 11

— DIRECTOR NOMINEE BIOGRAPHIES

|

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE THEIR SHARES FOR EACH OF THE NOMINEES. |

| GREGORY L. CHRISTOPHER | |

| Chairman of the Board and Chief Executive Officer | |

| Age

59 Director Since 2010 |

Mr. Christopher has served as Chairman of the Board of Directors since January 1, 2016. Mr. Christopher has served as Chief Executive Officer of the Company since October 30, 2008. Prior to that, he served as the Company’s Chief Operating Officer. |

| ELIZABETH DONOVAN | |

| Age

68 Director Since 2019 |

Ms. Donovan was an early member, and at the time, one of the few women on the Chicago Board Options Exchange. She subsequently became an independent broker representing major institutional options orders and has been retired from employment for more than five years. |

| Ms. Donovan was nominated to serve as a director of the Company because of her knowledge of market dynamics and institutional trading practices, knowledge acquired through her 18-year tenure as a fiduciary representative amidst an array of market conditions. She currently serves on the Nominating and Corporate Governance Committee. | |

| GENNARO J. FULVIO | |

| Age

64 Director Since 2002 |

Mr. Fulvio, a Certified Public Accountant, has been a member of Fulvio & Associates, LLP, a CPA firm, since 1987.

Mr. Fulvio was nominated to serve as a director of the Company because of his strength in the area of accounting, combined with his financial acumen, and his knowledge of and experience with tax and audit matters. He currently serves as Chairman of the Audit Committee. |

| GARY S. GLADSTEIN | |

| Age

76 Director Since 2000 |

Mr. Gladstein served as Chairman of the Board of Directors of the Company from 2013 to 2015, and was previously a director of the Company from 1990 to 1994. Mr. Gladstein is currently an independent investor and consultant. From the beginning of 2000 to August 31, 2004, Mr. Gladstein was a Senior Consultant at Soros Fund Management. He was a partner and Chief Operating Officer at Soros Fund Management from 1985 until his retirement at the end of 1999. During the past five years, Mr. Gladstein also served as a director of Inversiones y Representaciones Sociedad Anónima, Darien Rowayton Bank and a number of private companies.

Mr. Gladstein was nominated to serve as a director of the Company because of his financial and accounting expertise, combined with his years of experience providing strategic advisory services to complex organizations. In addition, having been a member of the compensation, audit and other committees of public company boards, Mr. Gladstein is deeply familiar with corporate governance issues. He currently serves as Chairman of the Compensation and Stock Option Committee. |

| SCOTT J. GOLDMAN | |

| Age

68 Director Since 2008 |

For the past ten years, Mr. Goldman has served as Chief Executive Officer of TextPower, Inc., a company he also co-founded. TextPower provides software-integrated text messaging alerts to various institutions. Mr. Goldman also speaks, writes and educates regarding cybersecurity issues, and has assisted Fortune 1000 companies in licensing, developing, building and operating wireless technologies and systems around the world.

Mr. Goldman was nominated to serve as a director of the Company because of his extensive experience with cybersecurity, advanced technologies and global market strategies. He currently serves on the Audit and Compensation and Stock Option Committees. |

MUELLER INDUSTRIES • 2021 PROXY STATEMENT 12

| JOHN B. HANSEN | |

| Age

74 Director Since 2014 |

Prior to his retirement as an Executive Vice President of the Company in 2014, Mr. Hansen served the Company in a variety of roles, including President-Plumbing Business, President-Manufacturing Operations and Senior Vice President – Strategy and Industry Relations.

Mr. Hansen was nominated to serve as a director because of his extensive industry experience and deep knowledge of the Company, its full array of operations and the global markets it serves. He currently serves on the Audit and Nominating and Corporate Governance Committees. |

| TERRY HERMANSON | |

| Lead Independent Director | |

| Age

78 Director Since 2003 |

Mr. Hermanson has been the principal of Mr. Christmas Incorporated, a wholesale merchandising company, since 1978, and serves as its Chairman.

Mr. Hermanson was nominated to serve as a director of the Company because of his extensive experience in management and strategic planning, as well as his thorough knowledge of wholesale merchandising and international business issues. |

| CHARLES P. HERZOG, JR. | |

| Age

64 Director Since 2017 |

Since 2010, Mr. Herzog has been a principal at Atadex LLC, a firm he co-founded. He co-founded a second firm, Vypin LLC, in 2016. Atadex and Vypin provide advanced technological and data delivery solutions to support the transportation logistics industry.

Mr. Herzog was nominated to serve as a director of the Company based on his extensive knowledge of the transportation logistics industry, and the developing technologies that support it. He currently serves on the Compensation and Stock Option Committee, and as Chairman of the Nominating and Corporate Governance Committee. |

MUELLER INDUSTRIES • 2021 PROXY STATEMENT 13

|

CORPORATE GOVERNANCE |

The Company adheres to an established set of Corporate Governance Guidelines for purposes of defining director independence, assigning responsibilities, setting high standards of professional and personal conduct, and ensuring compliance with such responsibilities and standards. Such Guidelines are periodically reviewed in light of evolving trends in corporate governance standards, regulations and related disclosure requirements, particularly as adopted by the NYSE and (with respect to the Audit Committee (the SEC)).

In order for a director to qualify as “independent,” our Board of Directors must affirmatively determine, consistent with NYSE rules, that the director has no material relationship with the Company that would impair the director’s independence. Our Board of Directors undertook its annual review of director independence in February 2021. In applying the NYSE standards for independence, and after considering all relevant facts and circumstances, the Board of Directors has affirmatively determined that the Company’s current “independent” directors are: Elizabeth Donovan, Gennaro J. Fulvio, Gary S. Gladstein, Scott J. Goldman, John Hansen, Terry Hermanson and Charles P. Herzog, Jr. In the course of the Board of Directors’ determination regarding the independence of each non-management director, the Board considered for:

| • | Mr. Hansen, the fact that while he was previously an executive officer of the Company (until his retirement on April 30, 2014), more than five years have lapsed since the termination of his employment relationship with the Company. |

— BOARD OF DIRECTORS AND ITS COMMITTEES

The Board of Directors and its committees meet regularly throughout the year, and may also hold special meetings and act by written consent from time to time. In 2020, the Board of Directors held four regularly scheduled meetings and one special meeting. During this time, our directors attended 100% of our Board of Directors meetings and meetings of the committees on which they served. The Company’s Corporate Governance Guidelines provide that the Company’s non-management directors shall hold annually at least two formal meetings independent from management. Our Lead Independent Director presides at these executive sessions of the Board of Directors.

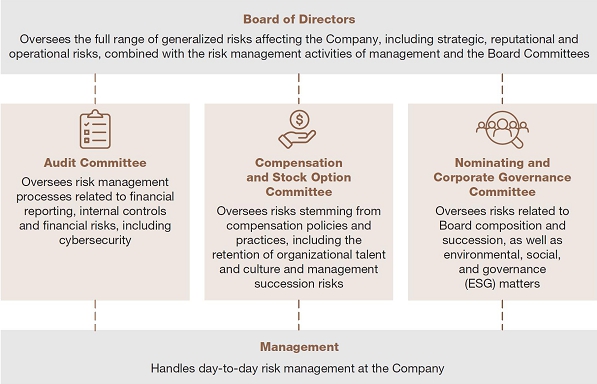

Three standing committees have been convened to assist the Board of Directors with various functions: the Audit Committee, the Compensation and Stock Option Committee, and the Nominating and Corporate Governance Committee. Each committee operates pursuant to a formal charter that may be obtained, free of charge, at the Company’s website at www.muellerindustries.com, or by requesting a print copy from our Corporate Secretary at the address listed herein.

MUELLER INDUSTRIES • 2021 PROXY STATEMENT 14

| AUDIT COMMITTEE | |

Current Members:

Gennaro J. Fulvio (Chairman)

Meetings in

|

The Audit Committee assists the Board of Directors in fulfilling its oversight functions with respect to matters involving financial reporting, independent and internal audit processes, disclosure controls and procedures, internal controls over financial reporting, related-party transactions, employee complaints, cybersecurity and risk management. In particular, the Audit Committee is responsible for:

• appointing, retaining, compensating and evaluating the Company’s independent auditors; • reviewing and discussing with management and the independent auditors the Company’s annual and quarterly financial statements, and accounting policies; • reviewing the effectiveness of the Company’s internal audit procedures and personnel; • reviewing, evaluating and assessing the Company’s risk management programs, including with respect to cybersecurity; • reviewing the Company’s policies and procedures for compliance with disclosure requirements concerning conflicts of interest and the prevention of unethical, questionable or illegal payments; and • making such other reports and recommendations to the Board of Directors as it deems appropriate.

The Board of Directors has determined that each Audit Committee member meets the standards for independence required by the New York Stock Exchange (the “NYSE”) and applicable SEC rules. Moreover, it has determined (i) that all members of the Audit Committee are financially literate; and (ii) that Gennaro J. Fulvio possesses accounting and related financial management expertise within the meaning of the listing standards of the NYSE, and therefore is an audit committee financial expert within the meaning of applicable SEC rules. In accordance with the rules and regulations of the SEC, the above paragraph regarding the independence of the members of the Audit Committee shall not be deemed to be “soliciting material” or to be “filed” with the SEC or subject to Regulation 14A or 14C of the Exchange Act or to the liabilities of Section 18 of the Exchange Act and shall not be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, notwithstanding any general incorporation by reference of this Proxy Statement into any other filed document. |

| COMPENSATION AND STOCK OPTION COMMITTEE | |

Current Members:

Gary S. Gladstein (Chairman)

Meetings in

|

The Compensation and Stock Option Committee is responsible for:

• providing assistance to the Board of Directors in discharging the Board of Directors’ responsibilities related to management organization, performance, compensation and succession; and • making such recommendations to the Board of Directors as it deems appropriate.

The Board of Directors has determined that each member of the Compensation and Stock Option Committee meets the NYSE’s standards for independence. |

| NOMINATING AND CORPORATE GOVERNANCE COMMITTEE | |

Current Members:

Charles P. Herzog, Jr. (Chairman)

Meetings in

|

The Nominating and Corporate Governance Committee is responsible for:

• recommending director nominees to the Board of Directors; • recommending committee assignments and responsibilities to the Board of Directors; • overseeing the evaluation of the Board of Directors and management effectiveness; • developing and recommending to the Board of Directors corporate governance guidelines; • reviewing and discussing with management the Company’s implementation of procedures for identifying, assessing, monitoring, managing and reporting on the environmental, social and governance (ESG) and sustainability risks and opportunities related to the Company’s business; and • generally advising the Board of Directors on corporate governance and related matters.

The Board of Directors has determined that each member of the Nominating and Corporate Governance Committee meets the NYSE’s standards for independence. |

MUELLER INDUSTRIES • 2021 PROXY STATEMENT 15

The Board of Directors has currently implemented a leadership structure in which Mr. Christopher serves as both Chief Executive Officer and Chairman of the Board. The Board has determined that having Mr. Christopher serve in this dual capacity is in the best interest of stockholders at this time. The Company believes that this structure currently allows ultimate leadership and accountability to reside in a single individual, who has both extensive knowledge of the Company’s business and critical relationships with the Company’s customer base.

In order to coordinate the activities of the independent members of the Board of Directors, and to liaise between such directors and the Chairman of the Board, the Company has currently designated Mr. Hermanson to serve as Lead Independent Director. The Lead Independent Director’s responsibilities are set forth in a formal charter, which can be obtained free of charge from the Company’s website at www.muellerindustries.com, or may be requested in print by any stockholder.

— BOARD’S ROLE IN RISK OVERSIGHT

The Board of Directors is actively involved in oversight of risks that could affect the Company. These efforts can be summarized as follows:

MUELLER INDUSTRIES • 2021 PROXY STATEMENT 16

The Board of Directors has adopted various policies, including a comprehensive set of Corporate Governance Guidelines, by which the Company is governed. These policies are designed to promote sound corporate governance and prudent stewardship of the Company, both by the Board of Directors and management.

Anti-Pledging Policy

The Corporate Governance Guidelines include amendments adopted in February 2020 that prohibit the future pledging of the Company’s common stock as security under any obligation by our directors and executive officers.

Insider Trading and Anti-Hedging Policy

The Company maintains a policy which mandates compliance with insider trading laws and institutes safeguards to mitigate the risk of insider trading. Further, the Corporate Governance Guidelines prohibit any director, officer or employee of the Company from engaging in short sales, transactions in derivative securities (including put and call options), or other forms of hedging and monetization transactions, such as zero-cost collars, equity swaps, exchange funds and forward sale contracts, that allow the holder to limit or eliminate the risk of a decrease in the value of the Company’s securities.

Clawback Policy

Under the Corporate Governance Guidelines, if the Company is required to restate its financial results due to material noncompliance with financial reporting requirements under the securities laws as a result of an executive’s (i.e., a President or Vice President level officer’s) willful, knowing or intentional misconduct or gross negligence (as determined by the Compensation and Stock Option Committee), the Company may take action to recoup from the executive all or any portion of an incentive award received by the executive, the amount of which had been determined in whole or in part upon specific performance targets relating to the restated financial results. In such an event, the Company shall be entitled to recoup up to the amount, if any, by which the incentive award actually received by the executive exceeded the payment that would have been received based on the restated financial results, as determined by the Compensation and Stock Option Committee. The Company’s right of recoupment pursuant to this policy applies to incentive awards received during the three-year period preceding the date on which the Company is required to prepare the restatement, based on the determination of the Company’s independent registered public accounting firm.

Code of Business Conduct and Ethics

The Company has adopted a Code of Business Conduct and Ethics, which is designed to help officers, directors and employees resolve ethical issues in an increasingly complex business environment. The Code of Business Conduct and Ethics is applicable to all of the Company’s officers, directors and employees, including the Company’s principal executive officer, principal financial officer, principal accounting officer or controller and other persons performing similar functions. The Code of Business Conduct and Ethics covers topics, including but not limited to, conflicts of interest, confidentiality of information and compliance with laws and regulations.

Director Responsibilities

It is the duty of the Board of Directors to serve as prudent fiduciaries for stockholders and to oversee the management of the Company’s business. Accordingly, the Corporate Governance Guidelines include specifications for director qualification and responsibility, attendance, access to officers and employees, compensation, orientation, continuing education and self-evaluation.

The Company’s policy is that all members of the Board of Directors attend annual meetings of stockholders, except where the failure to attend is due to unavoidable circumstances or conflicts discussed in advance with the Chairman of the Board. Because of travel restrictions and safety concerns related to the COVID-19 pandemic, the Chairman excused all non-management members of the Board of Directors from attending the 2020 annual meeting of stockholders in person.

Where to Find Our Key Governance Policies: The Corporate Governance Guidelines and Code of Business Conduct and Ethics can be obtained free of charge from the Company’s website at www.muellerindustries.com, or may be requested in print by any stockholder. |

MUELLER INDUSTRIES • 2021 PROXY STATEMENT 17

| — | COMMUNICATION WITH THE BOARD OF DIRECTORS |

Any stockholder or interested party who wishes to communicate with the Board of Directors, or specific individual directors, including the non-management directors as a group, may do so by directing a written request addressed to such directors or director in care of the Chairman of the Nominating and Corporate Governance Committee, Mueller Industries, Inc., 150 Schilling Boulevard, Suite 100, Collierville, Tennessee 38017. Communication(s) directed to the Chairman will be relayed to him, except to the extent that it is deemed unnecessary or inappropriate to do so pursuant to the procedures established by a majority of the independent directors. Communications directed to non-management directors will be relayed to the intended director except to the extent that doing so would be contrary to the instructions of the non-management directors. Any communication so withheld will nevertheless be made available to any non-management director who wishes to review it.

| — | RELATED PARTY TRANSACTIONS |

Related party transactions may present potential or actual conflicts of interest, and create the appearance that Company decisions are based on considerations other than the best interests of the Company and its stockholders. Management carefully reviews all proposed related party transactions (if any), other than routine banking transactions, to determine if the transaction is on terms comparable to those that could be obtained in an arms-length transaction with an unrelated third party. Management reports to the Audit Committee, and then to the Board of Directors on all proposed material related party transactions. Upon the presentation of a proposed related party transaction to the Audit Committee or the Board of Directors, the related party is excused from participation in discussion and voting on the matter.

| — | ENVIRONMENTAL, SOCIAL AND GOVERNANCE (ESG) RISK MANAGEMENT AND SUSTAINABILITY |

The Company assesses and manages environmental, social and governance (“ESG”) considerations that may be material to the long-term sustainability of our business. In February 2021, the Nominating and Corporate Governance Committee’s charter was formally amended to include the management of ESG risk within the Committee’s jurisdiction. In that spirit, the Nominating and Corporate Governance Committee shall be responsible for reviewing and discussing with management the Company’s implementation of procedures for identifying, assessing, monitoring, managing and reporting on the ESG and sustainability risks and opportunities related to the Company’s business. Among other matters, we focus on such issues as workplace health and safety, environmental stewardship, business ethics and compliance, supply chain management and the development of human capital. We also focus outwardly on the communities in which we operate, including through a foundation that makes charitable contributions to various causes and organizations. ESG-related risks and opportunities are integral to our strategic decision-making. Such matters are addressed by senior management and subject to the oversight of the Nominating and Corporate Governance Committee and the full Board of Directors. The Company is also prioritizing the enhanced reporting and disclosure of the ESG-related risks and opportunities relating to its business and associated metrics, and has published its first sustainability report, which is available on the Company’s website.

MUELLER INDUSTRIES • 2021 PROXY STATEMENT 18

|

2020 DIRECTOR COMPENSATION |

| — | ELEMENTS OF DIRECTOR COMPENSATION |

Our non-employee director compensation for 2020 was awarded in a combination of cash and equity, as shown below.*

| Annual fee for the Lead Independent Director. | For serving as Lead Independent Director, Mr. Hermanson received an annual fee of $90,000. |

| Annual fee for other directors | All other non-employee directors received an annual fee of $62,000. |

| Discretionary Bonus | All non-employee directors received a discretionary bonus of $10,000. |

| Meeting fees | • $3,000

per full Board meeting attended

• $3,000 per Audit Committee meeting attended • $1,000 per Compensation and Stock Option Committee, Nominating and Corporate Governance Committee or special meeting attended |

| Annual fees for Committee Chairs | • $25,000 for the Audit Committee Chair |

| • $6,000 each for the chairs of the Compensation and Stock Option and Nominating and Corporate Governance Committees | |

| Annual equity award | • All non-employee directors received a grant of options to purchase 4,000 shares of our common stock, $.01 par value per share (“Common Stock”) (fully vested as of the date of grant), and were granted 2,000 shares of restricted stock. |

*In his capacity as Chairman of the Board of Directors, Mr. Christopher received neither a retainer nor any meeting fees.

In addition, each director received reimbursement for such director’s expenses incurred in connection with any such Board or Committee meeting, and each Committee fee was paid whether or not such committee meeting was held in conjunction with a Board of Directors meeting.

MUELLER INDUSTRIES • 2021 PROXY STATEMENT 19

| — | 2020 NON-EMPLOYEE DIRECTOR COMPENSATION |

The table below summarizes the total compensation we paid to our non-employee directors for the fiscal year ended December 26, 2020.

| Name | Fees Earned

or Paid in Cash ($) |

Stock Awards ($) |

(1) | Option

Awards ($) |

(1) | All Other Compensation ($) |

(2) | Total ($) | |

| Elizabeth Donovan | 77,000 | 48,660 | 27,230 | 10,800 | 163,690 | ||||

| Paul J. Flaherty | 38,000 | — | — | 32,600 | 70,600 | ||||

| Gennaro J. Fulvio | 118,000 | 48,660 | 27,230 | 10,800 | 204,690 | ||||

| Gary S. Gladstein | 84,000 | 48,660 | 27,230 | 10,800 | 170,690 | ||||

| Scott J. Goldman | 96,000 | 48,660 | 27,230 | 10,800 | 182,690 | ||||

| John B. Hansen | 95,000 | 48,660 | 27,230 | 10,800 | 181,690 | ||||

| Terry Hermanson | 103,000 | 48,660 | 27,230 | 10,800 | 189,690 | ||||

| Charles P. Herzog, Jr. | 86,000 | 48,660 | 27,230 | 10,800 | 172,690 |

| (1) | Represents the aggregate grant date fair value of awards granted to our directors in 2020, determined under Financial Accounting Standards Board Accounting Standards Codification 718. For information on the valuation assumptions with respect to awards made, refer to Note 17 - Stock-Based Compensation to the Company’s Consolidated Financial Statements filed with its Annual Report on Form 10-K for the fiscal year ended December 26, 2020. The amounts above reflect the Company’s aggregate expense for these awards and do not necessarily correspond to the actual value that will be recognized by the directors. As of December 26, 2020, the aggregate number of shares of our Common Stock subject to outstanding options held by our non-employee directors was as follows: Ms. Donovan, 10,000 shares, Mr. Fulvio, 35,555 shares, Mr. Gladstein, 45,333 shares, Mr. Goldman, 40,444 shares, Mr. Hansen, 25,778 shares, Mr. Hermanson, 16,000 shares, and Mr. Herzog, 14,000 shares. All non-employee directors each held 2,000 shares of non-vested restricted stock. |

| (2) | Other cash compensation included (i) a $10,000 cash award provided to our non-employee directors (with the exception of Mr. Flaherty, who retired from the Board effective May 7, 2020) in recognition of the support they provided amidst the unprecedented challenges posed by the COVID-19 pandemic (which included participation in special conference calls for which they otherwise received no compensation), and (ii) $800 in cash dividends. Included in Mr. Flaherty’s other compensation is $31,800 in fees pursuant to a consulting agreement in which Mr. Flaherty provides services to the Company in the areas of customer and industry relations. The term of the agreement is July 1, 2020 through June 30, 2021, subject to extension upon the mutual agreement of the parties. |

— STOCK OWNERSHIP POLICY FOR DIRECTORS

To further align the Company’s goal of aligning directors’ economic interests with those of stockholders, the Company has adopted stock ownership guidelines for its non-employee directors recommending that they hold equity interests of the Company (including vested and unvested interests, provided that with respect to options, only vested options that are exercisable within 60 days of the applicable measurement date will be counted) with a value equal to three times the annual cash director fee payable to each such director. All directors are expected to comply with the stock ownership guidelines within five years of being elected to the Board of Directors, and current directors should comply as soon as practicable. Director compliance with the stock ownership guidelines is monitored on an ongoing basis by the Company’s General Counsel.

MUELLER INDUSTRIES • 2021 PROXY STATEMENT 20

|

APPOINTMENT OF INDEPENDENT |

The Audit Committee has reappointed Ernst & Young LLP (“EY”) to audit and certify the Company’s financial statements for the fiscal year ending December 25, 2021, subject to ratification by the Company’s stockholders, which requires the affirmative vote of a majority of the outstanding shares of the Company present in person or by proxy at the Annual Meeting. If the appointment of EY is not so ratified, the Audit Committee will reconsider its action and will appoint auditors for the 2021 fiscal year without further stockholder action. Notwithstanding, the Audit Committee may at any time in the future in its discretion reconsider the appointment without submitting the matter to a vote of stockholders. Representatives of EY are expected to attend the Annual Meeting to answer questions and make a statement if they so choose.

Fees for EY’s audit and other services for each of the two fiscal years ended December 26, 2020 and December 28, 2019 are set forth below:

| 2020 | 2019 | |||||||

| Audit Fees (professional services rendered for the audit of (i) the Company’s consolidated annual and interim/quarterly financial statements, and (ii) internal controls over financial reporting) | $ | 2,749,755 | $ | 2,856,774 | ||||

| Audit-Related Fees (assurance and other services, including international accounting and reporting compliance) | 47,000 | 50,250 | ||||||

| Tax Fees (tax compliance, advice and planning) | 406,000 | 422,350 | ||||||

| All Other Fees | — | — | ||||||

| $ | 3,202,755 | $ | 3,329,374 | |||||

The Audit Committee’s policy is to pre-approve all audit and non-audit services provided by the independent auditors. Pre-approval is generally provided for up to one year, and any such pre-approval is detailed as to the particular service or category of services. The Audit Committee has delegated pre-approval authority to its Chairman when expedition of services is necessary. The independent auditors and management are required periodically to report to the full Audit Committee regarding the extent of services provided by the independent auditors in accordance with this pre-approval, and the fees for the services performed to date. All of the services provided by the independent auditors during fiscal years 2020 and 2019, respectively, under the categories Audit Fees, Audit-Related Fees, Tax Fees and All Other Fees described above were pre-approved.

|

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE THEIR SHARES FOR THE APPROVAL OF ERNST & YOUNG LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM. |

MUELLER INDUSTRIES • 2021 PROXY STATEMENT 21

|

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS |

The Audit Committee oversees the Company’s financial reporting process on behalf of the Board of Directors. Management has the primary responsibility for the financial statements and the reporting process, including the systems of internal controls. In fulfilling its oversight responsibilities, the Audit Committee reviewed the audited financial statements in the Annual Report on Form 10-K with management, including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements.

The Audit Committee reviewed with the independent auditors, who are responsible for expressing an opinion on the conformity of those audited financial statements with generally accepted accounting principles, their judgments as to the quality, not just the acceptability, of the Company’s accounting principles and such other matters as are required to be discussed with the Audit Committee under Public Company Accounting Oversight Board’s (PCAOB) Auditing Standard No. 1301. In addition, the Audit Committee discussed with the independent auditors the auditors’ independence from management and the Company, including the matters in the written disclosures required by Public Company Accounting Oversight Board’s Rule 3526, and considered the compatibility of non-audit services provided by the independent auditors with the auditor’s independence.

The Audit Committee discussed with the Company’s internal and independent auditors the overall scope and plans for their respective audits. The Audit Committee meets with the internal and independent auditors, with and without management present, to discuss the results of their examinations, their evaluations of the Company’s internal controls, and the overall quality of the Company’s financial reporting.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors (and the Board of Directors has approved) that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 26, 2020 for filing with the SEC. The Audit Committee and the Board has re-appointed, subject to stockholder approval, Ernst & Young LLP, independent auditors, to audit the consolidated financial statements of the Company for the fiscal year ending December 25, 2021.

The Audit Committee is governed by a formal charter which can be accessed from the Company’s website at www.muellerindustries. com, or may be requested in print by any stockholder. The members of the Audit Committee are considered independent because they satisfy the independence requirements for Board members prescribed by the NYSE listing standards and Rule 10A-3 of the Exchange Act.

Gennaro J. Fulvio, Chairman

Scott J. Goldman

John B. Hansen

| (1) | This Section is not “soliciting material,” is not deemed “filed” with the SEC and is not to be incorporated by reference in any filing of the Company under the Securities Act or the Exchange Act, whether made before or after the date hereof, and irrespective of any general incorporation language in any such filing. |

MUELLER INDUSTRIES • 2021 PROXY STATEMENT 22

|

ADVISORY VOTE ON APPROVAL OF THE COMPENSATION OF THE COMPANY’S NAMED EXECUTIVE OFFICERS |

In accordance with Section 14A of the Exchange Act, stockholders are being asked to vote on an advisory, non-binding basis, on the compensation of the Company’s named executive officers. Specifically, the following resolution will be submitted for a stockholder vote at the Annual Meeting, the approval of which will require the affirmative vote of a majority of the outstanding shares of the Company present in person or by proxy at the Annual Meeting and entitled to vote thereon:

“RESOLVED, that the stockholders of the Company approve, on an advisory basis, the compensation of the Company’s named executive officers listed in the 2020 Summary Compensation Table included in the proxy statement for the 2021 Annual Meeting, as such compensation is disclosed pursuant to Item 402 of Regulation S-K in this proxy statement under the section titled “Compensation Discussion and Analysis,” as well as the compensation tables and other narrative executive compensation disclosures thereafter.”

Although the stockholder vote is not binding on either the Board of Directors or the Company, the views of stockholders on these matters are valued and will be taken into account in addressing future compensation policies and decisions.

The Company’s Compensation and Stock Option Committee is comprised of knowledgeable and experienced independent directors, who are committed to regular review and effective oversight of our compensation programs. The Company’s executive compensation program is grounded in a pay for performance philosophy, and accordingly, has been designed to motivate the Company’s key employees to achieve the Company’s strategic and financial goals, and to support the creation of long-term value for stockholders. Moreover, given the particularly competitive markets in which we operate and nature of our business, a principal goal underlying the Company’s long-term incentive compensation program specifically is the long-term retention and motivation of critical executives and business leaders. The Company’s success depends upon their leadership, judgment and experience, and as such, our compensation program is designed to promote their enduring commitment to the Company. We encourage stockholders to read the Executive Compensation section of this proxy statement, including the Compensation Discussion and Analysis (CD&A) and compensation tables, for a more detailed discussion of the Company’s compensation programs and policies, and how they are appropriate and effective in promoting growth, creating value, and retaining key members of our team.

|

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE THEIR SHARES FOR THE APPROVAL, ON AN ADVISORY BASIS, OF THE COMPENSATION OF THE COMPANY’S NAMED EXECUTIVE OFFICERS. |

MUELLER INDUSTRIES • 2021 PROXY STATEMENT 23

|

COMPENSATION DISCUSSION AND ANALYSIS TABLE OF CONTENTS |

| EXECUTIVE SUMMARY | 24 | ||

| DETERMINATION OF EXECUTIVE COMPENSATION | 26 | ||

| ELEMENTS OF COMPENSATION | 27 | ||

| COMPENSATION RISK MANAGEMENT | 32 |

This Compensation Discussion and Analysis (“CD&A”) provides an overview of how our named executive officers were compensated in 2020, as well as how this compensation furthers our established compensation philosophy and objectives.

Our Named Executive Officers

The Company’s NEOs for fiscal year 2020 were:

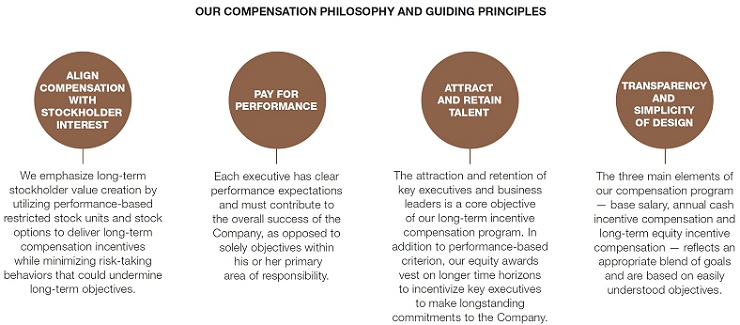

Our Compensation Philosophy and Guiding Principles

We believe in a pay for performance philosophy, such that a material portion of a named executive officer’s compensation is dependent upon both the short-term and long-term strategic and financial performance of the Company, considered in light of general economic and specific Company, industry, and competitive conditions. For 2020, we continued to reward named executive officers in a manner consistent with this philosophy by setting annual incentive targets based on the Company’s achievement of certain levels of operating income. While also rooted in a pay for performance philosophy, our long-term equity incentive compensation focused primarily on promoting the retention of key executives and business leaders in our industry, where the competition for leadership talent is a foremost concern. Accordingly, we continued to grant equity awards, such that any long-term compensation opportunity will be directly tied to stock performance, and will only be received by key executives and business leaders who remain with and make long-term commitments to the Company’s success. The Compensation and Stock Option Committee (hereinafter referred to as “the Committee” for purposes of this CD&A section) evaluates, on an annual basis, the overall structure and design of our program, and believes it has and continues to reflect the best balance of the Company’s priorities.

MUELLER INDUSTRIES • 2021 PROXY STATEMENT 24

Our Compensation Practices At a Glance

Our pay and equity programs are designed to align executives’ interests with those of our stockholders, and to motivate and retain critical leaders. Below is a snapshot of our compensation practices:

| WHAT WE DO | WHAT WE DON’T DO | |||

|

We maintain a fully independent Compensation and Stock Option Committee. |  |

We do not provide for single trigger severance upon a change in control. | |

|

A higher percentage of our executives’ compensation is variable than fixed. |  |

We do not permit gross-up payments to cover excise taxes. | |

|

We utilize varying performance metrics under our short-term and long-term incentive plans. |  |

We do not permit the pledging or hedging of our common stock. | |

|

Our annual incentive program is based on earnings performance and capped for maximum payouts. |  |

We do not support compensation programs or policies that reward material or excessive risk taking. | |

|

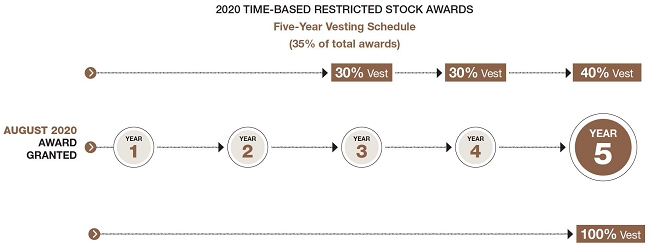

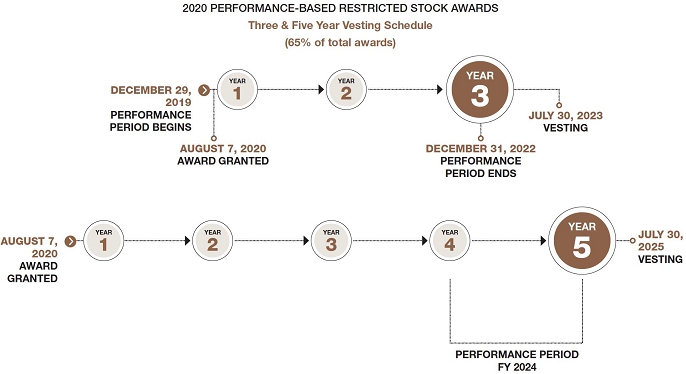

Our equity awards include extended vesting schedules and performance-based criteria. |  |

We do not maintain any supplemental executive retirement plans. | |

|

We have a clawback policy applicable to all senior employees, including all President and Vice President level personnel. | |||

2020 Say-on-Pay Vote and Stockholder Engagement

At our 2020 Annual Meeting, we held our annual non-binding stockholder advisory vote on executive compensation. Approximately 77% of our shares voted (excluding abstentions and broker non-votes) were in favor of the compensation of our named executive officers as disclosed in the proxy statement for the 2020 Annual Meeting.

Last year, in response to stockholder feedback, the Company not only endeavored to more clearly and fully present its compensation program, but also to dramatically revamp the look, format and substance of the 2020 proxy statement. Our goal in doing so was to provide a more useful tool to assist stockholders in evaluating our compensation program, including pay-for-performance alignment and whether it serves the vital strategic goal of attracting and retaining key executives in the competitive markets in which we participate. We were gratified that last year’s stockholder advisory vote on executive compensation reflected an improvement in support, but it was clear that there was more work to do in this regard.

MUELLER INDUSTRIES • 2021 PROXY STATEMENT 25

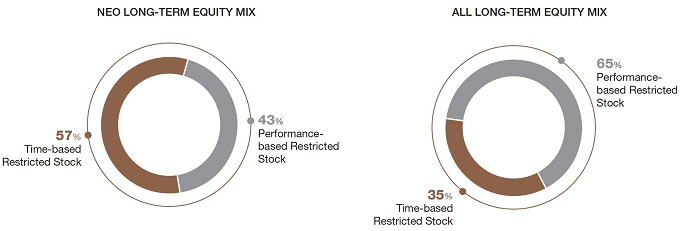

Accordingly, we continued to engage with stockholders regarding the Company’s compensation practices and the philosophies underlying them. Those discussions afforded stockholders the opportunity to raise questions and concerns regarding the executive compensation program as presented in last year’s proxy solicitation. One specific aspect of the compensation program that was a particular focus was our long-term equity incentive program, and how the performance-based criterion underlying those equity awards were chosen to emphasize long-term strategic growth and to serve as a complement to the Company’s ambitious targets underlying its annual cash incentive program in an effort to create a balanced and well-rounded incentive structure. In response to that feedback, the Company implemented two reforms in 2020:

| (1) | The Company revised the performance metric underlying the equity incentive awards given to Mr. Christopher and other key executive officers of the Company. Since the performance-based awards were implemented in 2016, the growth targets underlying such awards were based on 3.5% compounded annual growth rates in either total shareholder return (TSR) or earnings per share (EPS). In response to stockholder feedback regarding the appropriateness of these metrics, the Company reviewed the metrics utilized by industry peers and determined that for a business such as ours, operational based metrics would be a more effective gauge of our executives’ performance and driver of strategic growth. Accordingly, in 2020, the Company shifted to performance metrics based on growth in adjusted earnings before income tax, depreciation and amortization (EBITDA) and average return on invested capital, each as compared with specified targets and weighted on a 50%-50% basis. (For more details on the new performance metrics, please see the section entitled “Performance Criteria for Performance-Based Restricted Stock.”) |

| (2) | As previously discussed by the Company, for the first time in 2020, the long-term equity incentive awards given to operational business leaders was tied to achievement of the ambitious targets set forth in the Company’s 2024 Strategic Growth Plan (the awards given to these members of the management team previously had no performance component). The Company believes that these revised criteria will serve as an effective motivator for our operational business leaders to drive their respective businesses and contribute toward the Company’s overall long-term strategic growth objectives. |

The Committee will consider the outcome of this year’s stockholder advisory vote on executive compensation as it makes future compensation decisions.

— DETERMINATION OF EXECUTIVE COMPENSATION

Guided by the philosophy and design outlined above, the Committee determines the compensation of our Chief Executive Officer. In turn, our Chief Executive Officer makes recommendations to the Committee regarding all components of our other NEOs’ compensation, including base salary, annual cash incentive compensation, and long-term equity incentive compensation. The Committee considers and acts upon those recommendations in setting the compensation of our other NEOs.

In determining compensation, we generally do not rely upon hierarchical or seniority-based levels or guidelines, nor did the Committee formally benchmark executive compensation (or any component thereof) against any particular peer group. Instead, we utilize a more flexible approach that allows us to adapt components and levels of compensation to motivate and reward individual executives within the context of our broader strategic and financial goals. This requires that we consider subjective factors including, but not limited to the following:

| • | The nature of the executive’s position; |

| • | The performance record of the executive, combined with the value of the executive’s skills and capabilities in supporting the long-term performance of the Company; |

| • | The Company’s overall operational and financial performance; and |

| • | Whether each executive’s total compensation potential and structure is sufficient to ensure the retention of the executive officer when considering the compensation potential that may be available elsewhere. |

In making compensation decisions, the Committee relies on the members’ general knowledge of our industry, supplemented by advice from our Chief Executive Officer based on his knowledge of our industry and the markets in which we participate. From time to time, we conduct informal analyses of compensation practices and our Compensation and Stock Option Committee may review broad-based third-party surveys to obtain a general understanding of current compensation practices.

The Committee has chosen incentive operating income targets as the metric to measure performance for each named executive officer. The compensation of Messrs. Christopher, Martin and Miritello is based upon their oversight of and responsibility for the entire Company. Accordingly, their compensation levels are reflective of the scope and breadth of their management responsibility, and the performance of the Company on a consolidated basis. For Messrs. Sigloch and Westermeyer, a portion of their compensation is based upon the performance of specific business lines within their purviews. Notwithstanding the foregoing, a portion of their compensation is still based upon consolidated Company performance to discourage parochialism and align their interests with those of our stockholders.

MUELLER INDUSTRIES • 2021 PROXY STATEMENT 26

As outlined below, our compensation program for our NEOs is comprised of three primary elements: (i) base salary and traditional benefits, (ii) annual incentive compensation, and (iii) long-term equity incentive compensation. Each element plays an integral role in our overall compensation strategy. Moreover, the Committee has approved certain executive perquisites and post-employment change-in-control compensation to our NEOs for purposes of motivating them and retaining their services.

| Element of Compensation | Purpose/Description | Form/Timing of Payment | ||

| Base Salary and traditional benefits | Provide a base level of compensation for services performed, to encourage the continued service of our executive officers and to attract additional talented executive officers when necessary | Cash/throughout the fiscal year | ||

| Annual Incentive Compensation | To attract, motivate and reward executives to achieve and surpass key performance target goals | Cash/typically in February based upon the prior fiscal year’s performance | ||

| Long-Term Equity Incentive Compensation | To attract, motivate and reward executives to increase stockholder value, and encourage them to make long-term commitments to serve the Company | Restricted stock units with performance and time vesting criterion/following the release of second quarter earnings |

Pay-for-Performance and At-Risk Compensation

Base Salary and Traditional Benefits

Base salaries paid to our NEOs are set forth in the “Summary Compensation Table for 2020.” Base salary adjustments are determined by making reasoned subjective determinations about current economic conditions such as general wage inflation as well as the executive’s qualifications, experience, responsibilities, and past performance. In addition to base salaries, we provide traditional benefits such as group health, disability, and life insurance benefits, as well as matching contributions to our 401(k) plan.

Annual Incentive Compensation

Each of our NEOs received annual incentive compensation for 2020, based upon the actual performance of the Company and, for Messrs. Sigloch and Westermeyer, the performance of the business lines which they oversee, relative to the performance targets (as described below) established by the Committee on February 5, 2020 (as reviewed and revised on July 31, 2020). The table below shows the target annual incentive award for each of our NEOs.

For 2020, the amount of incentive compensation payable to each of our named executive officers was calculated as follows:

MUELLER INDUSTRIES • 2021 PROXY STATEMENT 27

INCENTIVE GRADE LEVEL FACTOR

Set forth below are the incentive grade level factors for each of our NEOs:

| NEO | Multiple of

Base Salary |

| Mr. Christopher | 125% |

| Mr. Martin | 90% |

| Mr. Sigloch | 90% |

| Mr. Miritello | 75% |

| Mr. Westermeyer | 75% |

PERFORMANCE FACTOR

Set forth below are the corresponding payout percentages tied to various levels of achievement above or below pre-approved operating income performance targets. To promote alignment between pay and performance, incentive compensation amounts are not paid to NEOs when the achievement level of the operating income performance target is less than 80%.

| Performance to Target | Payout Percentage |

| < 80% | 0% |

| 80-84% | 40% |

| 85-89% | 55% |

| 90-94% | 70% |

| 95-99% | 85% |

| 100-102% | 100% |

| 103-105% | 115% |

| 106-109% | 130% |

| 110% | 150% |

Based on their incentive grade level factors, certain NEOs are entitled to an additional payout percentage of 10% for each additional percentage of achievement between 111% and 115% of the target, thereby resulting in a maximum payout percentage of 200%. For more information, please see the “2020 Grants of Plan Based Awards Table.”

The performance factor applicable to each of the NEOs was determined based on the achievement level of the consolidated Company incentive operating income target, as shown in the following table:

| Name | Incentive Operating Income Performance Criteria(1) | Incentive Operating Income Performance Target | Weighting | Performance | 2020 Achievement Level | 2020 Performance Factor | ||||||

| Gregory L. Christopher | Consolidated Company | $164.9 million | 100% | $217.1 million | 131% | 200% | ||||||

| Jeffrey A. Martin | Consolidated Company | $164.9 million | 100% | $217.1 million | 131% | 200% | ||||||

| Steffen Sigloch | Consolidated Company | $164.9 million | 75% | $217.1 million | 131% | 200% | ||||||

| Blended Business Lines Weighted Average Performance | $15.9 million | 25% | $17.0 million | 107% | 130% | |||||||

| Christopher J. Miritello | Consolidated Company | $164.9 million | 100% | $217.1 million | 131% | 200% | ||||||

| Gary Westermeyer | Consolidated Company | $164.9 million | 25% | $217.1 million | 131% | 150% | ||||||

| Blended Business Lines Weighted Average Performance | $17.8 million | 75% | $20.1 million | 113% | 150% |

| (1) | Incentive operating income is the performance criteria metric used for all bonus plans. Incentive operating income includes adjustments to operating income as presented in the Company’s audited financial statements for purposes of defining the performance criteria, such as: (i) certain standard adjustments made annually, including expenses associated with phantom shares granted to personnel in our European businesses, and FIFO variances; and (ii) certain adjustments made when applicable, including impairment charges, certain gains or losses on the sale of assets, certain gains stemming from claim recoveries, consolidation related expenses and purchase accounting adjustments. |

The performance targets applicable to our NEOs were established by the Committee on February 5, 2020, before the onset of the COVID-19 pandemic, and reflected a continuation of the execution of our growth strategy over the last several years. However, following the onset of the COVID-19 pandemic, the Company continued to evaluate its financial performance, as well as employees’ contributions across the organization, and measured those against the key objectives of our executive compensation program, including pay for performance, alignment with stockholders’ interests, and motivation and retention of key talent, which includes maintaining a program that is a fair reflection of corporate and individual performance. Thus, in light of these key objectives, which are intended to position the Company for long term profitable growth, and the extraordinary circumstances caused by the COVID-19 pandemic, in July 2020, the Company recommended to the Committee that the incentive operating income targets that were originally established in February be adjusted to keep all employees, including our NEOs, motivated and focused on continuing to work towards advancing the Company’s long-term goals for the remainder of 2020. On that basis, the Committee determined to adjust the consolidated company and business line incentive operating income targets applicable to the NEOs down by 15%, which, in the Committee’s view, were challenging but achievable levels, such that, based on performance expectations at the time of the July adjustment (which, due in large part to the extraordinary circumstances

MUELLER INDUSTRIES • 2021 PROXY STATEMENT 28

caused by COVID-19 pandemic, were trending below 2019 levels) the minimum incentive payout percentage could reasonably be attained.

From a financial performance standpoint in 2020, our NEOs and employees contributed to significant improvements in our third and fourth quarter earnings, and we concluded the year with results that were significantly better than our performance expectations at the onset of the COVID-19 pandemic and at the time of the July adjustment. As a result, notwithstanding the adjustment, which the Committee believes served the purpose of effectively motivating the Company’s NEOs and employees to overcome the unique challenges posed by the COVID-19 pandemic, overall incentive payments as a percentage of the Company’s earnings were generally consistent with prior years.

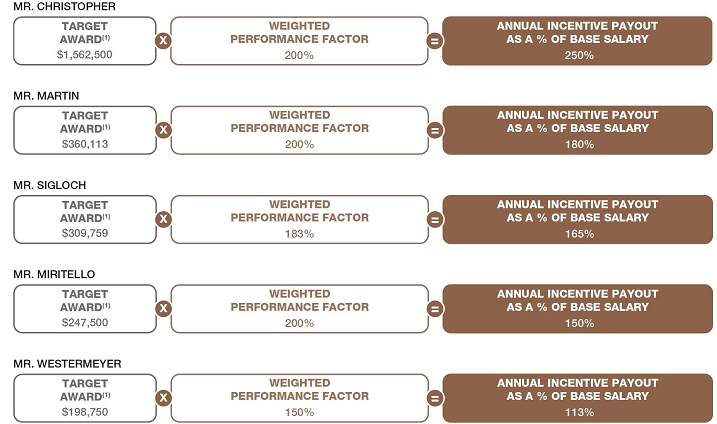

2020 NEO ANNUAL INCENTIVE CALCULATIONS

As a result of 2020 performance, the annual incentive payments for the NEOs were calculated as follows: