8285 Tournament Drive, Suite 150

Memphis, Tennessee 38125

Telephone (901) 753-3200

Notice of Annual Meeting of

Stockholders to be Held

May 5, 2005

To the Stockholders of

Mueller Industries, Inc.

1. |

To elect seven directors, each to serve until the next annual meeting of stockholders (tentatively scheduled for April 27, 2006) or until his successor is elected and qualified; |

2. |

To approve the Mueller Industries, Inc. Annual Bonus Plan; |

3. |

To consider and act upon a proposal to approve the appointment of Ernst & Young LLP, independent public accountants, as auditors of the Company for the fiscal year ending December 31, 2005; and |

4. |

To consider and transact such other business as may properly be brought before the Annual Meeting and any adjournment(s) thereof. |

Corporate Secretary

March 23, 2005

TABLE OF CONTENTS

SOLICITATION

OF PROXIES |

1 | |||||

VOTING

SECURITIES |

2 | |||||

PRINCIPAL

STOCKHOLDERS |

2 | |||||

ELECTION OF

DIRECTORS |

3 | |||||

OWNERSHIP OF

COMMON STOCK BY DIRECTORS AND EXECUTIVE OFFICERS AND INFORMATION ABOUT DIRECTOR NOMINEES |

3 | |||||

Meetings and

Committees of the Board of Directors |

7 | |||||

Director

Compensation |

8 | |||||

Board of

Directors’ Affiliations |

8 | |||||

CORPORATE

GOVERNANCE |

8 | |||||

Director

Independence |

9 | |||||

Independent

Directors |

9 | |||||

Audit

Committee |

10 | |||||

Compensation

Committee |

10 | |||||

Nominating and

Corporate Governance Committee |

10 | |||||

Corporate

Governance Guidelines |

12 | |||||

Code of

Business Conduct and Ethics |

12 | |||||

Directors’ Attendance at Annual Meetings of Stockholders |

12 | |||||

Communication

With the Board of Directors |

12 | |||||

EXECUTIVE

COMPENSATION |

13 | |||||

Summary

Compensation Table |

13 | |||||

Option Grants

During 2004 Fiscal Year |

14 | |||||

Option

Exercises During 2004 Fiscal Year and Fiscal Year-End Option Values |

16 | |||||

Employment

Contracts and Termination of Employment Arrangements |

16 | |||||

REPORT OF THE

AUDIT COMMITTEE OF THE BOARD OF DIRECTORS |

20 | |||||

REPORT OF THE

COMPENSATION COMMITTEE OF THE BOARD OF DIRECTORS ON EXECUTIVE COMPENSATION |

21 | |||||

PERFORMANCE

GRAPH |

23 | |||||

PROPOSAL TO

ADOPT THE MUELLER INDUSTRIES, INC. ANNUAL BONUS PLAN |

24 | |||||

EQUITY

COMPENSATION PLAN INFORMATION |

26 | |||||

APPOINTMENT OF

AUDITORS |

27 | |||||

STOCKHOLDER

NOMINATIONS FOR BOARD MEMBERSHIP AND OTHER PROPOSALS FOR 2006 ANNUAL MEETING |

28 | |||||

OTHER MATTERS

TO COME BEFORE THE ANNUAL MEETING |

29 | |||||

SECTION 16(a)

BENEFICIAL OWNERSHIP COMPLIANCE REPORTING |

29 | |||||

OTHER

INFORMATION |

29 |

8285 Tournament Drive, Suite 150

Memphis, Tennessee 38125

Telephone (901) 753-3200

PROXY STATEMENT

Annual Meeting of Stockholders

May 5, 2005

SOLICITATION OF PROXIES

VOTING SECURITIES

PRINCIPAL STOCKHOLDERS

| Name and Address of Beneficial Owner |

Shares Beneficially Owned |

Percent of Class |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|

Dimensional

Fund Advisors Inc. 1299 Ocean Avenue 11th Floor Santa Monica, CA 90401 |

2,208,133 (1) | 6.07% (2) | ||||||||

(1) |

Information obtained from a Schedule 13G, dated February 9, 2005, filed with the Securities and Exchange Commission (“SEC”) on behalf of Dimensional Fund Advisors Inc. The Schedule 13G reported ownership of 2,208,133 shares of Common Stock then outstanding. The Schedule 13G reported sole voting power and sole dispositive power over 2,208,133 shares. |

(2) |

The percent of class shown was based on the shares of Common Stock reported on the Schedule 13G and the total number of shares outstanding as of December 25, 2004. The difference in the total number of shares outstanding on December 25, 2004 and March 8, 2005 does not materially affect the percentage of ownership of the class. |

2

ELECTION OF DIRECTORS

OWNERSHIP OF COMMON STOCK BY DIRECTORS AND EXECUTIVE

OFFICERS AND

INFORMATION ABOUT DIRECTOR NOMINEES

| Principal Occupation, Employment, etc. |

Common Stock Beneficially Owned as of March 8, 2005 |

Percent of Class |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|

Alexander P.

Federbush Director of the Company since February 17, 2005; age 62 (1) |

1,500 | * | ||||||||

Gennaro J.

Fulvio Director of the Company since May 9, 2002; age 48 (2) |

10,336 | * | ||||||||

Gary S.

Gladstein Director of the Company since July 1, 2000; Director of Jos. A. Bank Clothiers, Inc. and Imergent, Inc.; age 60 (3) |

27,848 | * | ||||||||

Terry

Hermanson Director of the Company since February 13, 2003; age 62 (4) |

7,224 | * | ||||||||

Robert B.

Hodes Director of the Company since February 10, 1995; Director of Loral Space & Communications Ltd.; age 79 (5) |

35,060 | * | ||||||||

3

| Principal Occupation, Employment, etc. |

Common Stock Beneficially Owned as of March 8, 2005 |

Percent of Class | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

Harvey L.

Karp Chairman of the Board of Directors since October 8, 1991; Director since August 1991; age 77 |

1,041,886 | 2.85 | % | |||||||

William D.

O’Hagan Chief Executive Officer of the Company since January 1, 1994; Chief Operating Officer of the Company since June 22, 1992; President of the Company since December 1, 1992; Director of the Company since January 1993; age 63 (6) |

710,436 | 1.93 | % | |||||||

Karl J.

Bambas Vice President-Tax of the Company since October 28, 2004; age 44 (7) |

4,978 | * | ||||||||

Richard W.

Corman Vice President-Controller of the Company since October 28, 2004; age 48 (8) |

23,093 | * | ||||||||

Michael O.

Fifer Executive Vice President of the Company since June 30, 2003; age 48 (9) |

4,668 | * | ||||||||

Roy C. Harris

Vice President and Chief Information Officer of the Company since July 5, 2000; age 62 (10) |

91,990 | * | ||||||||

William H.

Hensley General Counsel of the Company since September 2, 2003; Vice President and Secretary of the Company since October 30, 2003; age 54 (11) |

8,621 | * | ||||||||

Jeffrey A.

Martin Vice President-Finance of the Company since October 28, 2004; age 38 (12) |

3,422 | * | ||||||||

Kent A. McKee

Chief Financial Officer of the Company since April 1, 1999; Vice President of the Company since February 11, 1999; age 44 (13) |

112,181 | * | ||||||||

Lee R. Nyman

Senior Vice President-Manufacturing/Engineering of the Company since February 11, 1999; age 52 (14) |

128,978 | * | ||||||||

James H.

Rourke President-Industrial Products Division of the Company since December 27, 2003; General Manager-Rod since January 29, 2002; age 56 (15) |

28,448 | * | ||||||||

4

| Principal Occupation, Employment, etc. |

Common Stock Beneficially Owned as of March 8, 2005 |

Percent of Class | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

Executive

Officers, Named Officers and Directors as a Group |

2,240,669 | 6.04 | %** | |||||||

* |

Less than 1 % |

** |

Includes 533,425 shares of Common Stock which are subject to currently exercisable stock options held by officers and directors of the Company. |

(1) |

Mr. Federbush has been the President of the Queens West Development Corp., a subsidiary of the Empire State Development Corporation, a public-benefit corporation that is a joint venture among New York State, New York City and the Port Authority of New York and New Jersey, for more than the past five years. The number of shares of Common Stock beneficially owned by Mr. Federbush includes (i) 500 shares of Common Stock owned by Mr. Federbush’s spouse and (ii) 1,000 shares of Common Stock owned by a corporation in which Mr. Federbush is an officer. |

(2) |

Mr. Fulvio has been a member of Fulvio & Associates, LLP, Certified Public Accountants (formerly Speer & Fulvio, LLP), since 1987. The number of shares of Common Stock owned beneficially by Mr. Fulvio includes 9,336 shares of Common Stock which are subject to currently exercisable stock options. |

(3) |

Mr. Gladstein previously served as a director of the Company from 1990 to 1994. Mr. Gladstein is currently an independent investor and consultant. From the beginning of 2000 to August 31, 2004, Mr. Gladstein was a Senior Consultant at Soros Fund Management. He was Chief Operating Officer at Soros Fund Management from 1985 until his retirement at the end of 1999. The number of shares of Common Stock beneficially owned by Mr. Gladstein includes 12,448 shares of Common Stock which are subject to currently exercisable stock options. |

(4) |

Mr. Hermanson has been the principal and President of Mr. Christmas, Inc., a wholesale merchandising company, for more than the last five years. The number of shares of Common Stock beneficially owned by Mr. Hermanson includes 6,224 shares of Common Stock which are subject to currently exercisable stock options. |

(5) |

Mr. Hodes is Of Counsel to the New York law firm of Willkie Farr & Gallagher LLP. The number of shares of Common Stock beneficially owned by Mr. Hodes includes (i) 2,200 shares of Common Stock owned by Mr. Hodes’ children (as to which Mr. Hodes disclaims beneficial ownership) and (ii) 15,560 shares of Common Stock which are subject to currently exercisable stock options. |

(6) |

The number of shares of Common Stock beneficially owned by Mr. O’Hagan includes (i) 186,732 shares of Common Stock which are subject to currently exercisable stock options, (ii) 28,136 shares of Common Stock owned by Mr. O’Hagan’s spouse, and (iii) 28,838 shares of Common Stock owned by a family partnership of which Mr. O’Hagan is a general partner and in which Mr. O’Hagan or his spouse hold a 99% interest. Mr. O’Hagan disclaims beneficial ownership of the 28,136 shares of Common Stock owned by his spouse. |

(7) |

Mr. Bambas served as the Company’s Tax Director for more than five years prior to October 28, 2004. The number of shares of Common Stock beneficially owned by Mr. Bambas includes 4,978 shares of Common Stock which are subject to currently exercisable stock options. |

(8) |

Mr. Corman served as the Company’s Corporate Controller for more than five years prior to October 28, 2004. The number of shares of Common Stock beneficially owned by Mr. Corman includes 12,757 shares of Common Stock which are subject to currently exercisable stock options. |

5

(9) |

Mr. Fifer served as President, North American Operations, for Watts Water Technologies, Inc., a plumbing valve manufacturer, for more than five years prior to May 31, 2003. The number of shares of Common Stock beneficially owned by Mr. Fifer includes 4,668 shares of Common Stock which are subject to currently exercisable stock options. |

(10) |

Mr. Harris served (i) as Division Manager of the Company’s Standard Products Division from May 1, 1997 through July 11, 2000 and (ii) as Controller, Standard Products Division, from December 1995 to May 1, 1997. The number of shares of Common Stock beneficially owned by Mr. Harris includes 70,582 shares of Common Stock which are subject to currently exercisable stock options. |

(11) |

Mr. Hensley served as Vice President, General Counsel and Secretary of the Company for more than five years prior to July 5, 2000. From July 5, 2000 through September, 2000, Mr. Hensley provided ongoing legal services to the Company. From September, 2000 to August, 2003, Mr. Hensley pursued an advanced degree, was self-employed in managing his private investment portfolio and provided advice in connection with private business ventures. The number of shares of Common Stock beneficially owned by Mr. Hensley includes 1,470 shares of Common Stock owned by one of Mr. Hensley’s children. |

(12) |

Mr. Martin served (i) as Director of Corporate Finance of the Company from January 1, 2002 to October 28, 2004, (ii) as Manager of Corporate Finance of the Company from January 1, 2001 to December 31, 2001, (ii) as Manager of Corporate Accounting of the Company from January 15, 1996 to December 31, 2000, and (iv) as a Manager and other positions in audit services with Pricewaterhouse Coopers LLP, a public accounting firm, from September 1989 to January 1996. The number of shares of Common Stock beneficially owned by Mr. Martin includes 3,422 shares of Common Stock which are subject to currently exercisable stock options. |

(13) |

Mr. McKee served (i) as Vice President-Business Development/Investor Relations of the Company from December 14, 1995 to February 11, 1999, (ii) as Treasurer of the Company from November 8, 1991 to December 14, 1995, and (iii) as Assistant Secretary of the Company from August 28, 1991 to December 14, 1995. The number of shares of Common Stock beneficially owned by Mr. McKee includes 66,435 shares of Common Stock which are subject to currently exercisable stock options. |

(14) |

Mr. Nyman served as Vice President-Manufacturing/Management Engineering of the Company from July 7, 1993 to February 11, 1999. The number of shares of Common Stock beneficially owned by Mr. Nyman includes 112,968 shares of Common Stock which are subject to currently exercisable stock options. |

(15) |

Mr. Rourke served (i) as Vice President-Industrial Products Division of the Company from December 14, 1995 to December 27, 2003, (ii) as Vice President and General Manager-Industrial Division of the Company from November 4, 1993 to December 14, 1995, and (iii) prior thereto as Vice President and General Manager, Industrial Products, for Mueller Brass Co. in Port Huron. The number of shares of Common Stock beneficially owned by Mr. Rourke includes 27,315 shares of Common Stock which are subject to currently exercisable stock options. |

6

Meetings and Committees of the Board of Directors

7

Directors as it deems appropriate. During fiscal 2004, the Compensation Committee and the Option Plan Committee held two formal meetings.

Director Compensation

Board of Directors’ Affiliations

CORPORATE GOVERNANCE

8

Director Independence

Independent Directors

• |

A majority of the members of the Company’s Board of Directors have been determined to meet the NYSE’s standards for independence. See “Director Independence” above. |

• |

The Company’s Corporate Governance Guidelines provide that the Company’s independent directors shall hold annually at least two formal meetings independent from management. The independent directors will choose a non-management director to preside at non-management sessions of the Board of Directors. |

9

Audit Committee

• |

All members of the Audit Committee have been determined to meet

the standards of independence required of audit committee members by the NYSE and applicable SEC rules. See “Director Independence”

above. In accordance with the rules and regulations of the SEC, the above paragraph regarding the independence of the members of the Audit Committee shall not be deemed to be “soliciting material” or to be “filed” with the SEC or subject to Regulations 14A or 14C of the Exchange Act or to the liabilities of Section 18 of the Exchange Act and shall not be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, notwithstanding any general incorporation by reference of this Proxy Statement into any other filed document. |

• |

The Board of Directors has determined that all members of the Audit Committee are financially literate. Further, the Board of Directors has determined that Gary S. Gladstein and Gennaro J. Fulvio each possess accounting or related financial management expertise, within the meaning of the listing standards of the NYSE, and are each audit committee financial experts within the meaning of applicable SEC rules. |

• |

Ernst & Young LLP, the Company’s independent auditors, reports directly to the Audit Committee. |

• |

The Audit Committee, consistent with the Sarbanes-Oxley Act of 2002 and the rules adopted thereunder, meets with management and the Company’s independent auditors prior to the filing of officers’ certifications with the SEC to receive information concerning, among other things, significant deficiencies in the design or operation of internal control over financial reporting. |

• |

The Audit Committee has adopted procedures for the receipt, retention and treatment of complaints by Company employees regarding the Company’s accounting, internal accounting controls or auditing matters. |

• |

The Audit Committee operates under a formal charter adopted by the Board of Directors that governs its duties and standards of performance. Copies of the charter can be obtained free of charge from the Company’s Web site at www.muellerindustries.com. |

Compensation Committee

• |

All members of the Compensation Committee have been determined to meet the NYSE standards for independence. See “Director Independence” above. Further, each member of the Compensation Committee is a “Non-Employee Director” as defined in Rule 16b-3 under the Exchange Act and an “outside director” as defined in Section 162(m) of the Code. |

• |

The Compensation Committee operates under a formal charter adopted by the Board of Directors that governs its duties and standards of performance. Copies of the charter can be obtained free of charge from the Company’s Web site at www.muellerindustries.com. |

Nominating and Corporate Governance Committee

• |

All members of the Nominating and Corporate Governance Committee have been determined to meet the NYSE standards for independence. See “Director Independence” above. |

10

• |

The Nominating and Corporate Governance Committee recommends to

the Board of Directors as director nominees individuals of established personal and professional integrity, ability and judgment, which are chosen with

the primary goal of ensuring that the entire Board of Directors collectively serves the interests of the Company’s stockholders. Due consideration

is given to assessing the qualifications of potential nominees and any potential conflicts with the Company’s interests. The Nominating and

Corporate Governance Committee also assesses the contributions of the Company’s incumbent directors in connection with their potential

re-nomination. In identifying and recommending director nominees, the Committee members take into account such factors as they determine appropriate,

including recommendations made by the Board of Directors. Once the Nominating and Corporate Governance Committee has identified prospective nominees, background information is elicited about the candidates, following which they are investigated, interviewed and evaluated by the Committee which then reports to the Board of Directors. |

• |

The Nominating and Corporate Governance Committee operates under a formal charter adopted by the Board of Directors that governs its duties and standards of performance. Copies of the charter can be obtained free of charge from the Company’s Web site at www.muellerindustries.com. |

11

| and of such beneficial owner, and (ii) the class and number of shares of Common Stock which are owned beneficially and of record by such stockholder and such beneficial owner. The presiding officer of the meeting may refuse to acknowledge the nomination of any person not made in compliance with the foregoing procedure. See “Stockholder Nominations for Board Membership and Other Proposals for 2006 Annual Meeting.” |

Corporate Governance Guidelines

• |

The Company has adopted a set of Corporate Governance Guidelines, including specifications for director qualification and responsibility, director access to officers and employees, director compensation, director orientation and continuing education, and the annual performance evaluation of the Board of Directors. |

• |

Copies of the guidelines can be obtained free of charge from the Company’s Web site at www.muellerindustries.com. |

Code of Business Conduct and Ethics

• |

The Company has adopted a Code of Business Conduct and Ethics, which is designed to help officers, directors and employees resolve ethical issues in an increasingly complex business environment. The Code of Business Conduct and Ethics is applicable to all of the Company’s officers, directors and employees, including the Company’s principal executive officer, principal financial officer, principal accounting officer or controller and other persons performing similar functions. The Code of Business Conduct and Ethics covers topics, including but not limited to, conflicts of interest, confidentiality of information and compliance with laws and regulations. |

• |

Waivers from the Code of Business Conduct and Ethics are discouraged. Any waivers from the Code of Business Conduct and Ethics that relate to the Company’s directors and executive officers must be approved by the Board of Directors, and will be posted on the Company’s Web site at www.muellerindustries.com. |

• |

Copies of the Code of Business Conduct and Ethics can be obtained free of charge from the Company’s Web site at www.muellerindustries.com. |

Directors’ Attendance at Annual Meetings of Stockholders

Communication With the Board of Directors

12

the procedures established by a majority of the independent directors. Communications directed to non-management directors will be relayed to the intended Board member(s) except to the extent that doing so would be contrary to the instructions of the non-management directors. Any communication so withheld will nevertheless be made available to any non-management director who wishes to review it.

EXECUTIVE COMPENSATION

Summary Compensation Table

| Long-Term Compensation |

||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Awards |

||||||||||||||||||||||

| Annual Compensation(1) |

||||||||||||||||||||||

| Name and Principal Position |

Year |

Salary |

Bonus |

Securities Underlying Options(#)(2) |

All Other Compensation(3) |

|||||||||||||||||

Harvey L.

Karp |

2004 | $ | 873,605 | $ | 1,790,890 | — | — | |||||||||||||||

Chairman of the

Board |

2003 | $ | 841,250 | $ | 841,250 | — | — | |||||||||||||||

| 2002 | $ | 801,190 | $ | 801,190 | — | — | ||||||||||||||||

William D.

O’Hagan |

2004 | $ | 595,634 | $ | 1,191,266 | 100,000 | $ | 8,200 | ||||||||||||||

President and

Chief Executive |

2003 | $ | 573,573 | $ | 544,894 | 100,000 | $ | 8,000 | ||||||||||||||

Officer |

2002 | $ | 546,260 | $ | 768,947 | 100,000 | $ | 8,000 | ||||||||||||||

Michael O.

Fifer |

2004 | $ | 240,404 | $ | 324,545 | 15,000 | $ | 8,200 | ||||||||||||||

Executive Vice

President (4) |

2003 | $ | 103,846 | $ | 45,401 | 20,000 | $ | 2,078 | ||||||||||||||

| 2002 | $ | — | $ | — | — | $ | — | |||||||||||||||

Kent A.

McKee |

2004 | $ | 264,108 | $ | 356,545 | 25,000 | $ | 8,200 | ||||||||||||||

Vice President

and Chief |

2003 | $ | 247,200 | $ | 113,278 | 20,000 | $ | 8,000 | ||||||||||||||

Financial

Officer |

2002 | $ | 208,142 | $ | 99,931 | 12,500 | $ | 8,000 | ||||||||||||||

Lee R.

Nyman |

2004 | $ | 267,115 | $ | 360,606 | 20,000 | $ | 8,200 | ||||||||||||||

Senior Vice

President- |

2003 | $ | 244,802 | $ | 111,757 | 20,000 | $ | 8,000 | ||||||||||||||

Manufacturing/Engineering |

2002 | $ | 212,629 | $ | 101,546 | 20,000 | $ | 8,000 | ||||||||||||||

(1) |

Includes all amounts earned for the respective years, even if deferred under the Company’s Executive Deferred Compensation Plan. |

(2) |

All options were issued prior to October 12, 2004. See “Voting Securities” above. |

(3) |

Consists of $8,200 contributed on behalf of each of Messrs. O’Hagan, Fifer, McKee and Nyman, as matching contributions for 2004 under the Company’s 401(k) Plan. |

(4) |

Mr. Fifer joined the Company on June 30, 2003. |

13

Option Grants During 2004 Fiscal Year

Option Grants in Last Fiscal Year

| Individual Grants |

Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term |

|||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name |

Number of Securities Underlying Options Granted (#) |

% of Total Options Granted to Employees in Fiscal Year |

Exercise or Base Price ($/Sh) |

Market Price on Date of Grant ($/Sh) |

Expiration Date |

5% |

10% |

|||||||||||||||||||||||||

Harvey L.

Karp |

— | 0.00% | $ | — | $ | — | — | $ | — | $ | — | |||||||||||||||||||||

William D.

O’Hagan |

100,000 | 33.33%(1) | $ | 32.24 | $ | 32.24 | 2/10/2014 | $ | 2,027,556 | $ | 5,138,226 | |||||||||||||||||||||

Michael O.

Fifer |

15,000 | 5.00%(2) | $ | 32.24 | $ | 32.24 | 2/10/2014 | $ | 304,133 | $ | 770,734 | |||||||||||||||||||||

Kent A.

McKee |

25,000 | 8.33%(2) | $ | 32.24 | $ | 32.24 | 2/10/2014 | $ | 506,889 | $ | 1,284,556 | |||||||||||||||||||||

Lee R.

Nyman |

20,000 | 6.67%(2) | $ | 32.24 | $ | 32.24 | 2/10/2014 | $ | 405,511 | $ | 1,027,645 | |||||||||||||||||||||

(1) |

These options were granted on February 10, 2004. Sixty-five percent of these options were granted under the Company’s 1998 Stock Option Plan and the remainder were granted under the Company’s 2002 Stock Option Plan, in each case with a per-share exercise price equal to 100% of the fair market value of a share of Common Stock at the time of grant, which, in accordance with the terms of the 1998 Stock Option Plan and the 2002 Stock Option Plan, was the mean between the highest and lowest sale price of the Common Stock on the last trading date immediately preceding the date of grant. For purposes of determining the potential realizable values of these options, the mean between the highest and lowest sales price of the Common Stock on the trading date immediately preceding the date of grant was used as the per-share market price at the time of grant. These options vest ratably over a five-year term on each anniversary of the date of grant, with the first 20% vesting on February 10, 2005, except that if there is a “Change in Control,” all remaining unvested options become immediately exercisable on the later of (i) the day Mr. O’Hagan notifies the Company he is terminating as a result of said change, and (ii) ten days prior to the date Mr. O’Hagan’s employment is terminated. For the purpose of determining the accelerated vesting of Mr. O’Hagan’s options, “Change in Control” is defined as (i) a change in control which would be required to be reported to the SEC or any securities exchange on which the Common Stock is listed, (ii) any non-exempted person or party becoming the beneficial owner of securities representing 20% or more of the voting power of the Company, or (iii) when the individuals who, on February 13, 2002, constituted the Board of Directors of the Company cease to constitute at least a majority of the Board, provided that new directors are deemed to have been directors on that date if elected by or on recommendation of at least sixty percent of the directors who were directors on February 13, 2002. |

(2) |

These options were granted on February 10, 2004 under the Company’s 2002 Stock Option Plan with a per-share exercise price equal to 100% of the fair market value of a share of Common Stock at the time of grant, which, in accordance with the terms of the 2002 Stock Option Plan, was the mean between the highest and lowest sale price of the Common Stock on the last trading date immediately preceding the date of grant. For purposes of determining the potential realizable values |

14

| of these options, the mean between the highest and lowest sales price of the Common Stock on the trading date immediately preceding the date of grant was used as the per-share market price at the time of grant. These options vest ratably over a five-year term on each anniversary of the date of grant, with the first 20% vesting on February 10, 2005, except that upon a “Change in Control,” any options not previously vested become immediately exercisable. For the purpose of determining the accelerated vesting of Messrs. Fifer’s, McKee’s and Nyman’s options, “Change in Control” is defined to mean, unless the Board of Directors otherwise directs by resolution adopted prior thereto, (i) individuals who, on February 10, 2004, constituted the Board of Directors of the Company cease to constitute at least a majority of the Board, provided that new directors are deemed to have been directors on that date if elected by or whose nomination for election was approved by a vote of at least a majority of the directors then comprising the incumbent board, (ii) any person, entity or group (within the meaning of Section 13(d) or 14(d) of the Exchange Act) becoming the beneficial owner of securities representing more than 50% of the voting power of the Company, other than (A) any acquisition by the Company or any employee benefit plan (or related trust) sponsored or maintained by the Company or any subsidiary, and (B) any acquisition by any corporation pursuant to a reorganization, merger or consolidation, if, following such reorganization, merger or consolidation, the conditions described in clauses (A) and (B) of clause (iii) of this definition are satisfied, (iii) the occurrence of a reorganization, merger or consolidation, in each case, unless, following such reorganization, merger or consolidation, (A) more than 50% of the outstanding shares of common stock of the corporation resulting from such reorganization, merger or consolidation and the combined voting power of the then outstanding voting securities of such corporation entitled to vote generally in the election of directors is then beneficially owned by all or substantially all the individuals and entities who were the beneficial owners, respectively, of the outstanding voting securities immediately prior thereto in substantially the same proportion of their ownership immediately prior to such reorganization, merger or consolidation, and (B) at least a majority of the members of the board of directors of the corporation resulting from such reorganization, merger or consolidation were members of the Board of Directors of the Company at the time of the execution of the initial agreement, providing for such reorganization, merger or consolidation, or (iv) approval by the stockholders of the Company of (A) a complete liquidation or dissolution of the Company, as applicable, or (B) the sale or other disposition of all or substantially all of the assets of the Company, other than to a corporation, with respect to which following such sale or other disposition, (1) more than 50% of, respectively, the then outstanding shares of common stock of such corporation entitled to vote generally in the election of directors is then beneficially owned, directly or indirectly, by all or substantially all of the individuals and entities who were the beneficial owners, respectively of the outstanding voting securities immediately prior to such sale or other disposition, of the outstanding voting securities, and (2) at least a majority of the members of the board of directors of such corporation were members of the Board of Directors of the Company at the time of the execution of the initial agreement or action of the Board of Directors of the Company providing for such sale or other disposition of assets of the Company; provided, however, that no transaction resulting in the disposition of one or more subsidiaries or other business units of the Company will be treated as substantially all of the assets of the Company unless the assets so disposed of comprise more than 70% of all corporate assets. |

15

Option Exercises During 2004 Fiscal Year and Fiscal Year-End Option Values

Aggregated Option Exercises in Last Fiscal Year

and Option Values at

December 25, 2004

| Number of Securities Underlying Unexercised Options at Dec. 25, 2004 (#) |

Value of Unexercised In-the-Money Options at Dec. 25, 2004 (2) |

|||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name |

Shares Acquired on Exercise (#) |

Value Realized ($)(1) |

Exercisable/ Unexercisable |

Exercisable/ Unexercisable |

||||||||||||||

Harvey L.

Karp |

2,400,000 | $ | 80,650,650 | 0 / 0 | $ | 0 / $ 0 | ||||||||||||

William D.

O’Hagan |

600,000 | 15,675,262 | 93,366 / 373,464 | $ | 1,231,592 / $ 4,877,368 | |||||||||||||

Michael O.

Fifer |

4,000 | 58,960 | 0 / 48,238 | $ | 0 / $ 635,281 | |||||||||||||

Kent A.

McKee |

46,595 | 861,319 | 48,541 / 80,918 | $ | 651,665 / $ 1,051,636 | |||||||||||||

Lee R.

Nyman |

— | — | 94,295 / 82,474 | $ | 1,204,263 / $ 1,079,089 | |||||||||||||

(1) |

Represents the difference between the closing price of the Common Stock on the date of exercise and the exercise price of the options. |

(2) |

Represents the difference between the closing price of the Common Stock on the last trading day prior to December 25, 2004 and the exercise price of the options. |

Employment Contracts and Termination of Employment Arrangements

16

equal to the average bonus for the three calendar years immediately preceding the written notice of termination. In addition, all outstanding unvested Company stock options then held by Mr. Karp will immediately vest and become exercisable and Mr. Karp will continue to participate in the Company’s health plans and programs at the Company’s expense and the Company will furnish Mr. Karp with an office in New York City and a secretary for the remainder of such term.

17

will continue to participate in the Company’s health plans and programs at the Company’s expense until he reaches age 65.

18

(i) their respective highest annual cash compensation (consisting of base salary and annual bonus) during the last three years of their employment with the Company or (ii) $2,000,000. In addition, they will be entitled to participate in the same health, major medical, hospitalization and dental insurance coverage as is generally available to the executive officers of the Company from time to time during their consulting periods. The Company will also provide Messrs. Karp and O’Hagan with the same office space provided under their respective Employment Agreements (or such other comparable office space anywhere in the United States designated by and acceptable to them) and secretarial services. During the consulting period, they will continue to have access to the Company’s private airplane on the same basis available to them while employed with the Company, provided they reimburse the Company for any personal use of such airplane.

19

REPORT OF THE AUDIT COMMITTEE

OF THE BOARD OF DIRECTORS (1)

20

included in the Company’s Annual Report on Form 10-K for the year ended December 25, 2004, for filing with the SEC. The Audit Committee and the Board has re-appointed, subject to shareholder approval, Ernst & Young LLP, independent auditors, to audit the consolidated financial statements of the Company for the fiscal year ending December 31, 2005.

Gary S. Gladstein

Terry Hermanson

(1) |

This Section is not “soliciting material,” is not deemed “filed” with the SEC and is not to be incorporated by reference in any filing of the Company under the Securities Act or the Exchange Act, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing. |

REPORT OF THE COMPENSATION COMMITTEE

OF THE BOARD OF DIRECTORS

ON

EXECUTIVE COMPENSATION

21

recommendations from Messrs. Karp and O’Hagan. When granting options to executive officers, the Compensation Committee considers the total number of shares available under the Company’s option plans, the number of options previously granted to such officers, Company and individual performance, and each officer’s level of responsibility within the Company. However, no specific corporate or individual performance factors are used. The Compensation Committee believes that stock options are an integral part of the Company’s executive compensation program, which motivate executives to practice long-term strategic management, and align their financial interests with those of the Company’s stockholders. On February 9, 2004, the Compensation Committee approved an option grant of 100,000 shares of Common Stock to Mr. O’Hagan. The options were granted at fair market value at the time of grant, have a ten year term, and vest ratably over five years, except under certain circumstances if there is a “Change in Control.” Such options were granted in recognition of Mr. O’Hagan’s contributions to the Company’s success and as part of Mr. O’Hagan’s overall compensation program.

Alexander P. Federbush

Gennaro J. Fulvio

22

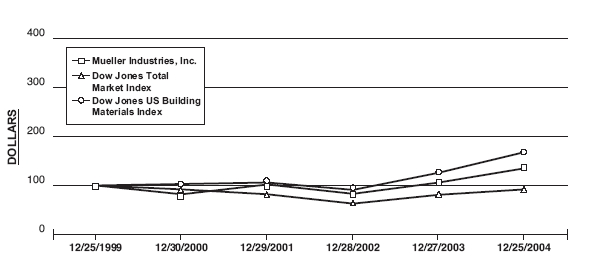

PERFORMANCE GRAPH

COMPARISON OF FIVE YEAR CUMULATIVE TOTAL RETURN

Among Mueller Industries, Inc., Dow Jones Total Market

Index and Dow Jones

US Building Materials Index

Fiscal Year Ending Last Saturday in December(1)

| 12/25/1999 |

12/30/2000 |

12/29/2001 |

12/28/2002 |

12/27/2003 |

12/25/2004 |

|||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Mueller

Industries, Inc. |

100 | 82 | 102 | 83 | 106 | 135 | ||||||||||||||||||||

Dow Jones

Total Market Index |

100 | 92 | 82 | 63 | 81 | 92 | ||||||||||||||||||||

Dow Jones US

Building Materials Index |

100 | 103 | 106 | 91 | 126 | 168 | ||||||||||||||||||||

(1) |

Reflects reinvestment in shares of Common Stock of (i) regular quarterly dividends paid by the Company, (ii) the cash paid by the Company in connection with the Special Dividend and (iii) the proceeds of an assumed sale at par of the Debentures paid by the Company in connection with the Special Dividend. |

23

PROPOSAL TO ADOPT THE MUELLER INDUSTRIES, INC.

ANNUAL BONUS

PLAN

24

New Plan Benefits

| Name and Position |

Dollar Value |

Number of Units |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|

Harvey L.

Karp Chairman of the Board |

$ | 1,747,210 | N/A | |||||||

William D.

O’Hagan President and Chief Executive Officer |

$ | 1,191,266 | N/A | |||||||

25

Required Vote

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS

VOTE THEIR SHARES FOR

THE PROPOSAL TO APPROVE THE MUELLER

INDUSTRIES, INC. ANNUAL BONUS PLAN

EQUITY COMPENSATION PLAN INFORMATION

| (a) |

(b) |

(c) |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Plan Category |

Number of securities to be issued upon exercise of outstanding options, warrants and rights |

Weighted average exercise price of outstanding options, warrants and rights |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) |

|||||||||||

Equity

compensation plans approved by security holders |

1,446 | $ | 18.91 | 455 | ||||||||||

Equity

compensation plans not approved by security holders |

836 | 18.20 | — | |||||||||||

Total |

1,782 | $ | 18.78 | 455 | ||||||||||

Arrangements Not Approved by Security Holders

26

Employment Agreement). The O’Hagan Treasury Options may only be exercised for shares of Common Stock held in treasury by the Company.

APPOINTMENT OF AUDITORS

| 2004 |

2003 |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|

Audit

Fees |

$ | 1,580,819 | $ | 613,133 | ||||||

Audit-Related

Fees |

176,471 | 107,117 | ||||||||

Tax

Fees |

153,155 | 171,470 | ||||||||

All Other

Fees |

6,470 | 2,731 | ||||||||

| $ | 1,916,915 | $ | 894,451 | |||||||

27

STOCKHOLDER NOMINATIONS FOR BOARD MEMBERSHIP

AND OTHER PROPOSALS FOR 2006

ANNUAL MEETING

28

OTHER MATTERS TO COME BEFORE THE ANNUAL MEETING

SECTION 16(a) BENEFICIAL OWNERSHIP COMPLIANCE REPORTING

OTHER INFORMATION

Corporate Secretary

29

[THIS PAGE INTENTIONALLY LEFT BLANK.]

30

C/O CONTINENTAL STOCK TRANSFER

17 BATTERY PLACE

NEW YORK, NY 10004

VOTE BY PHONE - 1-800-690-6903

Use any touch-tone telephone to transmit your voting instructions up until 11:59 P.M. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you call and then follow the instructions.

VOTE BY MAIL

Mark, sign, and date your proxy card and return it in the postage-paid envelope we have provided or return it to Mueller Industries, Inc., c/o ADP, 51 Mercedes Way, Edgewood, NY 11717.

| TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: | MUIND1 | KEEP THIS PORTION FOR YOUR RECORDS |

| DETACH AND RETURN THIS PORTION ONLY | ||

THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. |

||

MUELLER INDUSTRIES, INC.

| 1. Election of Directors | |||||||||

| Nominees: | |||||||||

| 01) Alexander P. Federbush | 05) Robert B. Hodes | For | Withhold | For All |

To withhold authority to vote, mark “For All Except” and write the nominee’s number on the line below.

|

||||

| 02) Gennaro J. Fulvio | 06) Harvey L. Karp | All | All | Except | |||||

| 03) Gary S. Gladstein | 07) William D. O’Hagan | ||||||||

| 04) Terry Hermanson | ¡ | ¡ | ¡ | ||||||

| For | Against | Abstain | |||||||||||

| Vote on Proposal | |||||||||||||

| 2. | Approve the Mueller Industries, Inc. Annual Bonus Plan. |

¡ | ¡ | ¡ | |||||||||

| 3. | Approve the appointment of Ernst & Young LLP as independent auditors of the Company. |

¡ | ¡ | ¡ | |||||||||

*Note* Such other business as may properly come before the meeting or any adjournment thereof |

|||||||||||||

THIS PROXY, WHEN PROPERLY EXECUTED, WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE SIGNED STOCKHOLDER. IF NO DIRECTION IS GIVEN, THIS PROXY WILL BE VOTED “FOR” ALL NOMINEES IN ITEM 1 AND “FOR” ITEMS 2 AND 3. |

|||||||||||||

Please sign exactly as your name appears to the right. When shares are held jointly, each stockholder named should sign. When signing as attorney, executor, administrator, trustee or guardian, you should so indicate when

signing. If a corporation, please sign in full corporate name by duly authorized officer. If a partnership, please sign in partnership name by duly authorized person. |

|||||||||||||

| Yes | No | ||||||||||||

HOUSEHOLDING ELECTION - Please indicate if you consent to receive certain future investor communications in a single package per household

|

¡ | ¡ | |||||||||||

| Signature [PLEASE SIGN WITHIN BOX] | Date | Signature (Joint Owners) | Date |

MUELLER INDUSTRIES, INC.

PROXY FOR ANNUAL MEETING OF STOCKHOLDERS - MAY 5, 2005

This Proxy is Solicited on Behalf of the Board of Directors

The undersigned hereby appoints William H. Hensley and Kent A. McKee, and each of them, Proxies, with full power of substitution in each, to represent and to vote, as designated, all shares of Common Stock of Mueller Industries, Inc. that the undersigned is entitled to vote at the Annual Meeting of Stockholders to be held on May 5, 2005, and at all adjournments thereof, upon and in respect of the matters set forth on the reverse side hereof, and in their discretion, upon any other matter that may properly come before said meeting.

PLEASE MARK, SIGN, DATE AND RETURN THIS PROXY CARD PROMPTLY USING THE ENCLOSED ENVELOPE.