UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

|

| | |

For the fiscal year ended | December 30, 2017 | Commission file number 1–6770 |

MUELLER INDUSTRIES, INC.

(Exact name of registrant as specified in its charter)

|

| |

Delaware | 25-0790410 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

|

| |

8285 Tournament Drive, Suite 150 | |

Memphis, Tennessee | 38125 |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (901) 753-3200

Securities registered pursuant to Section 12(b) of the Act:

|

| |

Title of each class | Name of each exchange on which registered |

Common Stock, $0.01 Par Value | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by a check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405 of this chapter) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

| |

Large accelerated filer ☒ | Accelerated filer ☐ |

Non-accelerated filer ☐ | Smaller reporting company ☐ |

Emerging growth company ☐ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the Registrant’s most recently completed second fiscal quarter was $1,698,272,608.

The number of shares of the Registrant’s common stock outstanding as of February 23, 2018 was 57,564,175 excluding 22,618,829 treasury shares.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the following document are incorporated by reference into this Report: Registrant’s Definitive Proxy Statement for the 2018 Annual Meeting of Stockholders, scheduled to be mailed on or about March 29, 2018 (Part III).

MUELLER INDUSTRIES, INC.

_____________________

As used in this report, the terms “we,” “us,” “our,” “Company,” “Mueller,” and “Registrant” mean Mueller Industries, Inc. and its consolidated subsidiaries taken as a whole, unless the context indicates otherwise.

____________________

TABLE OF CONTENTS

|

| | | |

| | | Page |

Part I | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Part II | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Part III | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Part IV | | |

| | | |

| | | |

| | | |

| | |

| | | |

| |

PART I

Introduction

Mueller Industries, Inc. (the Company) is a leading manufacturer of copper, brass, aluminum, and plastic products. The range of these products is broad: copper tube and fittings; line sets; brass and copper alloy rod, bar, and shapes; aluminum and brass forgings; aluminum impact extrusions; PEX plastic tube; refrigeration valves and fittings; fabricated tubular products; and steel nipples. We also resell brass and plastic plumbing valves, plastic fittings, malleable iron fittings, faucets, and plumbing specialty products. Our operations are located throughout the United States and in Canada, Mexico, Great Britain, South Korea, and China. The Company was incorporated in Delaware on October 3, 1990.

Each of our reportable segments is composed of certain operating segments that are aggregated primarily by the nature of products offered. These are the Piping Systems, Industrial Metals, and Climate segments.

Certain administrative expenses and expenses related primarily to retiree benefits at inactive operations are combined into the Corporate and Eliminations classification.

Financial information concerning segments and geographic information appears under “Note 3 – Segment Information” in the Notes to Consolidated Financial Statements, which is incorporated herein by reference.

New housing starts and commercial construction are important determinants of our sales to the heating, ventilation, and air-conditioning (HVAC), refrigeration, and plumbing markets because the principal end use of a significant portion of our products is in the construction of single and multi-family housing and commercial buildings. Repairs and remodeling projects are also important drivers of underlying demand for these products.

Piping Systems Segment

The Piping Systems segment is composed of Domestic Piping Systems Group, Great Lakes Copper (Great Lakes), Pexcor Manufacturing Company and Heatlink Group Inc. (collectively, Heatlink Group), European Operations, Trading Group, and Jungwoo Metal Ind. Co., LTD (Jungwoo-Mueller).

The Domestic Piping Systems Group manufactures copper tube and fittings, plastic fittings, and line sets. These products are manufactured in the U.S., sold in the U.S., and exported to markets worldwide. Our copper tube ranges in size from 1/8 inch to 8 1/8 inch diameter and is sold in various straight lengths and coils. We are a market leader in the air-conditioning and refrigeration service tube markets and we also supply a variety of water tube in straight lengths and coils used for plumbing applications in virtually every type of construction project. Our copper and plastic fittings, line sets, and related components are produced for the plumbing and heating industry to be used in water distribution systems, heating systems, air-conditioning, and refrigeration applications, and drainage, waste, and vent systems.

Great Lakes manufactures copper tube and line sets in Canada and sells the products primarily in the U.S. and Canada. Heatlink Group manufactures a complete line of products for PEX plumbing and radiant systems in Canada and sells these products in Canada and the U.S. European Operations manufactures copper tube in the United Kingdom, which is sold throughout Europe. The Trading Group manufactures steel pipe nipples and resells imported brass and plastic plumbing valves, malleable iron fittings, faucets, and plumbing specialty products to plumbing wholesalers, distributors to the manufactured housing and recreational vehicle industries, and building materials retailers in North America. Jungwoo-Mueller, our South Korean joint venture, manufactures copper-based joining products that are sold worldwide.

We acquired Howell Metal Company (Howell) on October 17, 2013, Yorkshire Copper Tube (Yorkshire) on February 28, 2014, Great Lakes on July 31, 2015, a 60 percent equity interest in Jungwoo-Mueller on April 26, 2016, and Heatlink Group on May 31, 2017. Howell manufactures copper tube and line sets for U.S. distribution, while Yorkshire produces European standard copper distribution tubes. These acquisitions complement our existing copper tube, line sets, copper fittings, and plastics businesses in the Piping Systems segment.

We disposed of Mueller Primaflow Limited (Primaflow), our U.K. based plumbing and heating systems import distribution business, on November 21, 2014. This business was part of European Operations in the Piping Systems segment. We also disposed of

Jiangsu Mueller-Xingrong Copper Industries Limited (Mueller-Xingrong), the Company’s Chinese joint venture, on June 21, 2017. This business manufactured engineered copper tube primarily for air-conditioning applications in China.

The segment sells products to wholesalers in the plumbing and refrigeration markets, distributors to the manufactured housing and recreational vehicle industries, building material retailers, and air-conditioning original equipment manufacturers (OEMs). It markets primarily through its own sales and distribution organization, which maintains sales offices and distribution centers throughout the United States and in Canada, Mexico, Europe, China, and South Korea. Additionally, products are sold and marketed through a complement of agents, which, when combined with our sales organization, provide the Company broad geographic market representation.

The total amount of order backlog for the Piping Systems segment as of December 30, 2017 was not significant.

We compete with various companies, depending on the product line. In the U.S. copper tube business, domestic competition includes Cerro Flow Products LLC, Cambridge-Lee Industries LLC (a subsidiary of Industrias Unidas S.A. de C.V.), and Wieland Copper Products LLC, as well as many actual and potential foreign competitors. In the European copper tube business, we compete with several European-based manufacturers of copper tube as well as other foreign-based manufacturers. In the Canadian copper tube business, our competitors include foreign-based manufacturers. In the copper fittings market, our domestic competitors include Elkhart Products Company (a subsidiary of Aalberts Industries N.V.) and NIBCO, Inc. We also compete with several foreign manufacturers. Additionally, our copper tube and fittings businesses compete with a large number of manufacturers of substitute products made from other metals and plastic. The plastic fittings competitors include NIBCO, Inc., Charlotte Pipe & Foundry, and other companies.

Industrial Metals Segment

The Industrial Metals segment is composed of Brass Rod & Copper Bar Products, Impacts & Micro Gauge, and Brass Value-Added Products.

Brass Rod & Copper Bar Products manufactures a broad range of brass rod and copper alloy shapes, as well as a wide variety of end products including plumbing brass, valves, and fittings sold primarily to OEMs in the industrial, HVAC, plumbing, and refrigeration industries. We extrude brass, bronze, and copper alloy rod in sizes ranging from 3/8 inches to 4 inches in diameter. These alloys are used in applications that require a high degree of machinability, wear and corrosion resistance, as well as electrical conductivity.

Impacts & Micro Gauge manufactures cold-form aluminum and copper products for automotive, industrial, and recreational components, as well as high-volume machining of aluminum, steel, brass, and cast iron impacts and castings for automotive applications. It sells its products primarily to OEMs in the U.S., serving the automotive, military ordnance, aerospace, and general manufacturing industries. Typical applications for impacts are high strength ordnance, high-conductivity electrical components, builders’ hardware, hydraulic systems, automotive parts, and other uses where toughness must be combined with varying complexities of design and finish.

Brass Value-Added Products manufactures brass and aluminum forgings; brass, aluminum, and stainless steel valves; fluid control solutions; and gas train assembles. Our forgings are used in a wide variety of products, including automotive components, brass fittings, industrial machinery, valve bodies, gear blanks, and computer hardware. Our valves, fluid control systems, and gas train assemblies are used in the compressed gas, pharmaceutical, construction, and gas appliance markets.

On June 18, 2015, we acquired Sherwood Valve Products, LLC (Sherwood), which manufactures valves and fluid control solutions for the HVAC, refrigeration, and compressed gas markets. The acquisition of Sherwood complements our existing brass businesses in the Industrial Metals segment.

The segment sells its products primarily to domestic OEMs in the industrial, construction, HVAC, plumbing, and refrigeration markets. The total amount of order backlog for the Industrial Metals segment as of December 30, 2017 was not significant.

Competitors, primarily in the brass rod market, include Chase Brass and Copper Company LLC, a subsidiary of Global Brass and Copper Holdings, Inc., and others, both domestic and foreign.

Climate Segment

The Climate segment is composed of Refrigeration Products, Fabricated Tube Products, Westermeyer Industries, Inc. (Westermeyer), and Turbotec Products, Inc. (Turbotec).

Refrigeration Products designs and manufactures valves, protection devices, and brass fittings for various OEMs in the commercial HVAC and refrigeration markets. Fabricated Tube Products manufactures tubular assemblies and fabrications for OEMs in the HVAC and refrigeration markets. Westermeyer designs, manufactures, and distributes high-pressure components and accessories for the air-conditioning and refrigeration markets. Turbotec manufactures coaxial heat exchangers and twisted tubes for the HVAC, geothermal, refrigeration, swimming pool heat pump, marine, ice machine, commercial boiler, and heat reclamation markets.

We acquired Turbotec on March 30, 2015. The acquisition complements our existing refrigeration business in the Climate segment.

The segment sells its products primarily to OEMs in the HVAC and refrigeration markets in the U.S. The total amount of order backlog for the Climate segment as of December 30, 2017 was not significant.

Labor Relations

At December 30, 2017, the Company employed approximately 4,125 employees, of which approximately 1,678 were represented by various unions. Those union contracts will expire as follows:

|

| |

Location | Expiration Date |

Port Huron, Michigan (Local 119 SPFPA) | April 1, 2018 |

Wynne, Arkansas | June 28, 2018 |

North Wales, Pennsylvania | July 31, 2018 |

Belding, Michigan | September 14, 2018 |

Fulton, Mississippi | September 30, 2018 |

Waynesboro, Tennessee | November 2, 2018 |

Port Huron, Michigan (Local 218 IAM) | May 5, 2019 |

Port Huron, Michigan (Local 44 UAW) | July 21, 2019 |

The union agreements at the Company’s U.K. and Mexico operations are renewed annually. The Company expects to renew its union contracts without material disruption to its operations.

Raw Material and Energy Availability

A substantial portion of our base metal requirements (primarily copper) is normally obtained through short-term supply contracts with competitive pricing provisions (for cathode) and the open market (for scrap). Other raw materials used in the production of brass, including brass scrap, zinc, tin, and lead are obtained from zinc and lead producers, open-market dealers, and customers with brass process scrap. Raw materials used in the fabrication of aluminum and plastic products are purchased in the open market from major producers.

Adequate supplies of raw material have historically been available to us from primary producers, metal brokers, and scrap dealers. Sufficient energy in the form of natural gas, fuel oils, and electricity is available to operate our production facilities. While temporary shortages of raw material and fuels may occur occasionally, to date they have not materially hampered our operations.

Our copper tube facilities can accommodate both refined copper and certain grades of copper scrap as the primary feedstock. The Company has commitments from refined copper producers for a portion of its metal requirements for 2018. Adequate quantities of copper are currently available. While we will continue to react to market developments, resulting pricing volatility or supply disruptions, if any, could nonetheless adversely affect the Company.

Environmental Proceedings

Compliance with environmental laws and regulations is a matter of high priority for the Company. Mueller’s provision for environmental matters related to all properties was $7.5 million for 2017, $0.9 million for 2016, and $0.1 million for 2015. The reserve for environmental matters was $28.0 million at December 30, 2017 and $21.9 million at December 31, 2016. Environmental expenses related to non-operating properties are presented below operating income in the Consolidated Statements of Income, and costs related to operating properties are included in cost of goods sold. We currently anticipate that we will need to make expenditures of approximately $8.6 million for compliance activities related to existing environmental matters during the next three fiscal years.

For a description of material pending environmental proceedings, see “Note 13 – Commitments and Contingencies” in the Notes to Consolidated Financial Statements, which is incorporated herein by reference.

Other Business Factors

Our business is not materially dependent on patents, trademarks, licenses, franchises, or concessions held. In addition, expenditures for Company-sponsored research and development activities were not material during 2017, 2016, or 2015. No material portion of our business involves governmental contracts. Seasonality of the Company’s sales is not significant.

SEC Filings

We make available through our internet website our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission (SEC). To retrieve any of this information, you may access our internet home page at www.muellerindustries.com, select Investors, and then select SEC Filings.

The Company is exposed to risk as it operates its businesses. To provide a framework to understand our operating environment, we are providing a brief explanation of the more significant risks associated with our businesses. Although we have tried to identify and discuss key risk factors, others could emerge in the future. These risk factors should be considered carefully when evaluating the Company and its businesses.

Increases in costs and the availability of energy and raw materials used in our products could impact our cost of goods sold and our distribution expenses, which could have a material adverse impact on our operating margins.

Both the costs of raw materials used in our manufactured products (copper, brass, zinc, aluminum, and PVC and ABS resins) and energy costs (electricity, natural gas and fuel) have been volatile during the last several years, which has resulted in changes in production and distribution costs. For example, recent and pending climate change regulation and initiatives on the state, regional, federal, and international levels that have focused on reducing greenhouse gas (GHG) emissions from the energy and utility sectors may affect energy availability and costs in the near future. While we typically attempt to pass costs through to our customers or to modify or adapt our activities to mitigate the impact of increases, we may not be able to do so successfully. Failure to fully pass increases to our customers or to modify or adapt our activities to mitigate the impact could have a material adverse impact on our operating margins. Additionally, if we are for any reason unable to obtain raw materials or energy, our ability to manufacture our products would be impacted, which could have a material adverse impact on our operating margins.

The unplanned departure of key personnel could disrupt our business.

We depend on the continued efforts of our senior management. The unplanned loss of key personnel, or the inability to hire and retain qualified executives, could negatively impact our ability to manage our business.

Economic conditions in the housing and commercial construction industries, as well as changes in interest rates, could have a material adverse impact on our business, financial condition, and results of operations.

Our business is sensitive to changes in general economic conditions, particularly in the housing and commercial construction industries. Prices for our products are affected by overall supply and demand in the market for our products and for our competitors’ products. In particular, market prices of building products historically have been volatile and cyclical, and we may be unable to control the timing and extent of pricing changes for our products. Prolonged periods of weak demand or excess supply in any of our businesses could negatively affect our revenues and margins and could result in a material adverse impact on our business, financial condition, and results of operations.

The markets that we serve, including, in particular, the housing and commercial construction industries, are significantly affected by movements in interest rates and the availability of credit. Significantly higher interest rates could have a material adverse effect on our business, financial condition, and results of operations. Our businesses are also affected by a variety of other factors beyond our control, including, but not limited to, employment levels, foreign currency exchange rates, unforeseen inflationary pressures, and consumer confidence. Since we operate in a variety of geographic areas, our businesses are subject to the economic conditions

in each such area. General economic downturns or localized downturns in the regions where we have operations could have a material adverse effect on our business, financial condition, and results of operations.

The impact of economic conditions on the operations or liquidity of any party with which we conduct our business, including our suppliers and customers, may adversely impact our business.

Competitive conditions, including the impact of imports and substitute products and technologies, could have a material adverse effect on the demand for our products as well as our margins and profitability.

The markets we serve are competitive across all product lines. Some consolidation of customers has occurred and may continue, which could shift buying power to customers. In some cases, customers have moved production to low-cost countries such as China, or sourced components from there, which has reduced demand in North America for some of the products we manufacture. These conditions could have a material adverse impact on our ability to maintain margins and profitability. The potential threat of imports and substitute products is based upon many factors, including raw material prices, distribution costs, foreign exchange rates, production costs, and the development of emerging technologies and applications. The end use of alternative import and/or substitute products could have a material adverse effect on our business, financial condition, and results of operations. Likewise, the development of new technologies and applications could result in lower demand for our products and have a material adverse effect on our business.

Our exposure to exchange rate fluctuations on cross border transactions and the translation of local currency results into U.S. dollars could have an adverse impact on our results of operations or financial position.

We conduct our business through subsidiaries in several different countries and export our products to many countries. Fluctuations in currency exchange rates could have a significant impact on the competitiveness of our products as well as the reported results of our operations, which are presented in U.S. dollars. A portion of our products are manufactured in or acquired from suppliers located in lower cost regions. Cross border transactions, both with external parties and intercompany relationships, result in increased exposure to foreign exchange fluctuations. The strengthening of the U.S. dollar could expose our U.S. based businesses to competitive threats from lower cost producers in other countries such as China. Lastly, our sales are translated into U.S. dollars for reporting purposes. The strengthening of the U.S. dollar could result in unfavorable translation effects when the results of foreign operations are translated into U.S. dollars. Accordingly, significant changes in exchange rates, particularly the British pound sterling, Mexican peso, Canadian dollar, South Korean won, and Chinese renminbi, could have an adverse impact on our results of operations or financial position.

The vote by the United Kingdom (U.K.) to leave the European Union (EU) could adversely affect us.

Through a June 2016 U.K. referendum on its membership in the EU, a majority of U.K. voters voted to exit the EU (Brexit). As a result, we face risks associated with the potential uncertainty and consequences that may follow Brexit, including with respect to volatility in exchange rates and interest rates and disruptions affecting our relationships with our existing and future customers, suppliers and employees. Brexit could adversely affect European or worldwide political, regulatory, economic or market conditions and could contribute to instability in global political institutions, regulatory agencies and financial markets. Any of these effects of Brexit, and others we cannot anticipate, could adversely affect our business, results of operations and financial condition.

We are subject to claims, litigation, and regulatory proceedings that could have a material adverse effect on us.

We are, from time-to-time, involved in various claims, litigation matters, and regulatory proceedings. These matters may include contract disputes, personal injury claims, environmental claims and administrative actions, Occupational Safety and Health Administration inspections or proceedings, other tort claims, employment and tax matters and other litigation including class actions that arise in the ordinary course of our business. Although we intend to defend these matters vigorously, we cannot predict with certainty the outcome or effect of any claim or other litigation matter, and there can be no assurance as to the ultimate outcome of any litigation or regulatory proceeding. Litigation and regulatory proceedings may have a material adverse effect on us because of potential adverse outcomes, defense costs, the diversion of our management’s resources, availability of insurance coverage and other factors.

A strike, other work stoppage or business interruption, or our inability to renew collective bargaining agreements on favorable terms, could impact our cost structure and our ability to operate our facilities and produce our products, which could have an adverse effect on our results of operations.

We have a number of employees who are covered by collective bargaining or similar agreements. If we are unable to negotiate acceptable new agreements with the unions representing our employees upon expiration of existing contracts, we could experience

strikes or other work stoppages. Strikes or other work stoppages could cause a significant disruption of operations at our facilities, which could have an adverse impact on us. New or renewal agreements with unions representing our employees could call for higher wages or benefits paid to union members, which would increase our operating costs and could adversely affect our profitability. Higher costs and/or limitations on our ability to operate our facilities and manufacture our products resulting from increased labor costs, strikes or other work stoppages could have a material adverse effect on our results of operations.

In addition, unexpected interruptions in our operations or those of our customers or suppliers due to such causes as weather-related events or acts of God, such as earthquakes, could have an adverse effect on our results of operations. For example, the Environmental Protection Agency has found that global climate change would be expected to increase the severity and possibly the frequency of severe weather patterns such as hurricanes. Although the financial impact of such future events is not reasonably estimable at this time, should they occur, our operations in certain coastal and flood-prone areas or operations of our customers and suppliers could be adversely affected.

We are subject to environmental, health, and safety laws and regulations and future compliance may have a material adverse effect on our results of operations, financial position, or cash flows.

The nature of our operations exposes us to the risk of liabilities and claims with respect to environmental, health, and safety matters. While we have established accruals intended to cover the cost of environmental remediation at contaminated sites, the actual cost is difficult to determine and may exceed our estimated reserves. Further, changes to, or more rigorous enforcement or stringent interpretation of environmental or health and safety laws could require significant incremental costs to maintain compliance. Recent and pending climate change regulation and initiatives on the state, regional, federal, and international levels may require certain of our facilities to reduce GHG emissions. While not reasonably estimable at this time, this could require capital expenditures for environmental control facilities and/or the purchase of GHG emissions credits in the coming years. In addition, with respect to environmental matters, future claims may be asserted against us for, among other things, past acts or omissions at locations operated by predecessor entities, or alleging damage or injury or seeking other relief in connection with environmental matters associated with our operations. Future liabilities, claims, and compliance costs may have a material adverse effect on us because of potential adverse outcomes, defense costs, diversion of our resources, availability of insurance coverage, and other factors. The overall impact of these requirements on our operations could increase our costs and diminish our ability to compete with products that are produced in countries without such rigorous standards; the long run impact could negatively impact our results and have a material adverse effect on our business.

If we do not successfully execute or effectively operate, integrate, leverage and grow acquired businesses, our financial results may suffer.

Our strategy for long-term growth, productivity and profitability depends in part on our ability to make prudent strategic acquisitions and to realize the benefits we expect when we make those acquisitions. In furtherance of this strategy, over the past several years, we have acquired businesses in Europe, Canada, South Korea, and the United States.

While we currently anticipate that our past and future acquisitions will enhance our value proposition to customers and improve our long-term profitability, there can be no assurance that we will realize our expectations within the time frame we have established, if at all, or that we can continue to support the value we allocate to these acquired businesses, including their goodwill or other intangible assets.

We are subject to risks associated with changes in tax laws and regulations.

We are a large corporation with operations in the U.S. and other jurisdictions. On December 22, 2017, the U.S. government enacted the Tax Cuts and Jobs Act (the Act). The overall effect of U.S. Tax Reform may be positive for Mueller, however, there are certain changes that may have adverse effects for Mueller. While the Act reduces the U.S. federal corporate tax rate from 35 percent to 21 percent, it also requires companies to pay a one-time transition tax on the accumulated earnings of certain foreign subsidiaries, and creates new taxes on certain foreign sourced earnings. At December 30, 2017, the Company has not completed its accounting for the tax effects of enactment of the Act. However, the Company has made a reasonable estimate of the one-time transition tax on accumulated foreign earnings as well as the impact of the Act on its existing deferred tax balances. The final transition impacts of the Act may differ from the estimates provided elsewhere in this Annual Report, possibly materially, due to, among other things, changes in interpretations of the Act, any legislative action to address questions that arise because of the Act, any changes in accounting standards for income taxes or related interpretations in response to the Act, or any updates or changes to estimates we have used to calculate the transition impacts. Any changes in enacted tax laws (such as the recent U.S. tax legislation), rules or regulatory or judicial interpretations, any adverse outcome in connection with tax audits in any jurisdiction, or any change in the pronouncements relating to accounting for income taxes could materially and adversely impact our financial condition and results of operations.

We may be subject to risks relating to our information technology systems.

We rely on information technology systems to process, transmit and store electronic information and manage and operate our business. A breach in cyber security could expose us, our customers, our suppliers and our employees to risks of misuse of confidential information. A breach could also result in manipulation and destruction of data, production downtimes and operations disruptions, which in turn could adversely affect our reputation, competitive position, business or results of operations.

|

| |

ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

Information pertaining to our major operating facilities is included below. Except as noted, we own all of the principal properties. In addition, we own and/or lease other properties used as distribution centers and corporate offices. Our plants are in satisfactory condition and are suitable for the purpose for which they were designed and are now being used.

|

| | | | | | |

Location of Facility | | Building Space (Sq. Ft.) | | Primary Use | | Owned or Leased |

| | | | | | |

Piping Systems Segment |

Fulton, MS | | 724,300 | | Manufacturing, Packaging, & Distribution | | Owned |

New Market, VA | | 413,120 | | Manufacturing & Distribution | | Owned |

Wynne, AR | | 400,000 | | Manufacturing & Distribution | | Owned |

Ansonia, CT | | 89,396 | | Manufacturing & Distribution | | Owned |

Covington, TN | | 159,500 | | Manufacturing | | Owned |

Phoenix, AZ | | 61,000 | | Manufacturing | | Leased |

Lawrenceville, GA | | 56,000 | | Manufacturing | | Leased |

North Wales, PA | | 174,000 | | Manufacturing | | Owned |

Cedar City, UT | | 260,000 | | Manufacturing & Distribution | | Owned |

Bilston, England | | 402,500 | | Manufacturing | | Owned |

London, Ontario, Canada | | 200,400 | | Manufacturing | | Leased |

Calgary, Alberta, Canada | | 20,000 | | Manufacturing | | Leased |

Calgary, Alberta, Canada | | 21,117 | | Manufacturing | | Leased |

Calgary, Alberta, Canada | | 6,600 | | Manufacturing | | Leased |

Monterrey, Mexico | | 152,000 | | Manufacturing | | Leased |

Yangju City, Gyeonggi Province, South Korea | | 343,909 | | Manufacturing | | Owned |

| | | | | | |

Industrial Metals Segment | | | | | | |

Port Huron, MI | | 450,000 | | Manufacturing | | Owned |

Belding, MI | | 293,068 | | Manufacturing | | Owned |

Brighton, MI | | 65,000 | | Machining | | Leased |

Marysville, MI | | 81,500 | | Manufacturing | | Owned |

Brooklyn, OH | | 75,000 | | Manufacturing | | Leased |

Valley View, OH | | 65,400 | | Manufacturing & Distribution | | Leased |

Middletown, OH | | 55,000 | | Manufacturing | | Owned |

Waynesboro, TN | | 57,000 | | Manufacturing | | Leased |

| | | | | | |

Climate Segment | | | | | | |

Hartsville, TN | | 78,000 | | Manufacturing | | Owned |

Carthage, TN | | 67,520 | | Manufacturing | | Owned |

Bluffs, IL | | 107,000 | | Manufacturing | | Owned |

Gordonsville, TN | | 54,000 | | Manufacturing | | Leased |

Carrollton, TX | | 9,230 | | Manufacturing | | Leased |

Hickory, NC | | 100,000 | | Manufacturing | | Owned |

Guadalupe, Mexico | | 130,110 | | Manufacturing | | Leased |

Xinbei District, Changzhou, China | | 33,940 | | Manufacturing | | Leased |

The Company is involved in certain litigation as a result of claims that arose in the ordinary course of business. Additionally, we may realize the benefit of certain legal claims and litigation in the future; these gain contingencies are not recognized in the Consolidated Financial Statements.

For a description of material pending legal proceedings, see “Note 13 – Commitments and Contingencies” in the Notes to Consolidated Financial Statements, which is incorporated herein by reference.

|

| |

ITEM 4. | MINE SAFETY DISCLOSURES |

Not applicable.

PART II

|

| |

ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Our common stock is listed on the New York Stock Exchange (NYSE) under the symbol “MLI.” As of February 23, 2018, the number of holders of record of Mueller’s common stock was 740. The following table sets forth, for the periods indicated, the high and low sales prices as reported by the NYSE and the cash dividends paid per share of common stock.

|

| | | | | | | | | | | | | |

| | Sales Prices | | | |

| | High | | Low | | Dividend | |

2017 | | | | | | | |

| | | | | | | |

Fourth quarter | | $ | 37.53 |

| | $ | 32.88 |

| | $ | 0.100 |

| |

Third quarter | | 35.02 |

| | 28.49 |

| | 0.100 |

| |

Second quarter | | 35.82 |

| | 27.72 |

| | 0.100 |

| |

First quarter | | 43.96 |

| (1) | 30.93 |

| | 3.100 |

| (2) |

|

| | | | | | | | | | | | | |

2016 | | |

| | |

| | |

| |

| | | | | | | |

Fourth quarter | | $ | 41.27 |

| | $ | 29.52 |

| | $ | 0.100 |

| |

Third quarter | | 35.52 |

| | 31.38 |

| | 0.100 |

| |

Second quarter | | 32.74 |

| | 28.01 |

| | 0.100 |

| |

First quarter | | 29.86 |

| | 23.09 |

| | 0.075 |

| |

(1) On March 9, 2017, the Company distributed a special dividend of $3.00 in cash and $5.00 in principal amount of the Company’s 6% Subordinated Debentures per share of outstanding common stock, which resulted in a commensurate decrease in sales price per share.

(2) Does not include the $5.00 in principal amount of the Company’s 6% Subordinated Debentures per share of outstanding common stock issued as part of our special dividend.

Payment of dividends in the future is dependent upon the Company’s financial condition, cash flows, capital requirements, earnings, and other factors.

Issuer Purchases of Equity Securities

The Company’s Board of Directors has extended, until August 2018, the authorization to repurchase up to 20 million shares of the Company’s common stock through open market transactions or through privately negotiated transactions. The Company may cancel, suspend, or extend the time period for the purchase of shares at any time. Any purchases will be funded primarily through existing cash and cash from operations. The Company may hold any shares purchased in treasury or use a portion of the repurchased shares for its stock-based compensation plans, as well as for other corporate purposes. From its initial authorization in 1999 through December 30, 2017, the Company had repurchased approximately 4.7 million shares under this authorization. Below is a summary of the Company’s stock repurchases for the quarter ended December 30, 2017.

|

| | | | | | | | | | | | | |

| | (a) Total Number of Shares Purchased (1) | | (b) Average Price Paid per Share | | (c) Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | | (d) Maximum Number of Shares That May Yet Be Purchased Under the Plans or Programs (2) |

| | | | | | | | |

October 1 – October 28, 2017 | | 753 |

| | $ | 28.53 |

| | — |

| | 15,287,060 |

|

October 29 – November 25, 2017 | | 1,842 |

| | 33.90 |

| | — |

| | 15,287,060 |

|

November 26 – December 30, 2017 | | 1,915 |

| | 29.30 |

| | — |

| | 15,287,060 |

|

Total | | 4,510 |

| | | | — |

| | |

(1) Shares tendered to the Company by holders of stock-based awards in payment of purchase price and/or withholding taxes upon exercise and/or vesting. Also includes shares resulting from restricted stock forfeitures at the average cost of treasury stock.

(2) Shares available to be purchased under the Company’s 20 million share repurchase authorization until August 2018. The extension of the authorization was announced on October 25, 2017.

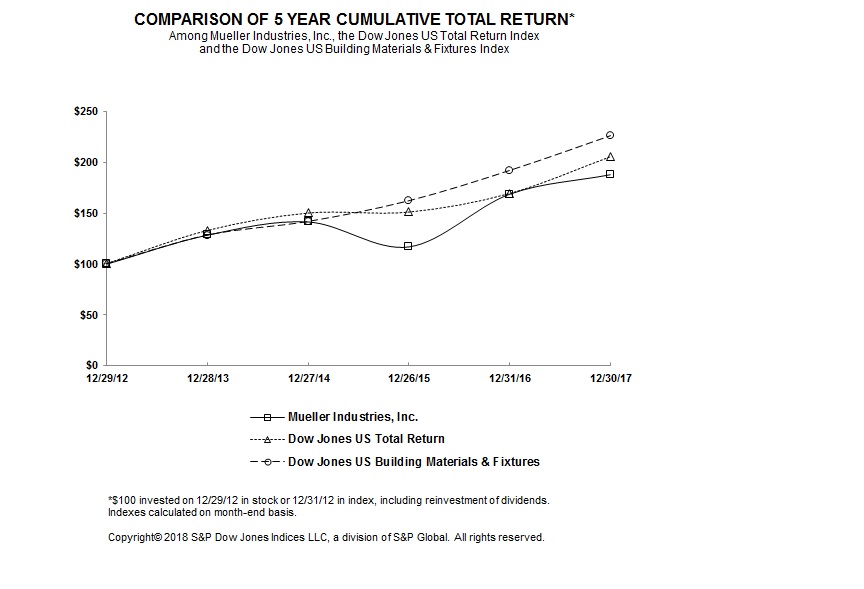

Company Stock Performance

The following graph compares total stockholder return since December 29, 2012 to the Dow Jones U.S. Total Return Index (Total Return Index) and the Dow Jones U.S. Building Materials & Fixtures Index (Building Materials Index). Total return values for the Total Return Index, the Building Materials Index and the Company were calculated based on cumulative total return values assuming reinvestment of (i) regular quarterly dividends paid by the Company, (ii) the cash paid by the Company in conjunction with the special dividend and (iii) the proceeds of an assumed sale at par of the Debentures paid by the Company in connection with the special dividend.

|

| | | | | | | | | | | | | | | | | | |

| | 2012 | | 2013 | | 2014 | | 2015 | | 2016 | | 2017 |

Mueller Industries, Inc. | | 100.00 |

| | 128.51 |

| | 141.40 |

| | 116.88 |

| | 168.73 |

| | 187.92 |

|

Dow Jones U.S. Total Return Index | | 100.00 |

| | 132.97 |

| | 150.19 |

| | 151.14 |

| | 169.65 |

| | 206.12 |

|

Dow Jones U.S. Building Materials & Fixtures Index | | 100.00 |

| | 128.20 |

| | 141.74 |

| | 162.11 |

| | 192.02 |

| | 226.29 |

|

|

| |

ITEM 6. | SELECTED FINANCIAL DATA |

|

| | | | | | | | | | | | | | | | | | | | |

(In thousands, except per share data) | 2017 | | 2016 | | 2015 | | 2014 | | 2013 | |

| | | | | | | | | | |

For the fiscal year: (1) | | | | | | | | | | |

| | | | | | | | | | |

Net sales | $ | 2,266,073 |

| | $ | 2,055,622 |

| | $ | 2,100,002 |

| | $ | 2,364,227 |

| | $ | 2,158,541 |

| |

| | | | | | | | | | |

Operating income | 151,957 |

| | 152,713 |

| | 137,268 |

| | 153,996 |

| | 270,937 |

| |

| | | | | | | | | | |

Net income attributable to Mueller Industries, Inc. | 85,598 |

| (2) | 99,727 |

| (3) | 87,864 |

| (4) | 101,560 |

| (5) | 172,600 |

| (6) |

| | | | | | | | | | |

Diluted earnings per share (7) | 1.49 |

| | 1.74 |

| | 1.54 |

| | 1.79 |

| | 3.06 |

| |

| | | | | | | | | | |

Cash dividends per share (7) | 3.40 |

| | 0.375 |

| | 0.30 |

| | 0.30 |

| | 0.25 |

| |

| | | | | | | | | | |

At year-end: | | | |

| | |

| | |

| | |

| |

| | | | | | | | | | |

Total assets | 1,320,173 |

| | 1,447,476 |

| | 1,338,801 |

| | 1,328,096 |

| | 1,247,767 |

| |

| | | | | | | | | | |

Long-term debt | 448,592 |

| | 213,709 |

| | 204,250 |

| | 205,250 |

| | 206,250 |

| |

| | | | | | | | | | |

| |

(1) | Includes activity of acquired businesses from the following purchase dates: Pexcor Manufacturing Company Inc. and Heatlink Group Inc., May 31, 2017; Jungwoo Metal Ind. Co., LTD, April 26, 2016; Great Lakes Copper Ltd., July 31, 2015; Sherwood Valve Products, LLC, June 18, 2015; Turbotec Products, Inc., March 30, 2015; Yorkshire Copper Tube, February 28, 2014; and Howell Metal Company, October 17, 2013. |

| |

(2) | Includes interest expense of $13.8 million on the Company’s Subordinated Debentures and pre-tax environmental expense for non-operating properties of $7.3 million. |

| |

(3) | Includes pre-tax impairment charges of $6.8 million on fixed assets. |

| |

(4) | Includes $15.4 million pre-tax gain from the sale of certain assets, severance charges of $3.4 million and a permanent adjustment to a deferred tax liability of $4.2 million. |

| |

(5) | Includes $6.3 million pre-tax gain on sale of assets, reversal of valuation allowance of $5.7 million, and $7.3 million of pre-tax charges related to severance. |

| |

(6) | Includes $106.3 million pre-tax gain from settlement of insurance claims, $39.8 million pre-tax gain from the sale of the Company’s Schedule 40 pressure plastic fittings business along with the sale of certain other plastic fittings manufacturing assets, and pre-tax impairment charges of $4.3 million primarily related to real property associated with the aforementioned plastics sale transaction. |

| |

(7) | Adjusted retroactively to reflect the two-for-one stock split that occurred on March 14, 2014. |

|

| |

ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Management’s discussion and analysis of financial condition and results of operations is contained under the caption “Financial Review” submitted as a separate section of this Annual Report on Form 10-K commencing on page F-2.

|

| |

ITEM 7A. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

Quantitative and qualitative disclosures about market risk are contained under the caption “Financial Review” submitted as a separate section of this Annual Report on Form 10-K commencing on page F-2.

|

| |

ITEM 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA |

Financial Statements required by this item are contained in a separate section of this Annual Report on Form 10-K commencing on page F-16.

|

| |

ITEM 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

None.

|

| |

ITEM 9A. | CONTROLS AND PROCEDURES |

Evaluation of Disclosure Controls and Procedures

The Company maintains disclosure controls and procedures designed to ensure information required to be disclosed in Company reports filed under the Securities Exchange Act of 1934, as amended (the Exchange Act), is recorded, processed, summarized, and reported within the time periods specified in the SEC’s rules and forms. Disclosure controls and procedures are designed to provide reasonable assurance that information required to be disclosed in Company reports filed under the Exchange Act is accumulated and communicated to management, including the Company’s Chief Executive Officer and Chief Financial Officer, as appropriate, to allow timely decisions regarding required disclosure.

The Company’s management, with the participation of the Company’s Chief Executive Officer and Chief Financial Officer, has evaluated the effectiveness of the Company’s disclosure controls and procedures pursuant to Rule 13a-15(e) of the Exchange Act as of December 30, 2017. Based on that evaluation, the Company’s Chief Executive Officer and Chief Financial Officer have concluded that the Company’s disclosure controls and procedures are effective as of December 30, 2017 to ensure that information required to be disclosed in Company reports filed under the Exchange Act is (i) recorded, processed, summarized and reported within the time periods specified in the SEC rules and forms and (ii) accumulated and communicated to management, including the Company’s principal executive officer and principal financial officer, as appropriate to allow timely decisions regarding required disclosure.

Management’s Report on Internal Control over Financial Reporting

The Company’s management is responsible for establishing and maintaining adequate internal control over financial reporting as defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act. Pursuant to the rules and regulations of the SEC, internal control over financial reporting is a process designed by, or under the supervision of, the Company’s principal executive and principal financial officers, and effected by the Company’s Board of Directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with accounting principles generally accepted in the United States and includes those policies and procedures that (i) pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the Company’s assets; (ii) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the issuer are being made only in accordance with authorizations of the Company’s management and directors; and (iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the Company’s assets that could have a material effect on the financial statements. Due to inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Further, because of changes in conditions, effectiveness of internal control over financial reporting may vary over time.

The Company acquired Pexcor Manufacturing Company Inc. and Heatlink Group Inc. during 2017 and has excluded these businesses from management’s assessment of internal controls. The total value of assets for these businesses at year-end was $19.8 million, which represents 1.5 percent of the Company’s consolidated total assets at December 30, 2017. Net sales from the date of acquisition represents 0.6 percent of the consolidated net sales of the Company for 2017. Operating results from the date of acquisition represents less than 0.1 percent of the consolidated operating income of the Company for 2017. Accordingly, these acquired businesses are not included in the scope of this report.

As required by Rule 13a-15(c) under the Exchange Act, the Company’s management, with the participation of the Company’s Chief Executive Officer and Chief Financial Officer, has evaluated the effectiveness of the Company’s internal control over financial reporting as of December 30, 2017 based on the control criteria established in a report entitled Internal Control—Integrated Framework, (2013 Framework) issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO). Based on such evaluation, management has concluded that our internal control over financial reporting was effective as of December 30, 2017.

Ernst & Young LLP, the independent registered public accounting firm that audited the Company’s financial statements included in this Annual Report on Form 10-K, has issued an attestation report on the Company’s internal control over financial reporting, which is included herein.

Changes in Internal Control Over Financial Reporting

There were no changes in the Company’s internal control over financial reporting during the Company’s fiscal quarter ended December 30, 2017, that have materially affected, or are reasonably likely to materially affect, the Company’s internal control over financial reporting.

Report of Independent Registered Public Accounting Firm

To the Stockholders and the Board of Directors of Mueller Industries, Inc.

Opinion on Internal Control over Financial Reporting

We have audited Mueller Industries, Inc.’s internal control over financial reporting as of December 30, 2017, based on criteria established in Internal Control-Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (2013 framework) (the COSO criteria). In our opinion, Mueller Industries, Inc. (the Company) maintained, in all material respects, effective internal control over financial reporting as of December 30, 2017, based on the COSO criteria.

As indicated in the accompanying Management’s Report on Internal Control over Financial Reporting, management’s assessment of and conclusion on the effectiveness of internal control over financial reporting did not include the internal controls of Pexcor Manufacturing Company Inc. and Heatlink Group Inc., which are included in the 2017 consolidated financial statements of the Company and constituted $19.8 million and $17.2 million of total and net assets, respectively, as of December 30, 2017 and $14.5 million and $0.3 million of net sales and operating losses, respectively, for the year then ended. Our audit of internal control over financial reporting of the Company also did not include an evaluation of the internal control over financial reporting of Pexcor Manufacturing Company Inc. and Heatlink Group Inc.

We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States) (PCAOB), the consolidated balance sheets of the Company as of December 30, 2017 and December 31, 2016, the related consolidated statements of income, comprehensive income, changes in equity and cash flows for each of the three years in the period ended December 30, 2017, and the related notes and financial statement schedule listed in the Index at Item 15(a) and our report dated February 28, 2018 expressed an unqualified opinion thereon.

Basis for Opinion

The Company’s management is responsible for maintaining effective internal control over financial reporting and for its assessment of the effectiveness of internal control over financial reporting included in the accompanying Management’s Report on Internal Control over Financial Reporting. Our responsibility is to express an opinion on the Company’s internal control over financial reporting based on our audit. We are a public accounting firm registered with the PCAOB and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects.

Our audit included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, testing and evaluating the design and operating effectiveness of internal control based on the assessed risk, and performing such other procedures as we considered necessary in the circumstances. We believe that our audit provides a reasonable basis for our opinion.

Definition and Limitations of Internal Control Over Financial Reporting

A company’s internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company’s internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’s assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

|

| |

Memphis, Tennessee | |

February 28, 2018 | |

|

| |

ITEM 9B. | OTHER INFORMATION |

None.

PART III

|

| |

ITEM 10. | DIRECTORS, EXECUTIVE OFFICERS, AND CORPORATE GOVERNANCE |

The information required by Item 10 is contained under the captions “Ownership of Common Stock by Directors and Executive Officers and Information about Director Nominees,” “Corporate Governance,” “Report of the Audit Committee of the Board of Directors,” and “Section 16(a) Beneficial Ownership Compliance Reporting” in the Company’s Proxy Statement for its 2018 Annual Meeting of Stockholders to be filed with the SEC on or about March 29, 2018, which is incorporated herein by reference.

The Company has adopted a Code of Business Conduct and Ethics that applies to its chief executive officer, chief financial officer, and other financial executives. We have also made the Code of Business Conduct and Ethics available on the Company’s website at www.muellerindustries.com.

|

| |

ITEM 11. | EXECUTIVE COMPENSATION |

The information required by Item 11 is contained under the caption “Compensation Discussion and Analysis,” “Summary Compensation Table for 2017,” “2017 Grants of Plan Based Awards Table,” “Outstanding Equity Awards at Fiscal 2017 Year-End,” “2017 Option Exercises and Stock Vested,” “Potential Payments Upon Termination of Employment or Change in Control as of the End of 2017,” “2017 Director Compensation,” “Report of the Compensation Committee of the Board of Directors on Executive Compensation” and “Corporate Governance” in the Company’s Proxy Statement for its 2018 Annual Meeting of Stockholders to be filed with the SEC on or about March 29, 2018, which is incorporated herein by reference.

|

| |

ITEM 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

Equity Compensation Plan Information

The following table discloses information regarding the securities to be issued and the securities remaining available for issuance under the Registrant’s stock-based incentive plans as of December 30, 2017 (shares in thousands):

|

| | | | | | | | | | |

| | (a) | | (b) | | (c) |

Plan category | | Number of securities to be issued upon exercise of outstanding options, warrants, and rights | | Weighted average exercise price of outstanding options, warrants, and rights | | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) |

| | | | | | |

Equity compensation plans approved by security holders | | 947 |

| | $ | 22.31 |

| | 696 |

|

| | | | | | |

Equity compensation plans not approved by security holders | | — |

| | — |

| | — |

|

| | | | | | |

Total | | 947 |

| | $ | 22.31 |

| | 696 |

|

Other information required by Item 12 is contained under the captions “Principal Stockholders” and “Ownership of Common Stock by Directors and Executive Officers and Information about Director Nominees” in the Company’s Proxy Statement for its

2018 Annual Meeting of Stockholders to be filed with the SEC on or about March 29, 2018, which is incorporated herein by reference.

|

| |

ITEM 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

The information required by Item 13 is contained under the caption “Corporate Governance” in the Company’s Proxy Statement for its 2018 Annual Meeting of Stockholders to be filed with the SEC on or about March 29, 2018, which is incorporated herein by reference.

|

| |

ITEM 14. | PRINCIPAL ACCOUNTING FEES AND SERVICES |

The information required by Item 14 is contained under the caption “Appointment of Independent Registered Public Accounting Firm” in the Company’s Proxy Statement for its 2018 Annual Meeting of Stockholders to be filed with the SEC on or about March 29, 2018, which is incorporated herein by reference.

PART IV

|

| |

ITEM 15. | EXHIBITS, FINANCIAL STATEMENT SCHEDULES |

| |

(a) | The following documents are filed as part of this report: |

| |

1. | Financial Statements: the financial statements, notes, and report of independent registered public accounting firm described in Item 8 of this Annual Report on Form 10-K are contained in a separate section of this Annual Report on Form 10-K commencing on page F-1. |

| |

2. | Financial Statement Schedule: the financial statement schedule described in Item 8 of this report is contained in a separate section of this Annual Report on Form 10-K commencing on page F-1. |

Certificate of Incorporation and Bylaws

Long-Term Debt Instruments

| |

4.3 | Certain instruments with respect to long-term debt of the Registrant have not been filed as Exhibits to this Report since the total amount of securities authorized under any such instruments does not exceed 10 percent of the total assets of the Registrant and its subsidiaries on a consolidated basis. The Registrant agrees to furnish a copy of each such instrument upon request of the SEC. |

Consulting, Employment, and Compensatory Plan Agreements

| |

10.2 | Amendment No. 1, dated December 2, 2008, to the Amended and Restated Consulting Agreement, dated October 25, 2007, by and between the Registrant and Harvey Karp (Incorporated herein by reference to Exhibit 10.7 of the Registrant’s Annual Report on Form 10-K, dated February 24, 2009, for the fiscal year ended December 27, 2008). |

Financing Agreements

| |

10.20 | Amended Credit Agreement, dated as of March 7, 2011, among the Registrant (as borrower) and Bank of America, N.A. (as agent), and certain lenders named therein, following adoption of Amendment No. 2 dated December 11, 2012 (Incorporated herein by reference to Exhibit 10.20 of the Registrant’s Annual Report on Form 10-K, dated February 27, 2013, for the fiscal year ended December 29, 2012). |

Other Exhibits

| |

101.CAL | XBRL Taxonomy Extension Calculation Linkbase |

| |

101.DEF | XBRL Taxonomy Extension Definition Linkbase |

| |

101.INS | XBRL Instance Document |

| |

101.LAB | XBRL Taxonomy Extension Label Linkbase |

| |

101.PRE | XBRL Presentation Linkbase Document |

| |

101.SCH | XBRL Taxonomy Extension Schema |

|

| |

ITEM 16. | Form 10-K Summary |

None.

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, on February 28, 2018.

MUELLER INDUSTRIES, INC.

|

| | |

| /s/ Gregory L. Christopher | |

| Gregory L. Christopher, Chief Executive Officer (Principal Executive Officer) and Chairman of the Board | |

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the date indicated.

|

| | |

Signature | Title | Date |

| | |

/s/ Gregory L. Christopher Gregory L. Christopher | Chief Executive Officer (Principal Executive Officer) and Chairman of the Board | February 28, 2018 |

| | |

/s/ Gary S. Gladstein | Lead Independent Director | February 28, 2018 |

Gary S. Gladstein | | |

| | |

/s/ Paul J. Flaherty | Director | February 28, 2018 |

Paul J. Flaherty | | |

| | |

/s/ Gennaro J. Fulvio | Director | February 28, 2018 |

Gennaro J. Fulvio | | |

| | |

/s/ Scott J. Goldman | Director | February 28, 2018 |

Scott J. Goldman | | |

| | |

/s/ John B. Hansen | Director | February 28, 2018 |

John B. Hansen | | |

| | |

/s/ Terry Hermanson | Director | February 28, 2018 |

Terry Hermanson | | |

| | |

/s/ Charles P. Herzog, Jr. | Director | February 28, 2018 |

Charles P. Herzog, Jr. | | |

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the date indicated.

|

| | |

| Signature and Title | Date |

| | |

| /s/ Jeffrey A. Martin | February 28, 2018 |

| Jeffrey A. Martin | |

| Chief Financial Officer and Treasurer | |

| (Principal Financial and Accounting Officer) | |

| | |

| /s/ Anthony J. Steinriede | February 28, 2018 |

| Anthony J. Steinriede | |

| Vice President – Corporate Controller | |

MUELLER INDUSTRIES, INC.

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

FINANCIAL STATEMENT SCHEDULE

|

| |

|

Schedule for the years ended December 30, 2017, December 31, 2016, and December 26, 2015 |

| |

| |

| |

FINANCIAL REVIEW

The Financial Review section of our Annual Report on Form 10-K consists of the following: Management’s Discussion and Analysis of Results of Operations and Financial Condition (MD&A), the Consolidated Financial Statements, and Other Financial Information, all of which include information about our significant accounting policies, practices, and the transactions that impact our financial results. The following MD&A describes the principal factors affecting the results of operations, liquidity and capital resources, contractual cash obligations, and the critical accounting estimates of the Company. The discussion in the Financial Review section should be read in conjunction with the other sections of this Annual Report, particularly “Item 1: Business” and our other detailed discussion of risk factors included in this MD&A.

OVERVIEW

We are a leading manufacturer of copper, brass, aluminum, and plastic products. The range of these products is broad: copper tube and fittings; line sets; brass and copper alloy rod, bar, and shapes; aluminum and brass forgings; aluminum impact extrusions; PEX plastic tube; refrigeration valves and fittings; fabricated tubular products; and steel nipples. We also resell brass and plastic plumbing valves, plastic fittings, malleable iron fittings, faucets and plumbing specialty products. Mueller’s operations are located throughout the United States and in Canada, Mexico, Great Britain, South Korea, and China.

Each of the reportable segments is composed of certain operating segments that are aggregated primarily by the nature of products offered as follows:

| |

• | Piping Systems: The Piping Systems segment is composed of Domestic Piping Systems Group, Great Lakes Copper, Heatlink Group, European Operations, Trading Group, and Jungwoo-Mueller (our South Korean joint venture). The Domestic Piping Systems Group manufactures copper tube and fittings, plastic fittings, and line sets. These products are manufactured in the U.S., sold in the U.S., and exported to markets worldwide. Great Lakes Copper manufactures copper tube and line sets in Canada and sells the products primarily in the U.S. and Canada. Heatlink Group manufactures a complete line of products for PEX plumbing and radiant systems in Canada and sells these products in Canada and the U.S. European Operations manufacture copper tube in the United Kingdom, which is sold throughout Europe. The Trading Group manufactures pipe nipples and sources products for import distribution in North America. Jungwoo-Mueller manufactures copper-based joining products that are sold worldwide. The Piping Systems segment sells products to wholesalers in the plumbing and refrigeration markets, distributors to the manufactured housing and recreational vehicle industries, building material retailers, and air-conditioning original equipment manufacturers (OEMs). |

The Company disposed of Mueller-Xingrong (the Company’s Chinese joint venture) on June 21, 2017. This business manufactured engineered copper tube primarily for air-conditioning applications in China.

| |

• | Industrial Metals: The Industrial Metals segment is composed of Brass Rod & Copper Bar Products, Impacts & Micro Gauge, and Brass Value-Added Products. The segment manufactures and sells brass and copper alloy rod, bar, and shapes; aluminum and brass forgings; aluminum impact extrusions; and gas valves and assemblies. The segment manufactures and sells its products primarily to domestic OEMs in the industrial, transportation, construction, heating, ventilation, and air-conditioning, plumbing, refrigeration, and energy markets. |

| |

• | Climate: The Climate segment is composed of Refrigeration Products, Fabricated Tube Products, Westermeyer, and Turbotec. The segment manufactures and sells refrigeration valves and fittings, fabricated tubular products, high pressure components, and coaxial heat exchangers. The segment sells its products primarily to the heating, ventilation, air-conditioning, and refrigeration markets in the U.S. |

New housing starts and commercial construction are important determinants of our sales to the heating, ventilation, and air-conditioning, refrigeration, and plumbing markets because the principal end use of a significant portion of our products is in the construction of single and multi-family housing and commercial buildings. Repairs and remodeling projects are also important drivers of underlying demand for these products.

Residential construction activity has shown improvement in recent years, but remains at levels below long-term historical averages. Per the U.S. Census Bureau, actual housing starts in the U.S. were 1.20 million in 2017, which compares to 1.17 million in 2016 and 1.11 million in 2015. Mortgage rates remain at historically low levels, as the average 30-year fixed mortgage rate was approximately 3.99 percent in 2017 and 3.65 percent in 2016. The private nonresidential construction sector, which includes offices, industrial, health care, and retail projects, has also shown improvement in recent years. Per the U.S. Census Bureau, the

value of private nonresidential construction put in place was $434.8 billion in 2017, $432.1 billion in 2016, and $401.2 billion in 2015. We expect that most of these conditions will continue to improve.

Profitability of certain of our product lines depends upon the “spreads” between the cost of raw material and the selling prices of our products. The open market prices for copper cathode and copper and brass scrap, for example, influence the selling price of copper tube and brass rod, two principal products manufactured by the Company. We attempt to minimize the effects on profitability from fluctuations in material costs by passing through these costs to our customers. Our earnings and cash flow are dependent upon these spreads that fluctuate based upon market conditions.

Earnings and profitability are also impacted by unit volumes that are subject to market trends, such as substitute products, imports, technologies, and market share. In our core product lines, we intensively manage our pricing structure while attempting to maximize profitability. From time-to-time, this practice results in lost sales opportunities and lower volume. For plumbing systems, plastics are the primary substitute product; these products represent an increasing share of consumption. U.S. consumption of copper tube is still predominantly supplied by U.S. manufacturers. For certain air-conditioning and refrigeration applications, aluminum based systems are the primary substitution threat. We cannot predict the acceptance or the rate of switching that may occur. In recent years, brass rod consumption in the U.S. has declined due to the outsourcing of many manufactured products from offshore regions.

RESULTS OF OPERATIONS

Consolidated Results

The following table compares summary operating results for 2017, 2016, and 2015:

|

| | | | | | | | | | | | | | | | | | |

| | | | | | | | Percent Change |

(In thousands) | | 2017 | | 2016 | | 2015 | | 2017 vs. 2016 | | 2016 vs. 2015 |

| | | | | | | | | | |

Net sales | | $ | 2,266,073 |

| | $ | 2,055,622 |

| | $ | 2,100,002 |

| | 10.2 | % | | (2.1 | )% |

Operating income | | 151,957 |

| | 152,713 |

| | 137,268 |

| | (0.5 | ) | | 11.3 |

|

Net income | | 85,598 |

| | 99,727 |

| | 87,864 |

| | (14.2 | ) | | 13.5 |

|

The following are components of changes in net sales compared to the prior year:

|

| | | | | | |

| | 2017 vs. 2016 | | 2016 vs. 2015 |

| | | | |

Net selling price in core product lines | | 13.0 | % | | (9.0 | )% |

Unit sales volume in core product lines | | (1.3 | ) | | (1.6 | ) |

Acquisitions and new products | | 1.5 |

| | 9.0 |

|

Dispositions | | (2.6 | ) | | — |

|

Other | | (0.4 | ) | | (0.5 | ) |

| | | | |

| | 10.2 | % | | (2.1 | )% |

The increase in net sales in 2017 was primarily due to (i) higher net selling prices of $266.9 million in our core product lines, primarily copper tube and brass rod, (ii) $16.4 million of incremental sales recorded by Jungwoo-Mueller, acquired in April 2016, and (iii) $14.4 million of sales recorded by Pexcor Manufacturing Company Inc. and Heatlink Group Inc. (collectively, Heatlink Group), acquired in May 2017. These increases were partially offset by (i) the absence of sales of $54.2 million recorded by Mueller-Xingrong, a business we sold during June 2017, and (ii) lower unit sales volume of $27.3 million in our core product lines.

The decrease in net sales in 2016 was primarily due to (i) lower net selling prices of $189.0 million in our core product lines, primarily copper tube and brass rod, and (ii) lower unit sales volume of $33.0 million in our core product lines. The decrease in net sales resulting from lower net selling prices also reflects the impact of translating net sales of the Company’s foreign operations to U.S. dollars, which was approximately $43.6 million. These decreases were partially offset by (i) $139.4 million of incremental sales recorded by Great Lakes Copper Ltd. (Great Lakes), acquired in July 2015, (ii) $22.0 million of sales recorded by Jungwoo-Mueller, (iii) $19.2 million of incremental sales recorded by Sherwood Valve LLC (Sherwood), acquired in June 2015, and (iv) $3.5 million of incremental sales recorded by Turbotec Products, Inc. (Turbotec), acquired in March 2015.

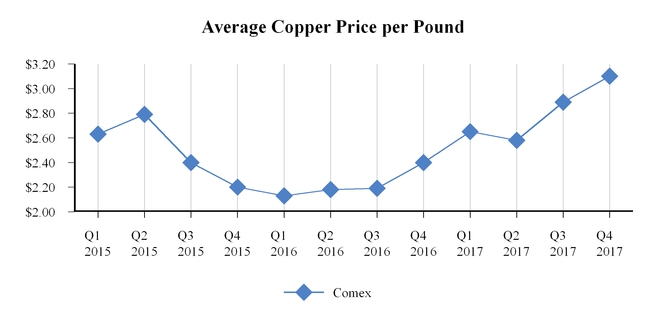

Net selling prices generally fluctuate with changes in raw material costs. Changes in raw material costs are generally passed through to customers by adjustments to selling prices. The following graph shows the Comex average copper price per pound by quarter for the most recent three-year period:

The following tables compare cost of goods sold and operating expenses as dollar amounts and as a percent of net sales for 2017, 2016, and 2015:

|

| | | | | | | | | | | | |

(In thousands) | | 2017 | | 2016 | | 2015 |

| | | | | | |

Cost of goods sold | | $ | 1,940,617 |

| | $ | 1,723,499 |

| | $ | 1,809,702 |

|

Depreciation and amortization | | 33,944 |

| | 35,133 |

| | 34,608 |

|

Selling, general, and administrative expense | | 139,580 |

| | 137,499 |

| | 130,358 |

|

Gain on sale of businesses | | (1,491 | ) | | — |

| | (15,376 | ) |

Impairment charges | | 1,466 |

| | 6,778 |

| | — |

|

Severance | | — |

| | — |

| | 3,442 |

|

| | | | | | |

Operating expenses | | $ | 2,114,116 |

| | $ | 1,902,909 |

|

| $ | 1,962,734 |

|

|

| | | | | | | | | |

| | 2017 | | 2016 | | 2015 |

| | | | | | |

Cost of goods sold | | 85.6 | % | | 83.9 | % | | 86.2 | % |

Depreciation and amortization | | 1.5 |

| | 1.7 |

| | 1.6 |

|

Selling, general, and administrative expense | | 6.2 |

| | 6.7 |

| | 6.2 |

|

Gain on sale of businesses | | (0.1 | ) | | — |

| | (0.7 | ) |

Impairment charges | | 0.1 |

| | 0.3 |

| | — |

|

Severance | | — |

| | — |

| | 0.2 |

|

| | | | | | |

Operating expenses | | 93.3 | % | | 92.6 | % | | 93.5 | % |